With the Base Protocol ($BASE) trading at $0.338869 as of October 14,2025, and anticipation for a major airdrop running high, maximizing your onchain score is more crucial than ever for those targeting top-tier $BASE token distribution. If you want to boost your Base airdrop eligibility and secure the largest possible rewards, strategic, consistent engagement with the Base ecosystem is essential. Here’s how to get ahead of the competition using current best practices and onchain analytics.

Maintain Consistent Onchain Activity: The Foundation of Airdrop Eligibility

The first and most critical step is maintaining regular activity on the Base network. Algorithms tracking user engagement often penalize dormant or sporadic wallets, so executing transactions weekly or monthly is vital. This could be as simple as sending ETH or USDC between your wallets, claiming NFT mints, or performing token swaps on Base-native platforms.

Consistent activity signals to the airdrop allocation algorithms that you’re an active participant rather than an opportunistic farmer. It’s not about size alone – frequency matters. Set a recurring calendar reminder to interact with the network each week, ensuring you never fall into inactivity.

Diversify Your Footprint: Engage with Base-Native dApps

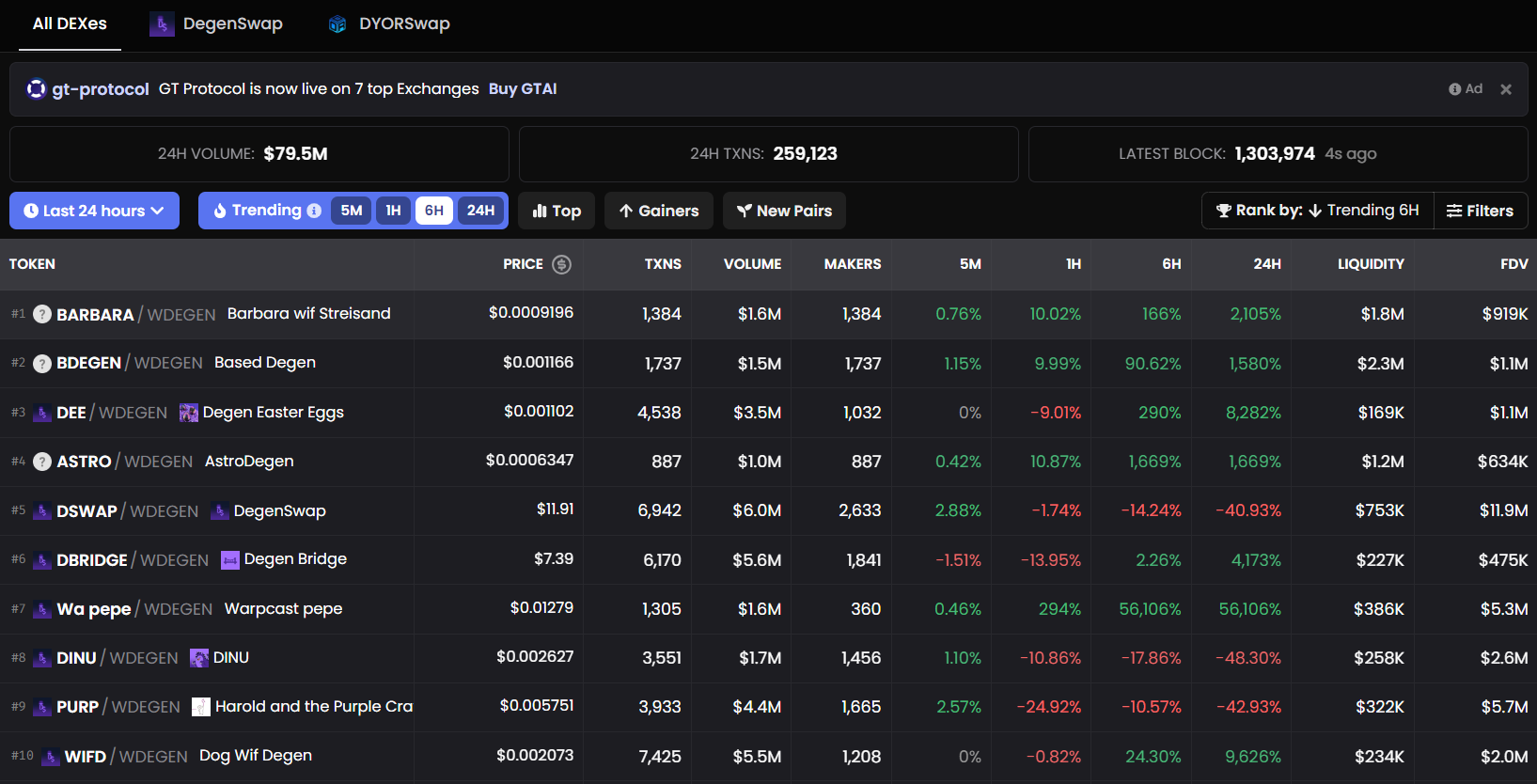

Diversification isn’t just for portfolios – it’s key to maximizing your Base onchain score. Interact with decentralized applications built specifically for the Base chain such as Aerodrome (DEX), Uniswap on Base, lending protocols like Seamless Protocol, and NFT marketplaces including Zora.

- Swap tokens regularly across different DEXes to show broad usage patterns.

- Mint or trade NFTs through platforms native to Base – this adds creative engagement points.

- Lend or borrow assets via DeFi protocols exclusive to Base; this signals deeper ecosystem involvement.

The more varied your interactions across dApp categories (DeFi, NFTs, infrastructure), the higher your eligibility score climbs. Remember: algorithms reward genuine engagement over one-off transactions.

