As Base Protocol (BASE) continues to attract attention in the DeFi landscape, early adopters are looking for every edge to maximize their rewards from the much-anticipated Base airdrop. With BASE trading at $0.275172 as of October 11,2025, and the airdrop design rumored to prioritize fairness and genuine ecosystem engagement, strategic participation is more critical than ever. If you’re aiming to position yourself at the front of the line for Base token distribution, here’s how you can optimize your approach using proven strategies tailored for June 2024 and beyond.

Why Strategy Matters: The New Era of Airdrop Eligibility

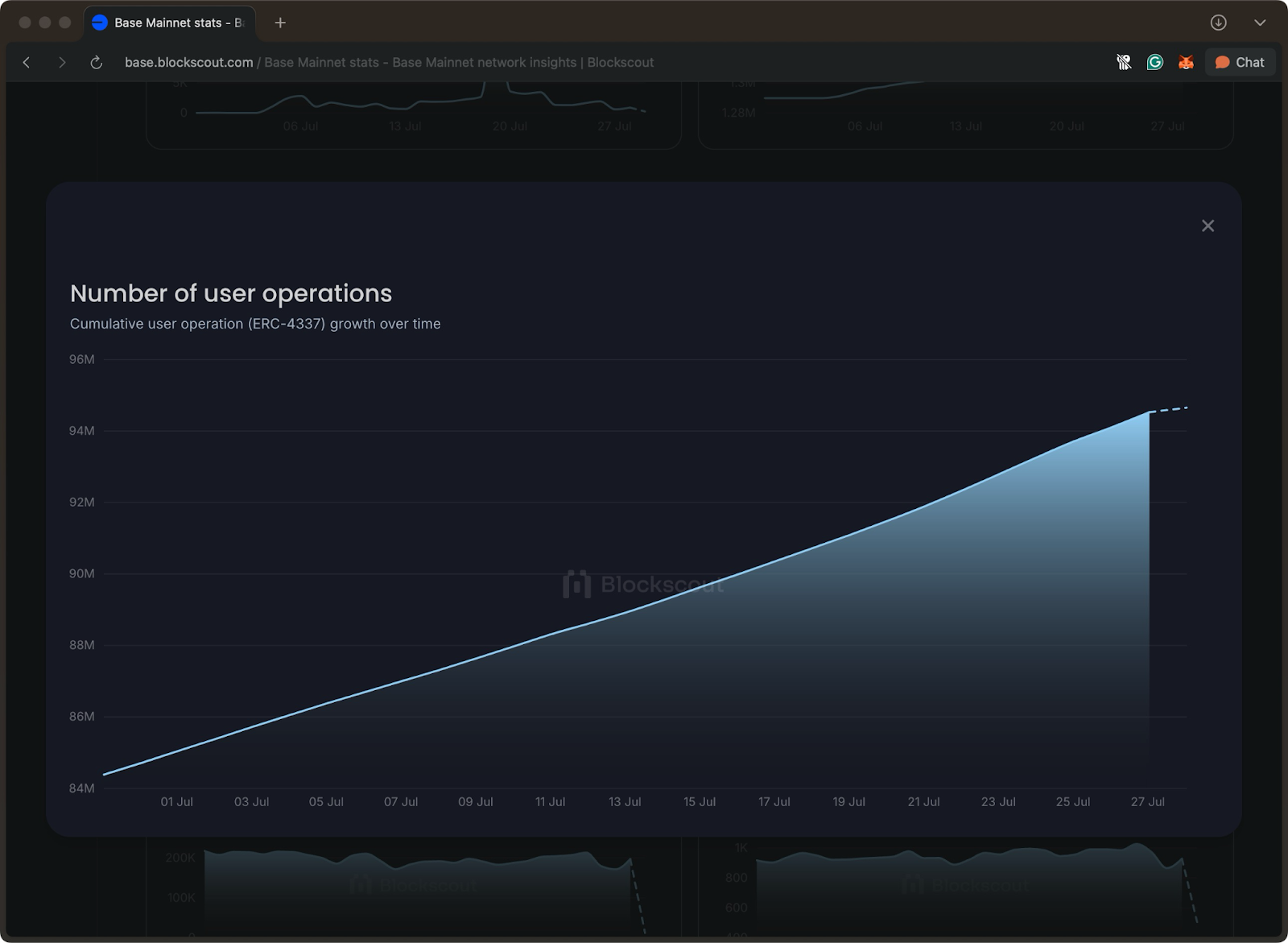

The days of simply holding tokens and waiting for a windfall are over. Modern airdrops like Base are expected to reward users who actively contribute to network growth and demonstrate authentic usage patterns. According to guides from MEXC Blog and insights from Dynamo DeFi, eligibility will likely hinge on a combination of on-chain activity, interaction diversity, and sustained engagement.

