With the Base Protocol (BASE) trading at $0.32062 as of October 18,2025, interest in the potential $BASE token airdrop is at an all-time high. Early adopters looking to maximize their Base token airdrop eligibility must move beyond passive speculation and take targeted, on-chain actions. The Base ecosystem is rewarding genuine, sustained participation, not just one-off transactions. If you want to position your wallet for the best possible airdrop allocation, focus on the following prioritized strategies, each backed by current market insights and expert consensus.

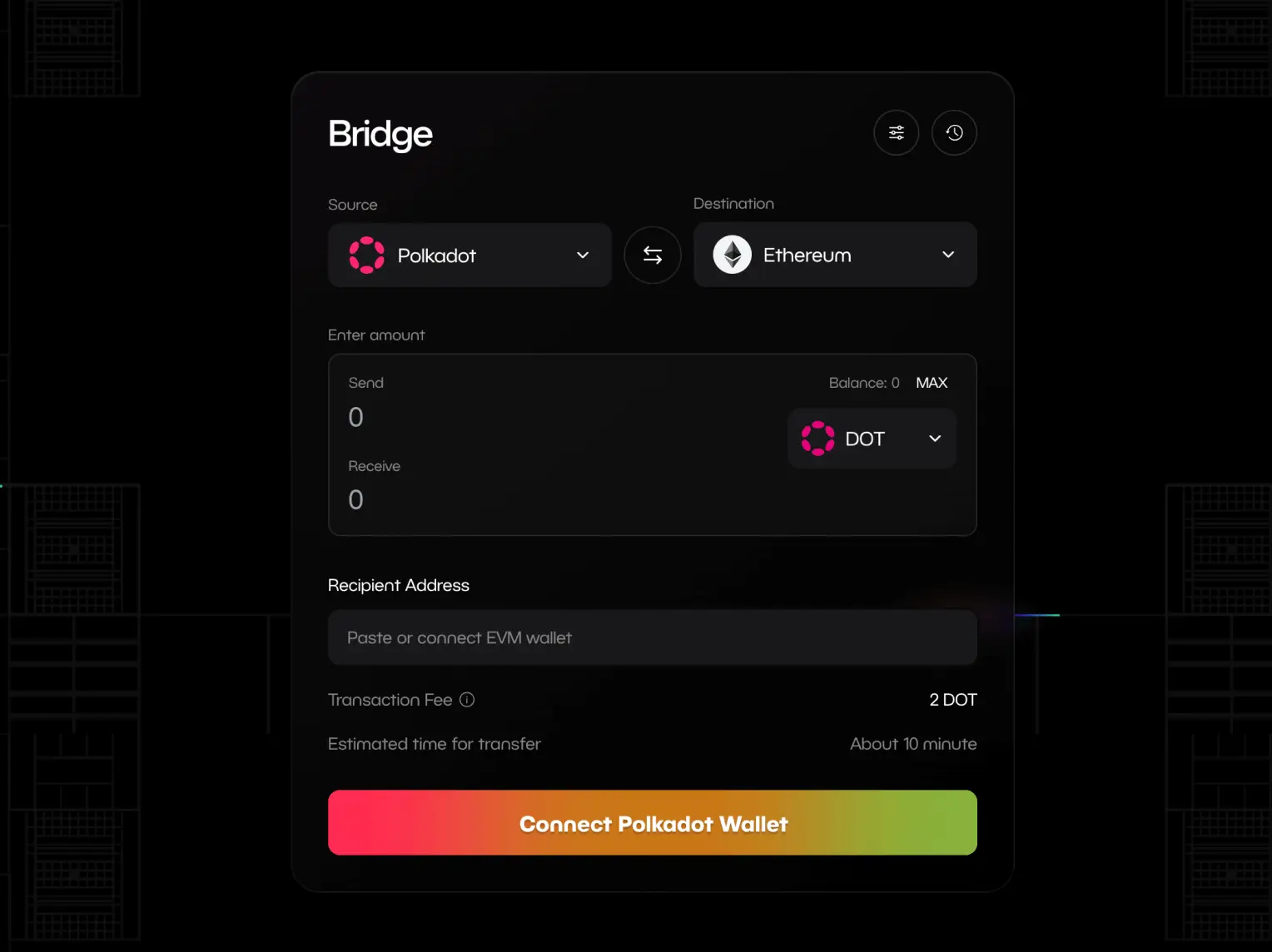