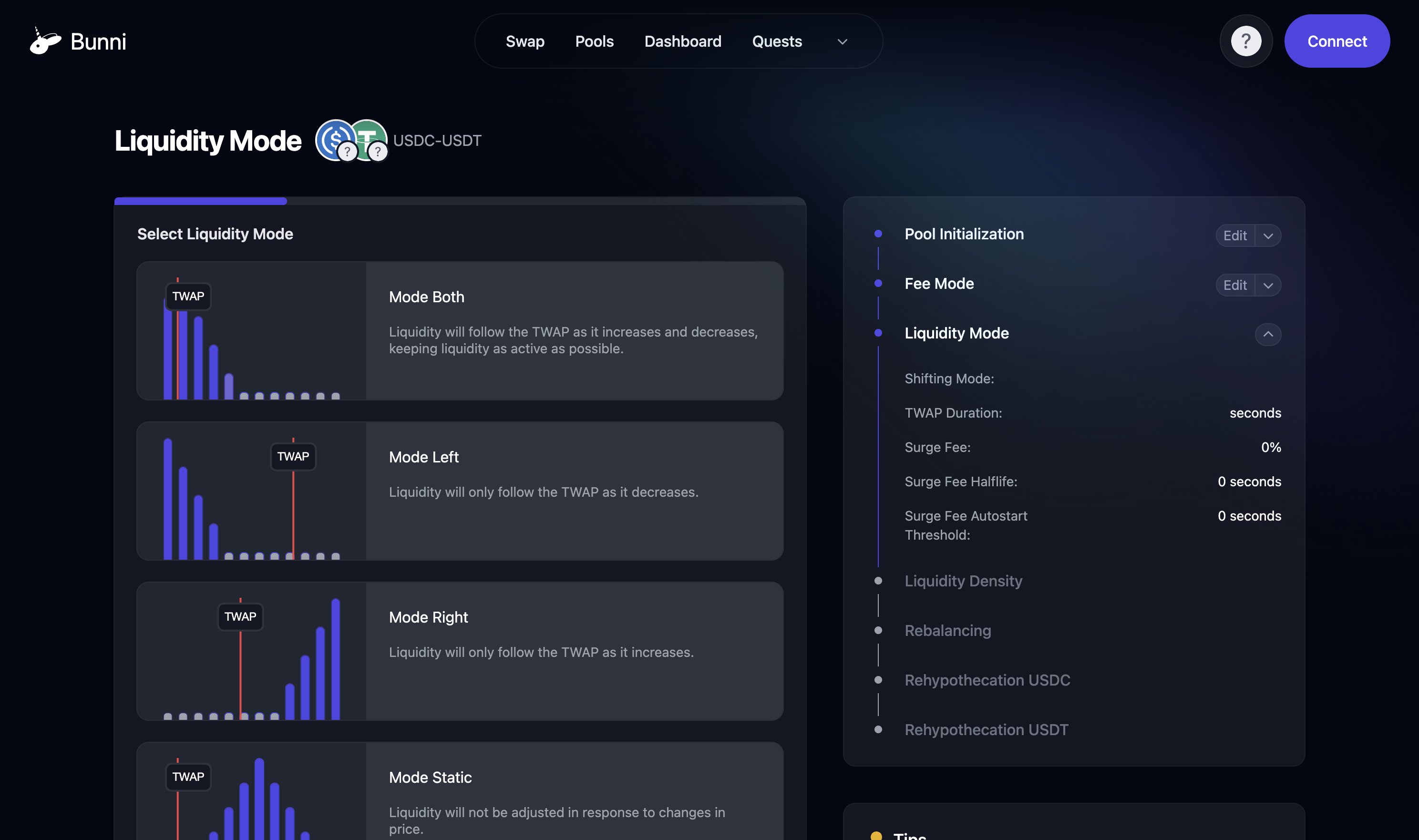

Provide Liquidity and Participate in DeFi for Maximum Points

If you’re serious about qualifying for maximum $BASE token rewards, providing liquidity and participating in DeFi protocols within the Base ecosystem is non-negotiable. Supply assets like ETH or USDC into pools on Aerodrome or lend/borrow via Seamless Protocol. These actions demonstrate both risk tolerance and commitment, two factors likely weighted heavily by allocation models.

Not only do these steps increase your potential airdrop allocation, but they also open up opportunities for yield farming and additional incentives provided by these protocols themselves. Just ensure you periodically rebalance positions and interact with new pools as they launch, stagnant liquidity can be overlooked by scoring algorithms.

Base (BASE) Price Prediction 2026-2031

Professional Outlook Based on Market Trends and Onchain Engagement Potential

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.29 | $0.42 | $0.60 | +24% | Increased user adoption post-airdrop, Base ecosystem growth drives moderate price appreciation. |

| 2027 | $0.38 | $0.54 | $0.85 | +29% | Potential Coinbase partnership announcements and DeFi integrations fuel bullish sentiment. |

| 2028 | $0.47 | $0.67 | $1.05 | +24% | Layer 2 competition intensifies; successful scaling and new dApps critical for further growth. |