“Airdrops have evolved into sophisticated incentive mechanisms that reward real participation, not just passive speculation. ”

1. Actively Bridge Assets to Base Using Official Bridges

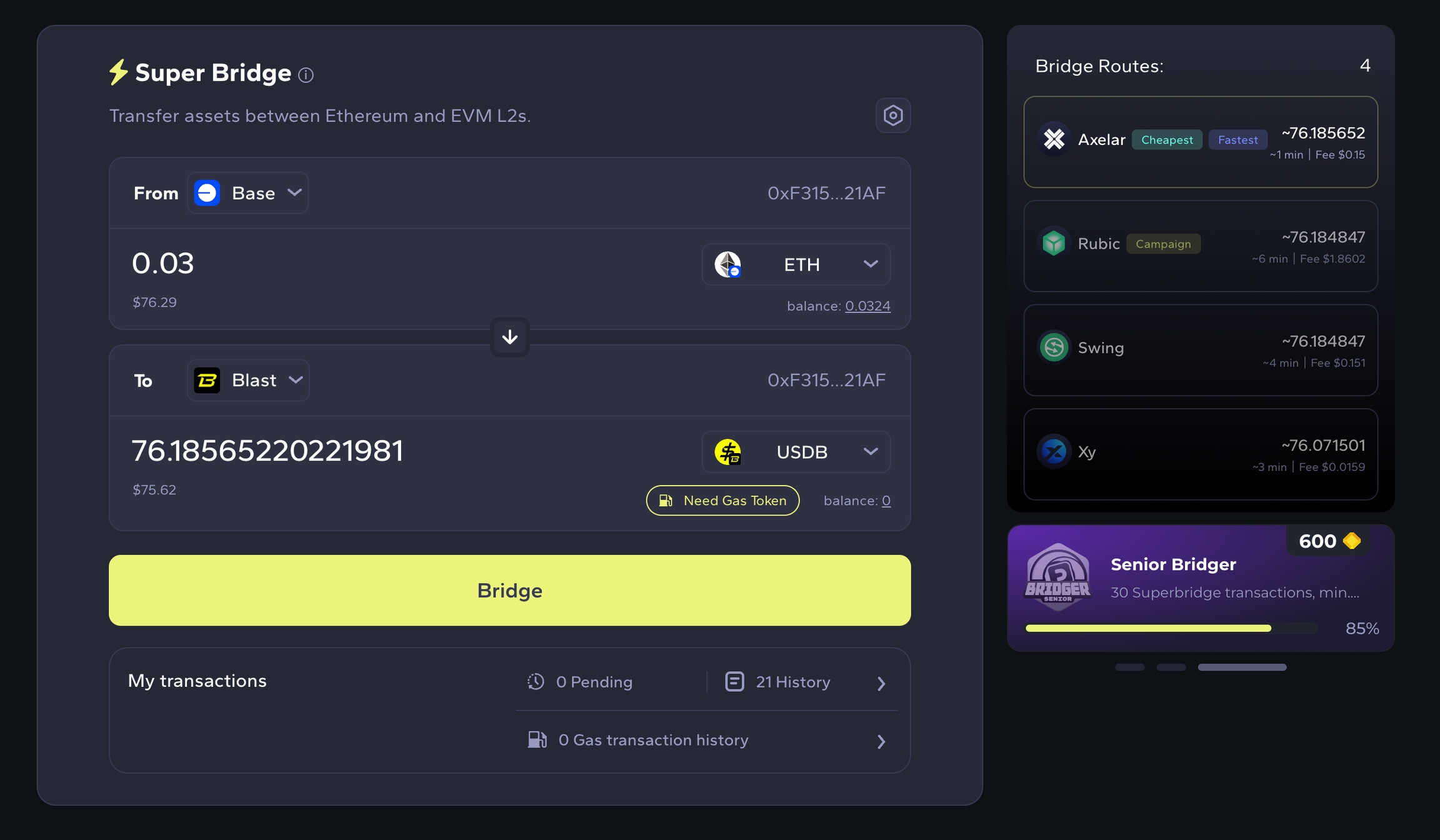

Your first step should be bridging assets, such as ETH or stablecoins, from Ethereum or other EVM-compatible chains into the Base network using official bridges. This isn’t just about moving funds; it’s about signaling your intent to participate long-term in the ecosystem. Frequent and varied bridging activities can help establish your presence as an active user rather than an opportunistic participant.

