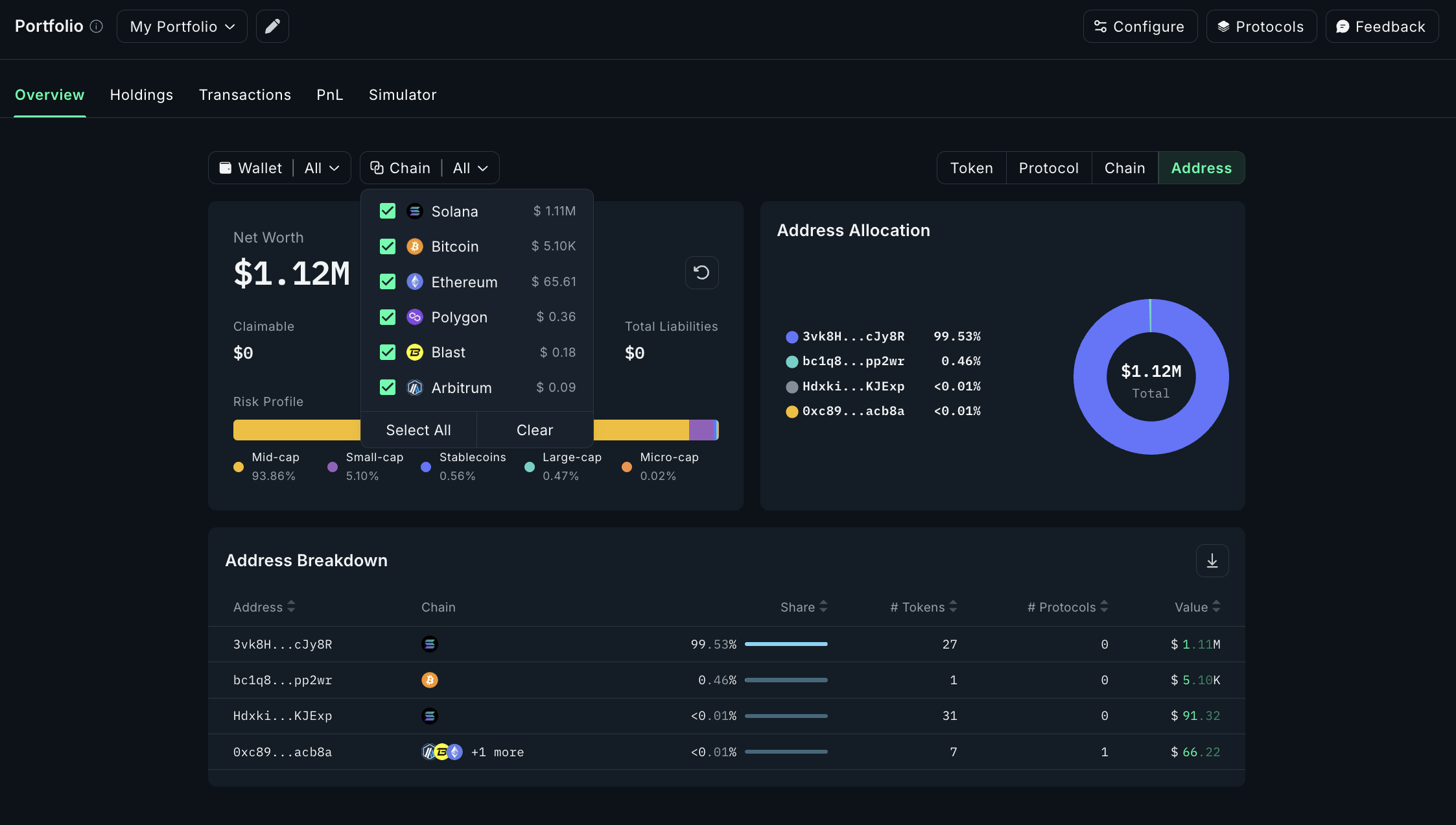

The competition among Ethereum Layer 2s has reached a fever pitch, and the upcoming Base token airdrop is poised to be one of the most anticipated events in the sector. As Base rapidly gains ground on Arbitrum in both transaction count and total value locked (TVL), it’s essential to benchmark its airdrop strategy against major predecessors like Arbitrum, Optimism, and Uniswap. This analysis will help you understand what sets the Base airdrop apart, how it stacks up in terms of eligibility and potential rewards, and why the broader context of L2 adoption matters for your portfolio.