| 2029 | $0.59 | $0.83 | $1.30 | +24% | Regulatory clarity in the US/EU, steady DeFi expansion on Base, but macro volatility remains. |

| 2030 | $0.73 | $1.02 | $1.65 | +23% | Mainstream adoption of Base-native applications, possible institutional interest, and broader crypto bull cycle. |

| 2031 | $0.89 | $1.23 | $2.10 | +21% | Base reaches maturity as a leading Layer 2, but faces strong competition from emerging protocols. |

Price Prediction Summary

Base (BASE) is poised for steady growth through 2031, supported by increasing ecosystem adoption, robust DeFi activity, and potential airdrop-driven engagement. While competition and regulatory risks persist, the protocol’s integration with Coinbase and active user base suggest a strong foundation for long-term appreciation. The average price could rise from $0.42 in 2026 to $1.23 in 2031, with bullish cycles potentially pushing prices above $2.00 during peak market conditions.

Key Factors Affecting Base Price

- Base’s integration with Coinbase and access to mainstream users.

- Sustained onchain activity and successful airdrop incentives.

- Ongoing development of DeFi, NFT, and social dApps on Base.

- Competition from other Ethereum Layer 2 solutions (e.g., Arbitrum, Optimism, zkSync).

- Regulatory developments, especially in the US and EU.

- Macro crypto market cycles and institutional adoption.