Top Strategies to Maximize Your Base Airdrop Eligibility

-

Actively Bridge Assets to Base Using Official Bridges: Regularly transfer ETH or stablecoins from Ethereum or other EVM-compatible chains to Base using the official Base Bridge. Consistent bridging activity demonstrates genuine engagement and may boost your eligibility for the airdrop.

-

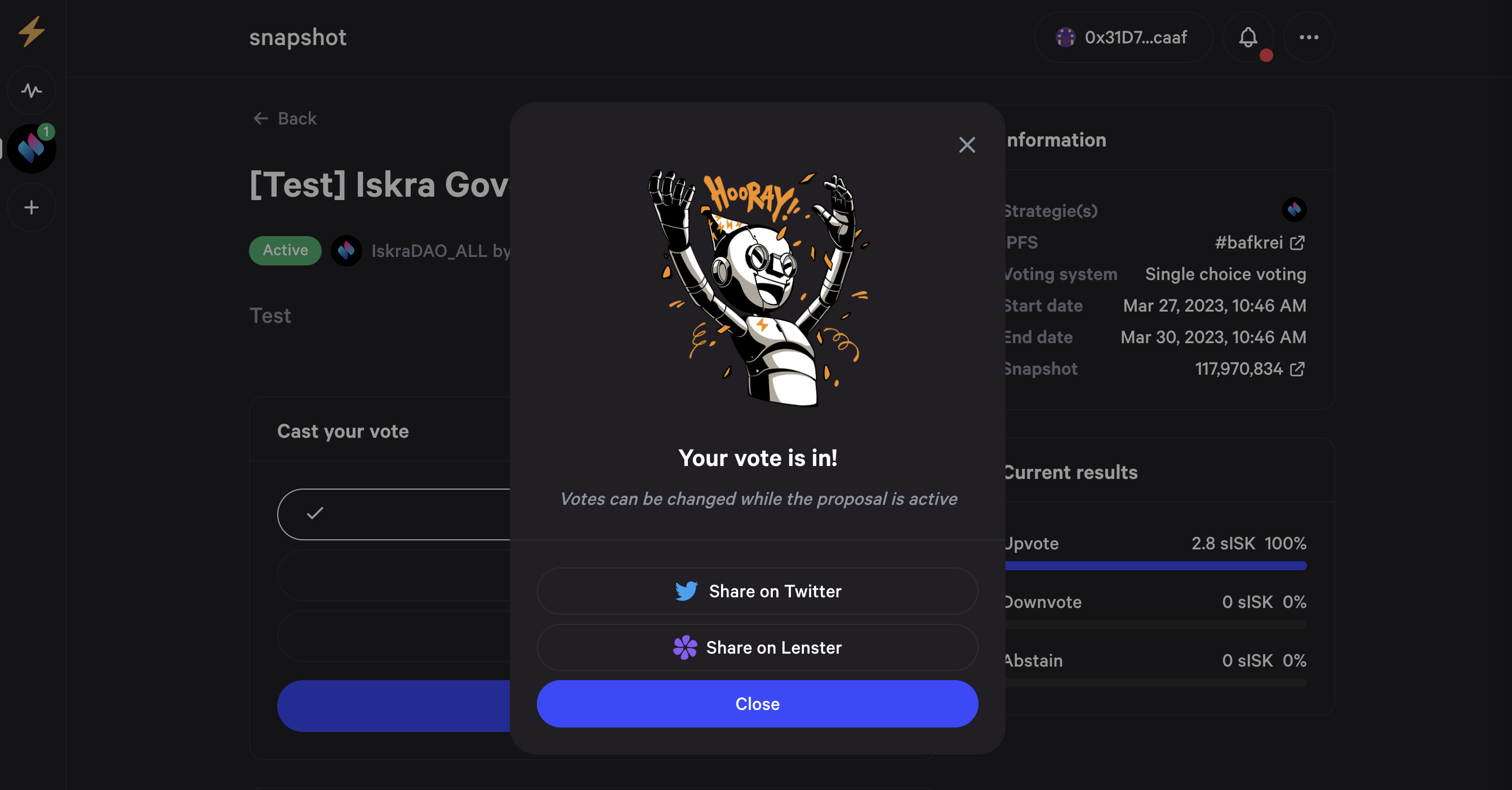

Participate in On-Chain Governance and Voting Activities: Take part in governance proposals and voting on Base-native protocols. This demonstrates a commitment to the ecosystem and may be considered in airdrop criteria.

-

Maintain Consistent Transaction Activity Over Time: Spread your transactions over weeks or months rather than in one burst. Consistency signals authentic use and can help maximize your airdrop rewards.