Base vs Arbitrum Airdrop: Key Differences in Distribution

Arbitrum’s March 2023 airdrop set a new standard for Layer 2 token launches. Over 1.162 billion ARB tokens were distributed to more than 600,000 wallets, making up 11.62% of its total supply. Eligibility was determined by on-chain activity: bridging funds to Arbitrum, frequent transactions, and smart contract usage all counted toward allocations. The median user received 1,250 ARB tokens, but awards ranged from 625 up to an impressive 10,250 per wallet.

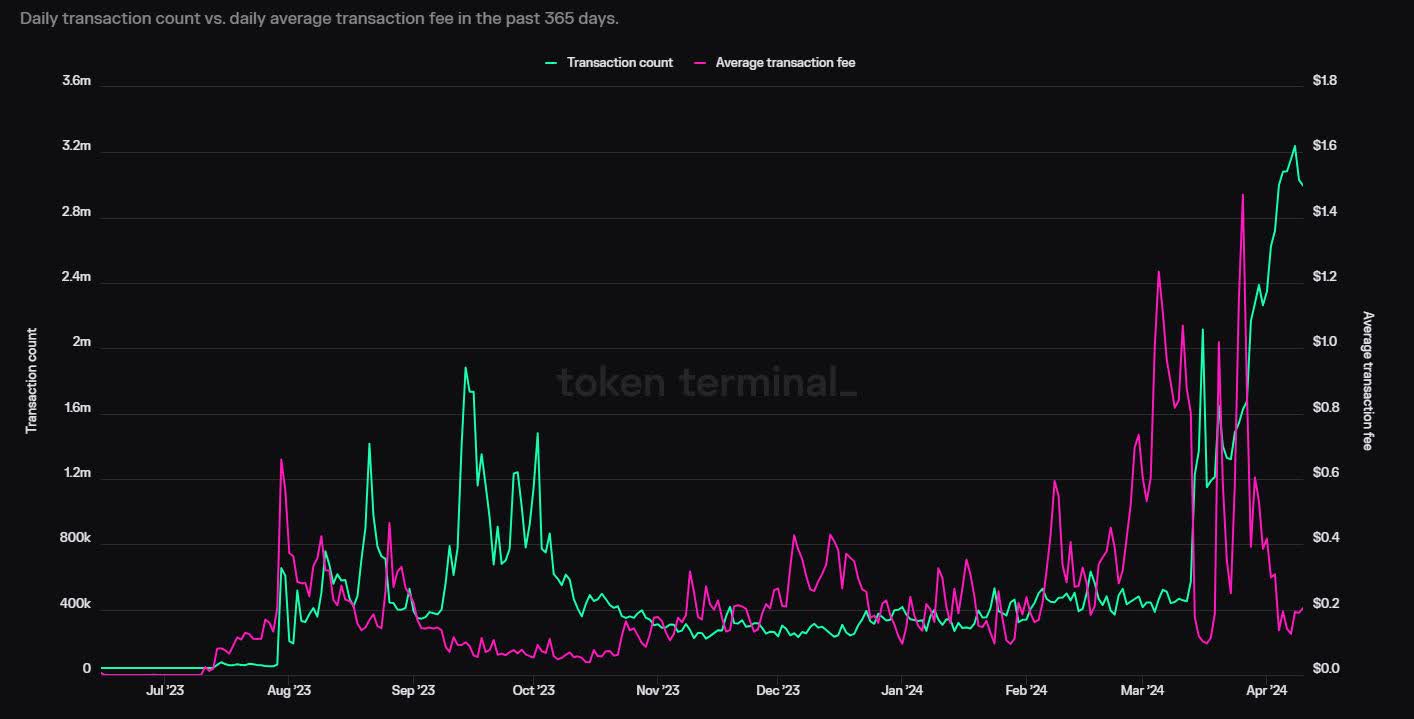

In contrast, details about the exact Base airdrop allocation model are still emerging. However, given that Base has already overtaken Arbitrum in daily transaction volume throughout 2025, processing over 50 million monthly transactions: expectations are high for an even broader distribution base and possibly novel eligibility criteria that reward both early adopters and active users.