- Security of the Base protocol and reliability of bridges.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

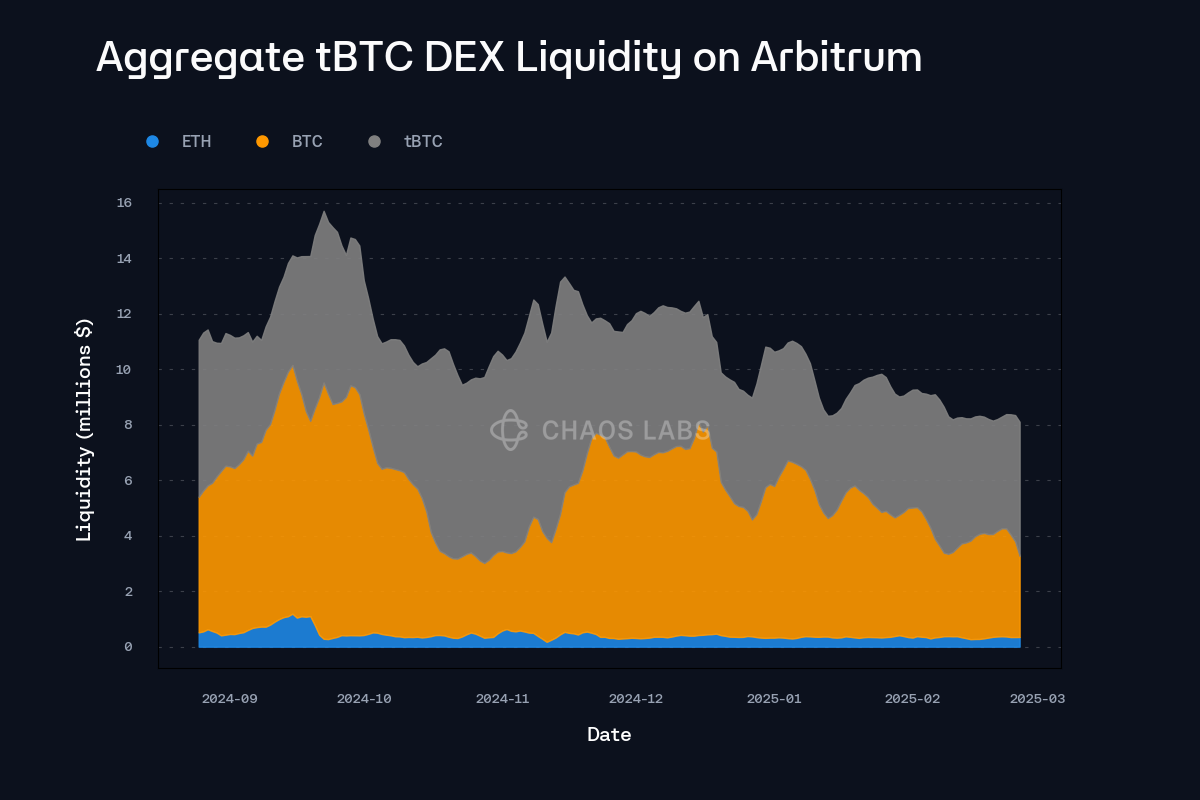

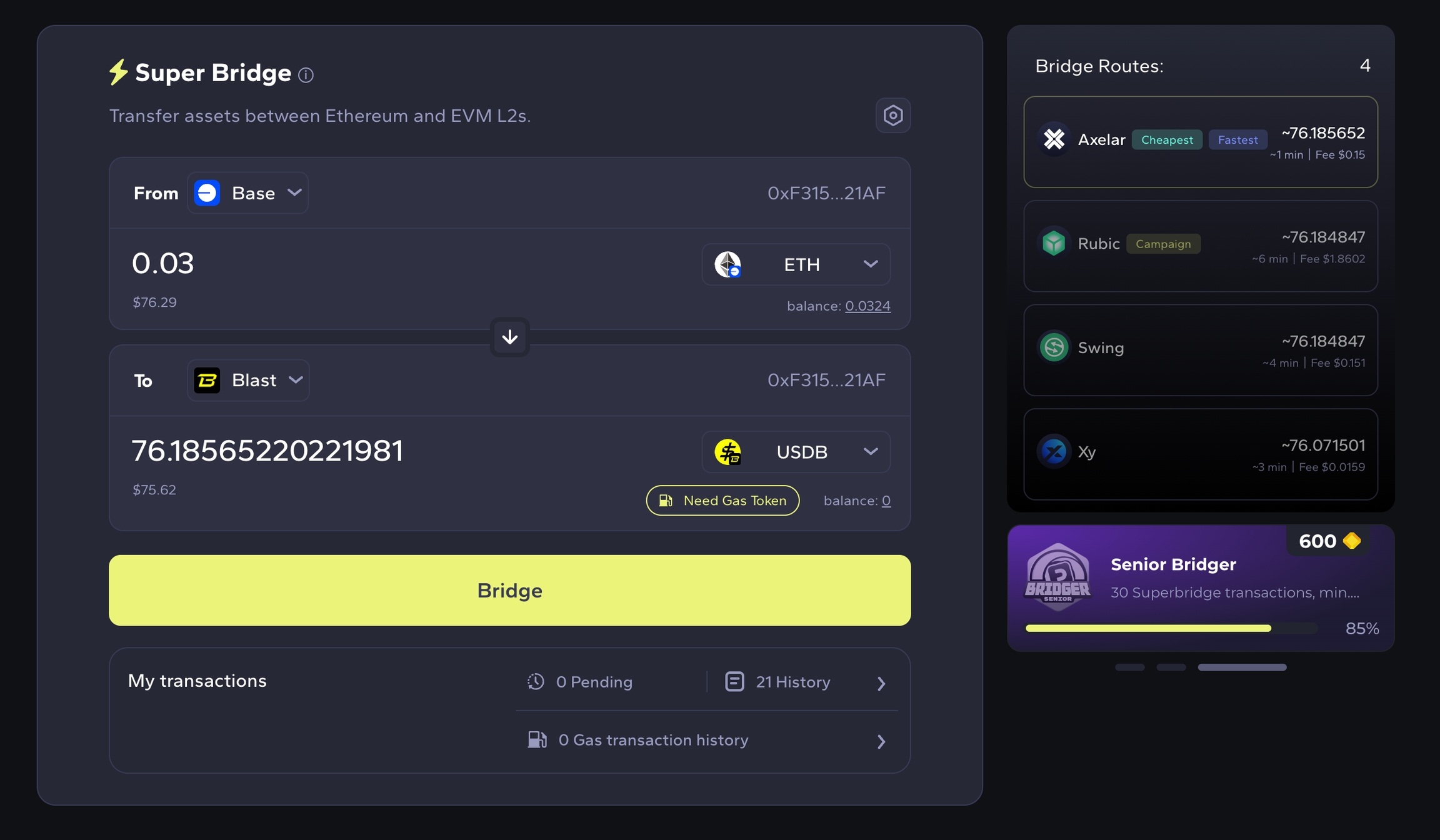

Bridge Assets and Utilize Cross-Chain Features to Stand Out

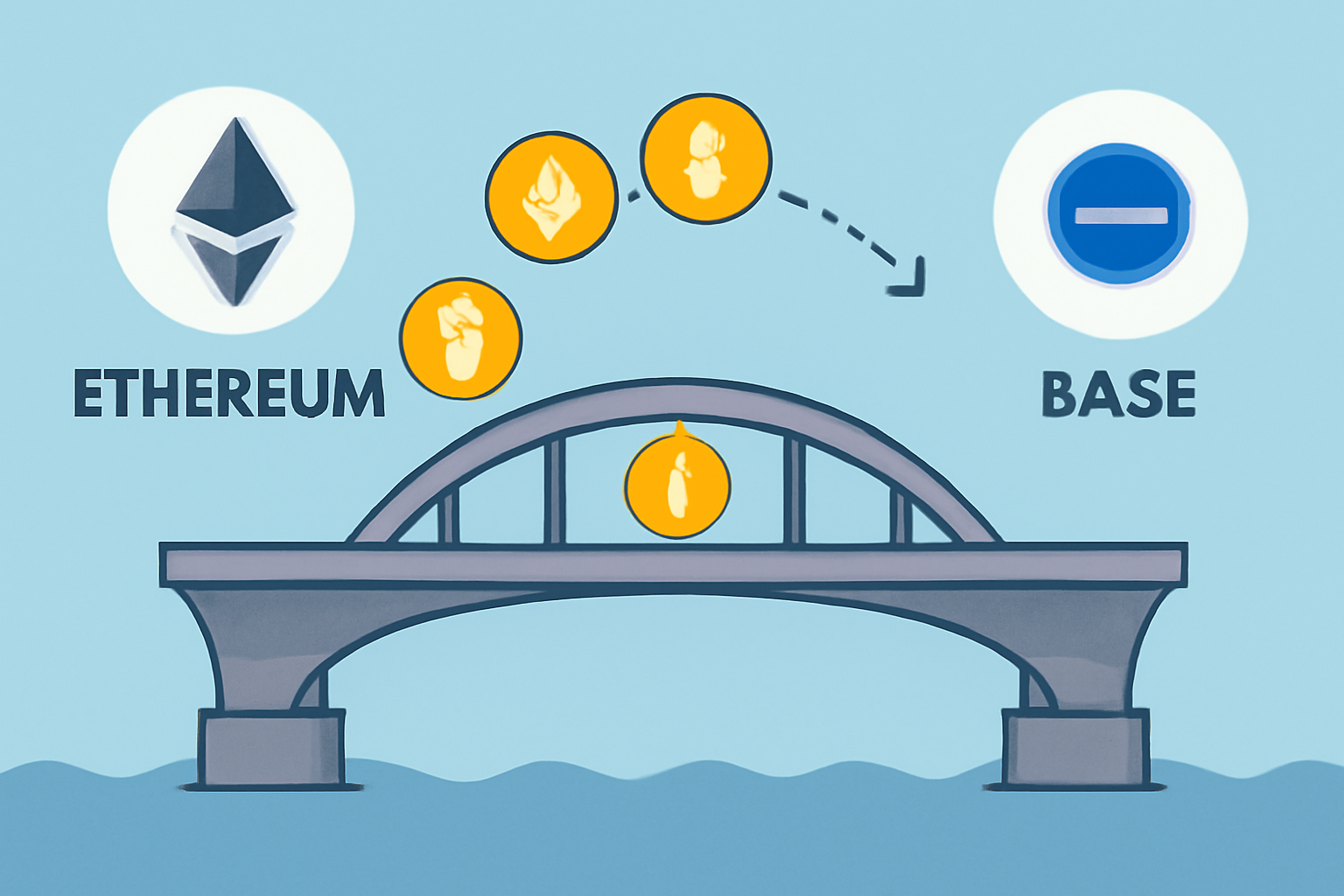

The ability to bridge assets between Ethereum mainnet and Base using official bridges like Base Bridge is another core pillar of high eligibility scores. Regularly moving funds in both directions shows that you are leveraging cross-chain capabilities, a key metric as interoperability becomes central in Layer 2 ecosystems.

Avoid simply bridging once; instead, make it a habit every few weeks. This demonstrates persistent interest rather than one-time farming behavior. Use analytics dashboards like Zerion or Dune (see below) to confirm that all bridged transactions are being recorded correctly toward your overall activity score.

Monitor and Optimize Your Onchain Score Like a Pro

You can’t improve what you don’t measure. Use analytics tools such as Zerion or custom Dune dashboards tailored for the Base network to track wallet activity across all relevant metrics, transaction count, unique dApp interactions, liquidity provision history, cross-chain transfers, and more.

- Check your current onchain score here

- Identify gaps where you may be underperforming (e. g. , little NFT activity? Try minting some art!)

- Tweak strategies monthly based on dashboard feedback, this iterative approach keeps you ahead of shifting eligibility criteria and market trends.

If you want deeper insights into optimizing every aspect of your score, including advanced tactics, see our full guide at How to Maximize Your Onchain Score for the BASE Token Airdrop: Step-by-Step Guide.

One of the most overlooked factors in airdrop positioning is consistency over time. While many users rush to complete tasks in a single week, algorithms increasingly favor wallets that display organic, ongoing engagement. If you want to stand out from the crowd for the $BASE token distribution, make every aspect of your onchain activity deliberate and sustained.