-

Interact with New and Emerging Projects Launching on Base: Explore and engage with recently launched dApps and NFT platforms on Base. Early adoption of new projects often aligns with airdrop eligibility requirements.

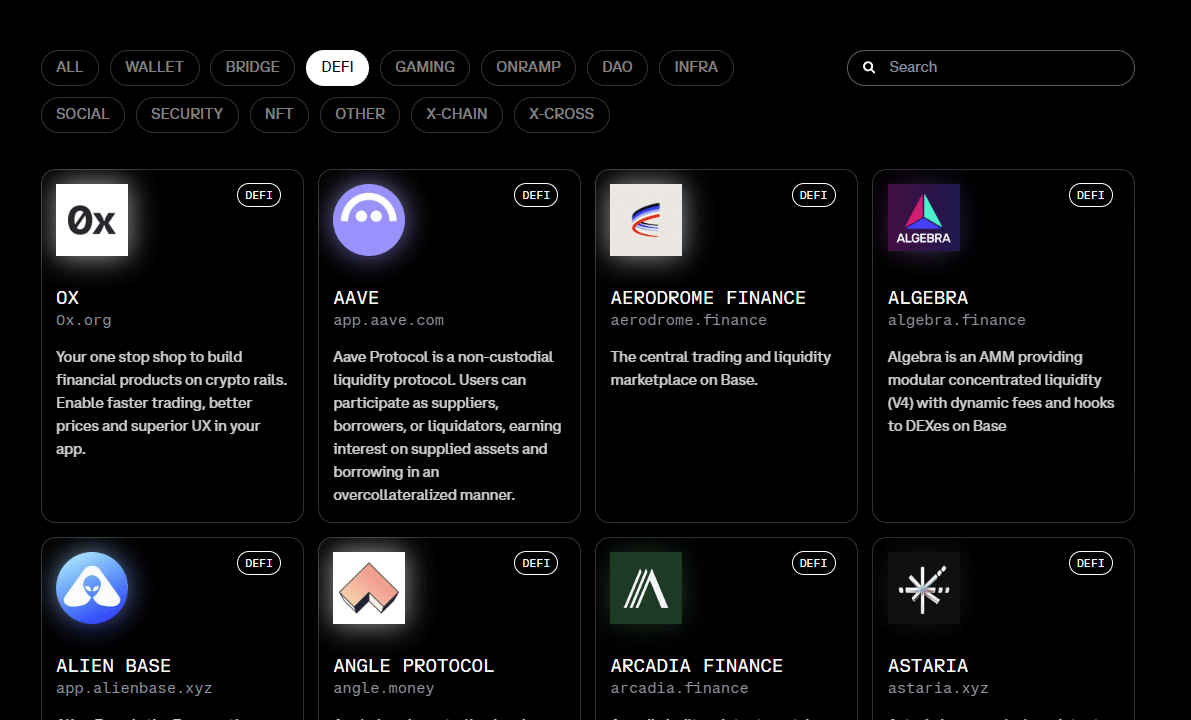

2. Engage with Top DeFi Protocols on Base

The next layer involves interacting with major DeFi protocols that have launched on Base. Platforms like Aerodrome, Uniswap, and Compound are not only foundational pillars but also likely data points for potential airdrop snapshots. Providing liquidity, executing swaps, staking tokens, or borrowing/lending assets all count as meaningful engagement.

This DeFi activity is often weighted heavily in eligibility algorithms, projects want users who help bootstrap liquidity and drive real transaction volume. For detailed walkthroughs on maximizing these interactions, check out this Base Airdrop Playbook.

3. Participate in On-Chain Governance and Voting Activities

A growing trend among major protocols is rewarding users who take part in governance processes, voting on proposals or participating in protocol forums directly demonstrates commitment and alignment with network values. If you want to stand out among early adopters, make sure you’re involved wherever governance opportunities arise within the Base ecosystem.

BASE Price Holds Steady at $0.275172: Why Market Context Matters for Early Adopters

The current BASE price of $0.275172, with intraday highs of $0.277745 and lows near $0.245499, underscores both stability and opportunity for those positioning themselves ahead of the token distribution event.