Transaction Volume and User Activity: The New Battleground

The L2 showdown is no longer just about technology, it’s about network effects driven by user engagement. According to recent Dune Analytics data, Base is quickly catching up to (and at times surpassing) Arbitrum in raw transaction count. While some of this surge can be attributed to microtransactions or bot-driven activity, it signals growing adoption and experimentation on Base.

This shift matters because most major crypto airdrops, including those from Uniswap (UNI) and Optimism (OP): have rewarded not just early presence but sustained interaction with protocols. For instance:

- Uniswap (UNI): In September 2020, every eligible user who had interacted with Uniswap before a cutoff date received 400 UNI tokens, a flat distribution model that fostered goodwill and rapid decentralization.

- Optimism (OP): In May 2022, OP allocated 5% of its total supply based on diverse engagement metrics beyond simple transaction count.

The lesson? The more you interact with these ecosystems, bridging assets, swapping tokens, voting on governance, the higher your chances for meaningful allocations when the snapshot arrives.

Current Market Context: Why Timing Matters More Than Ever

No analysis would be complete without referencing current market data. As of September 20,2025:

- Arbitrum (ARB) trades at $0.4926, reflecting a daily decrease of approximately 5.37%.

- The intraday high reached $0.5215; the low touched $0.4865.

This price action highlights both volatility and opportunity for those holding or receiving ARB via the original airdrop, and sets expectations for what might unfold with BASE once its token goes live.

Arbitrum (ARB) Price Prediction 2026-2031

Professional price outlook for ARB post-airdrop, considering market cycles, technology, and competition

| Year | Minimum Price | Average Price | Maximum Price | YOY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.38 | $0.57 | $0.92 | +16% | Continued competitive pressure from Base/Optimism; possible regulatory headwinds; ARB builds on ecosystem partnerships |

| 2027 | $0.41 | $0.64 | $1.12 | +12% | Potential for L2 consolidation; increased Ethereum upgrades may boost rollup utility; volatility from macro risk |

| 2028 | $0.49 | $0.83 | $1.48 | +30% | Bullish cycle likely; scaling adoption and DeFi growth on Arbitrum; Base remains key rival |

| 2029 | $0.58 | $1.06 | $1.95 | +28% | Arbitrum benefits from greater Ethereum activity; positive regulatory clarity; possible new airdrops/expansions |

| 2030 | $0.68 | $1.35 | $2.53 | +27% | Layer 2s see mainstream adoption; ARB governance and revenue-sharing mature; broader crypto uptrend |

| 2031 | $0.82 | $1.70 | $3.22 | +26% | Sustained adoption, possible L2 mergers or interoperability; Arbitrum positions as a core Ethereum scaling player |

Price Prediction Summary

Arbitrum (ARB) is projected to gradually recover from current lows, with upside potential driven by Ethereum scaling demand, DeFi expansion, and ecosystem growth. However, competition from Base and other L2s, as well as regulatory and macroeconomic uncertainties, will keep volatility high. Over the next 6 years, ARB could see a compound annual growth rate (CAGR) of 20-30% in average price, with higher upside in bullish cycles and downside risk if L2 consolidation or unfavorable regulations occur.

Key Factors Affecting Arbitrum Price

- Competition from Base, Optimism, and other leading Layer 2s

- Ethereum mainnet upgrades and overall Layer 2 adoption

- Regulatory changes affecting token utility and DeFi

- Arbitrum ecosystem growth and developer activity

- Macro crypto market cycles and investor sentiment

- Potential for further airdrops, revenue-sharing, or protocol upgrades

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Airdrop Comparison Table: Scale and Criteria Across Major L2s

Comparative Overview of Major Layer 2 and DeFi Token Airdrops

| Token | Airdrop Date | % of Total Supply Airdropped | Eligibility Methods | Median Allocation (Tokens) |

|---|---|---|---|---|

| Arbitrum (ARB) | March 23, 2023 | 11.62% | User activity (bridging, transaction frequency, smart contract interaction) | 1,250 |

| Uniswap (UNI) | September 2020 | 15% | Used protocol before cutoff date | 400 |

| Optimism (OP) | May 2022 | 5% | Early adopter engagement metrics | Varied (not specified) |

| Base (BASE) | TBD (Expected 2025) | TBD | Likely to reward early users, bridge activity, and ecosystem participation | TBD |

The landscape is shifting rapidly as new players like Base push innovation not just at the protocol level but also in community incentives through their token drops. In the next section we’ll dive deeper into how these strategies impact decentralization, and what savvy users can do now to maximize their future rewards.