5 Essential Steps to Maximize Your Base Airdrop Eligibility

-

Maintain Consistent Onchain Activity: Execute weekly or monthly transactions on the Base network to demonstrate regular usage and avoid inactivity penalties. Consistent activity is a key metric for airdrop eligibility.

-

Engage with Base-Native dApps: Interact with decentralized applications built specifically for Base, such as DEXes (Aerodrome, Uniswap on Base), lending protocols, and NFT marketplaces to diversify your onchain footprint.

-

Provide Liquidity and Participate in DeFi: Supply assets like ETH or USDC to liquidity pools or lending/borrowing platforms within the Base ecosystem to increase your eligibility score. Platforms like Aave on Base are popular options.

-

Bridge Assets and Utilize Cross-Chain Features: Frequently bridge assets between Ethereum mainnet and Base using official bridges like the Base Bridge, showcasing active cross-chain engagement.

-

Monitor and Optimize Your Onchain Score: Use analytics tools such as Zerion or Dune dashboards to track your activity, identify gaps, and adjust your strategies for maximum airdrop potential.

Fine-Tune Your Strategy: Avoid Common Pitfalls

Even seasoned DeFi participants can fall into traps that reduce their eligibility score. Here are some strategic tips to help you avoid costly mistakes:

- Avoid clustering all activity into a single day or week. Spread transactions and interactions across time.

- Don’t ignore smaller dApps or new launches. Early adoption often earns extra points, so explore emerging Base-native projects.

- Watch for duplicate patterns: Repeating only swaps or only NFT mints may look inorganic. Mix up your activities as much as possible.

- Monitor gas fees: With BASE Protocol currently at $0.338869, optimize for cost efficiency but don’t let high gas deter regular engagement.

Stay Agile as Eligibility Criteria Evolve

The Base ecosystem is rapidly evolving, with new dApps, bridges, and scoring methodologies emerging by the month. What works today may be less effective tomorrow. That’s why it’s critical to remain agile:

- Join community channels and monitor official announcements for changes in eligibility algorithms or bonus campaigns.

- Engage with governance votes or community quests: These often signal deeper involvement and can act as tie-breakers among top scorers.

- Regularly check your onchain score and adapt quickly if you notice any drop-offs or missed opportunities.

Summary Table: Five Essential Tasks for Maximizing Your BASE Airdrop Score

Key Tasks to Maximize Base ($BASE) Airdrop Eligibility and Their Impact

| Task | Description | Recommended Frequency | Impact on Eligibility |

|---|---|---|---|

| Maintain Consistent Onchain Activity | Execute transactions on the Base network regularly to show ongoing use and avoid inactivity penalties. | Weekly or Monthly | High – Regular activity is a core factor in onchain score calculation. |

| Engage with Base-Native dApps | Interact with Base-native decentralized applications (DEXes, lending, NFT platforms) to diversify your usage. | Weekly or Bi-weekly | High – Engaging with multiple dApps demonstrates ecosystem involvement. |

| Provide Liquidity and Participate in DeFi | Supply ETH, USDC, or other assets to Base liquidity pools or lending/borrowing protocols. | Monthly or as opportunities arise | Medium to High – Liquidity provision and DeFi participation are strong eligibility signals. |

| Bridge Assets and Utilize Cross-Chain Features | Bridge assets between Ethereum and Base using official bridges to showcase cross-chain activity. | Monthly or more frequently | Medium – Regular bridging shows active cross-chain engagement. |

| Monitor and Optimize Your Onchain Score | Use analytics tools (Zerion, Dune, Nomis, OnchainScore) to track and improve your activity. | Ongoing (at least monthly) | Medium – Proactive monitoring allows you to adjust and maximize your eligibility. |

The bottom line? The best-positioned wallets aren’t those that simply check off boxes, they’re those that demonstrate real commitment to building and using the Base ecosystem over time. With $BASE trading at $0.338869, even small differences in allocation could translate into significant value at distribution time.

Stay disciplined, stay curious, and keep optimizing your approach using all available analytics tools. For advanced strategies and ongoing updates tailored to current market conditions, bookmark our comprehensive guide at How to Maximize Your Onchain Score for the BASE Token Airdrop: Step-by-Step Guide.