Base (BASE) Price Prediction 2026-2031

Professional outlook based on current market data, adoption trends, and airdrop ecosystem strategies

| Year | Minimum Price | Average Price | Maximum Price | Y/Y % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.21 | $0.32 | $0.48 | +16% | Early adoption grows post-airdrop; volatility as market absorbs new supply |

| 2027 | $0.28 | $0.44 | $0.72 | +38% | Base ecosystem expands, more DeFi/NFTs; broader Coinbase integration |

| 2028 | $0.36 | $0.57 | $0.96 | +30% | Increased regulatory clarity, new use cases, steady user growth |

| 2029 | $0.41 | $0.68 | $1.18 | +19% | Potential for mainstream DeFi adoption, competition with L2s rises |

| 2030 | $0.48 | $0.81 | $1.42 | +19% | Improved scalability, possible institutional entry, bullish macro |

| 2031 | $0.54 | $0.95 | $1.65 | +17% | Mature ecosystem, high utility, but market cycles may trigger corrections |

Price Prediction Summary

BASE is expected to see steady growth as the ecosystem matures, driven by increased airdrop participation, integration with Coinbase, and broader DeFi/NFT adoption. While the token may face high volatility following major airdrops and new supply, long-term prospects appear positive assuming the Base network continues to innovate and attract users. Price appreciation is likely to be gradual, with potential for sharper gains during bullish market cycles.

Key Factors Affecting Base Price

- Airdrop mechanics and new token supply entering the market

- Growth of Base-native DeFi, NFT, and SocialFi applications

- Coinbase-led ecosystem expansion and user onboarding

- Broader regulatory developments impacting US-based protocols

- Technological improvements (scalability, interoperability)

- Competition from other L2s and emerging blockchain platforms

- Market sentiment and macroeconomic trends affecting crypto

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

4. Maintain Consistent Transaction Activity Over Time

A one-off flurry of transactions won’t cut it anymore; protocols now look for consistent engagement over weeks or months when determining eligibility tiers and allocation sizes. Make it a habit to transact regularly, swap tokens periodically, interact with dApps weekly, or provide ongoing liquidity, to build up a robust activity profile.

This approach not only signals genuine user intent but also helps you avoid being flagged as a “sybil” or opportunistic participant. Consistency is often the deciding factor between a small airdrop and a significant allocation, especially as Base aims to reward long-term ecosystem contributors. Many eligibility algorithms use time-weighted activity, so spreading your actions out over the coming months can have outsized benefits.

5. Interact with New and Emerging Projects Launching on Base

Base is rapidly becoming a launchpad for innovative projects, NFT platforms, SocialFi apps, and next-gen DeFi protocols are debuting here first. Early adopters who experiment with these new dApps are frequently rewarded in future airdrops, both from the projects themselves and potentially through Base’s own token distribution mechanisms. Seek out beta launches, participate in testnets, mint NFTs on up-and-coming platforms, or provide feedback in project communities to maximize your exposure.

Being an early supporter of nascent protocols can sometimes even lead to retroactive rewards if those teams later conduct their own airdrops or collaborate with Base for special incentives. To stay ahead of the curve, monitor community channels and curated lists like those found on EverythingAirdrops for new opportunities as they emerge.

Smart Participation: Avoiding Common Pitfalls

While maximizing your $BASE airdrop eligibility is about taking action, it’s equally important to avoid risky behaviors that could jeopardize your rewards. Avoid using multiple wallets (sybil attacks), as sophisticated detection tools are now standard across major protocols. Always verify you’re interacting with official bridges and dApps, phishing scams targeting eager airdrop farmers are on the rise.

Checklist for Staying Safe While Farming Base Airdrop Opportunities

-

Actively Bridge Assets to Base Using Official Bridges: Always use Base’s official bridge or reputable platforms like Coinbase Bridge to move assets. Avoid third-party links and double-check URLs to prevent phishing attacks.

-

Participate in On-Chain Governance and Voting Activities: Take part in governance proposals through official platforms like Snapshot for Base projects. Never sign suspicious transactions and always review permissions before voting.

-

Interact with New and Emerging Projects Launching on Base: Explore innovative dApps, but always research project legitimacy. Check for audits, community presence, and official announcements before connecting your wallet or approving transactions.

Keep meticulous records of your activity and monitor relevant announcements from trusted sources. For those serious about optimizing their position, consider using portfolio trackers or notification bots to stay updated on new project launches or governance proposals within the Base ecosystem.

The Road Ahead: Maximizing Your Share of BASE at $0.275172

The coming months will be pivotal for anyone aiming to secure meaningful rewards from the Base airdrop. With BASE currently priced at $0.275172, every strategic move you make could translate into tangible gains once tokens are distributed. By bridging assets via official channels, engaging deeply with top DeFi protocols like Aerodrome and Uniswap, participating in governance decisions, maintaining regular transaction activity, and supporting emerging projects on Base, you’ll be well-positioned for both immediate and long-term upside.

Remember: The most valuable rewards often go to those who combine curiosity with consistent effort, so stay active, informed, and ready to adapt as new opportunities arise within the dynamic Base ecosystem.