Decentralization and Community Impact: How Airdrop Models Shape Ecosystem Growth

Token airdrops are more than just marketing, they’re foundational to bootstrapping decentralized communities and aligning incentives. Base’s potential approach is under the microscope, especially as L2 competition intensifies. Unlike the flat, one-size-fits-all Uniswap drop or Arbitrum’s activity-weighted model, Base could blend both, rewarding not only early adopters but also those who actively contribute to ecosystem growth, whether through governance, liquidity provision, or developer engagement.

Why does this matter? Distribution models directly influence network effects. A broad, inclusive airdrop can jumpstart on-chain governance and liquidity while preventing a handful of whales from dominating protocol direction. As seen with Arbitrum and Optimism, a well-calibrated airdrop can ignite explosive TVL growth and attract builders seeking fairer playing fields.

With Base now consistently outperforming Arbitrum in daily transactions, over 50 million monthly, expectations for a wide-reaching drop are sky-high. However, users should be mindful of potential sybil attacks (fake/multiple accounts farming eligibility) that have plagued past events. Projects are increasingly implementing anti-sybil filters and multi-factor eligibility criteria to ensure genuine community rewards.

Action Steps for Users: Maximizing Your Base Token Airdrop Potential

Steps to Maximize Your Base Airdrop Eligibility

-

Bridge Funds to Base Using Official BridgesJust as Arbitrum required users to bridge assets to its network for airdrop eligibility, use the official Base Bridge or other reputable bridges like Coinbase Bridge to move ETH or stablecoins from Ethereum mainnet to Base. This on-chain activity is often a key eligibility criterion.

-

Interact Regularly With Base DAppsEngage with major decentralized applications (DApps) on Base, such as Uniswap, Aave, and friend.tech. Frequent swaps, lending, or social activity can demonstrate genuine user engagement, similar to criteria used in Arbitrum and Optimism airdrops.

-

Maintain Consistent Transaction ActivitySpread your transactions over several weeks or months, rather than concentrating them in a short period. Both Arbitrum and Optimism rewarded sustained, organic activity over time, while sudden spikes may be flagged as inauthentic.

-

Avoid Sybil Behavior and Use Unique WalletsUse wallets with unique, real activity. Projects like Arbitrum have filtered out wallets with signs of botting or Sybil attacks. Focus on organic usage and avoid creating multiple wallets solely for airdrop farming.

-

Engage With Base Governance and CommunityParticipate in Base’s governance forums or Discord, and vote on proposals if possible. Community involvement has been a bonus factor in some airdrops, such as Optimism’s.

If you’re aiming to secure the largest possible allocation in the upcoming Base token airdrop, now is the time to act:

- Bridge assets into Base from Ethereum mainnet or other chains.

- Engage with dApps: Swap tokens, provide liquidity, participate in DAOs.

- Maintain consistent activity: Avoid one-off transactions; sustained usage is often rewarded.

- Avoid sybil tactics: Focus on real engagement as filters become more sophisticated.

The takeaway? Quality of interaction may trump sheer transaction count as protocols refine their eligibility logic. Stay active across multiple fronts within the Base ecosystem, and don’t overlook governance participation or early adoption of new dApps launching on Base.

Looking Ahead: Base Token vs Other Major Airdrops

The Base token vs other airdrops debate will intensify as launch details emerge. If current trends hold, higher transaction throughput than Arbitrum (142.5 tx/s vs 26.74 tx/s according to Chainspect), surging TVL, and robust developer activity, Base could set new benchmarks for both scale and inclusivity in its distribution.

Ultimately, whether you’re an investor or builder, tracking these metrics isn’t just academic, it’s actionable alpha. Watch for official snapshot announcements and keep your wallet active within the Base ecosystem to maximize your future claim.

If history repeats itself, those who position themselves early, and engage meaningfully, often see outsized rewards when major crypto airdrops finally arrive.