Bridge Assets to Base Network Using Official Bridges

Bridging assets is your first and most critical step. Use the official Base bridge to transfer ETH or stablecoins from Ethereum mainnet to the Base network. This signals to the protocol that you’re an early adopter, willing to commit capital and interact natively on Base. Avoid third-party or unofficial bridges, as these may not be recognized during snapshot events. The more consistent and substantial your bridging activity, the stronger your eligibility profile becomes.

Interact Regularly with Top Base Ecosystem dApps

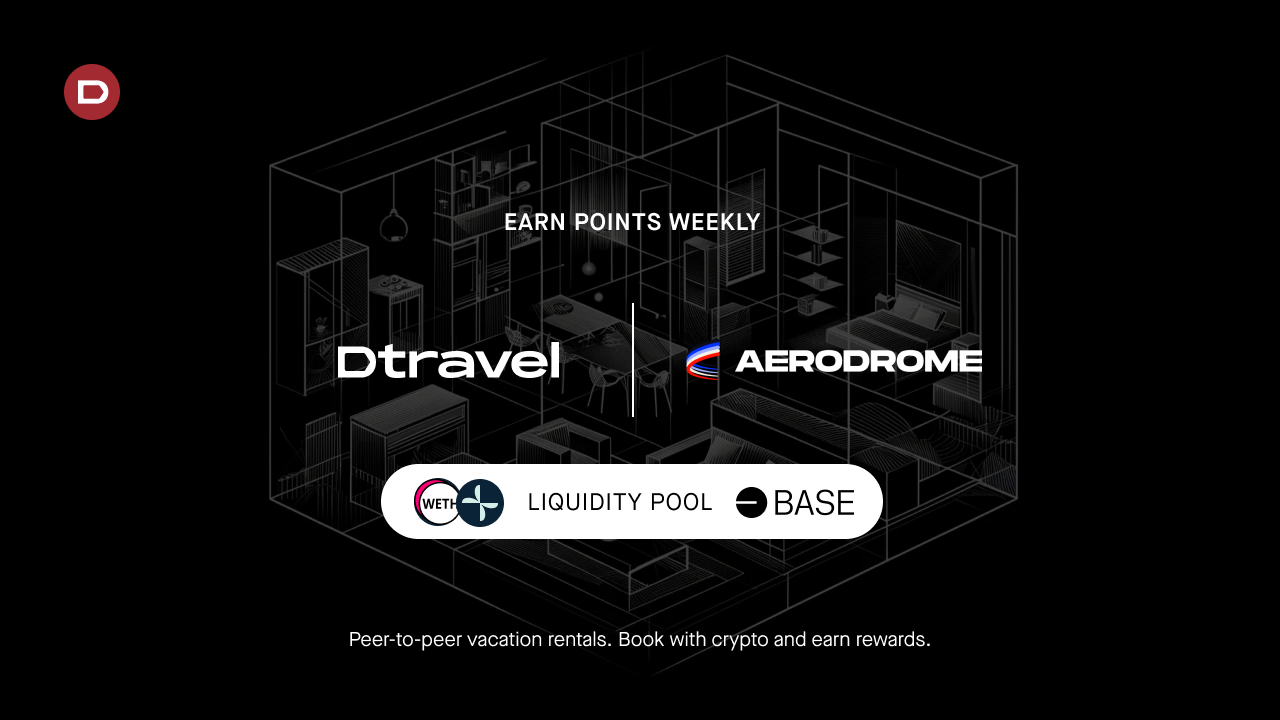

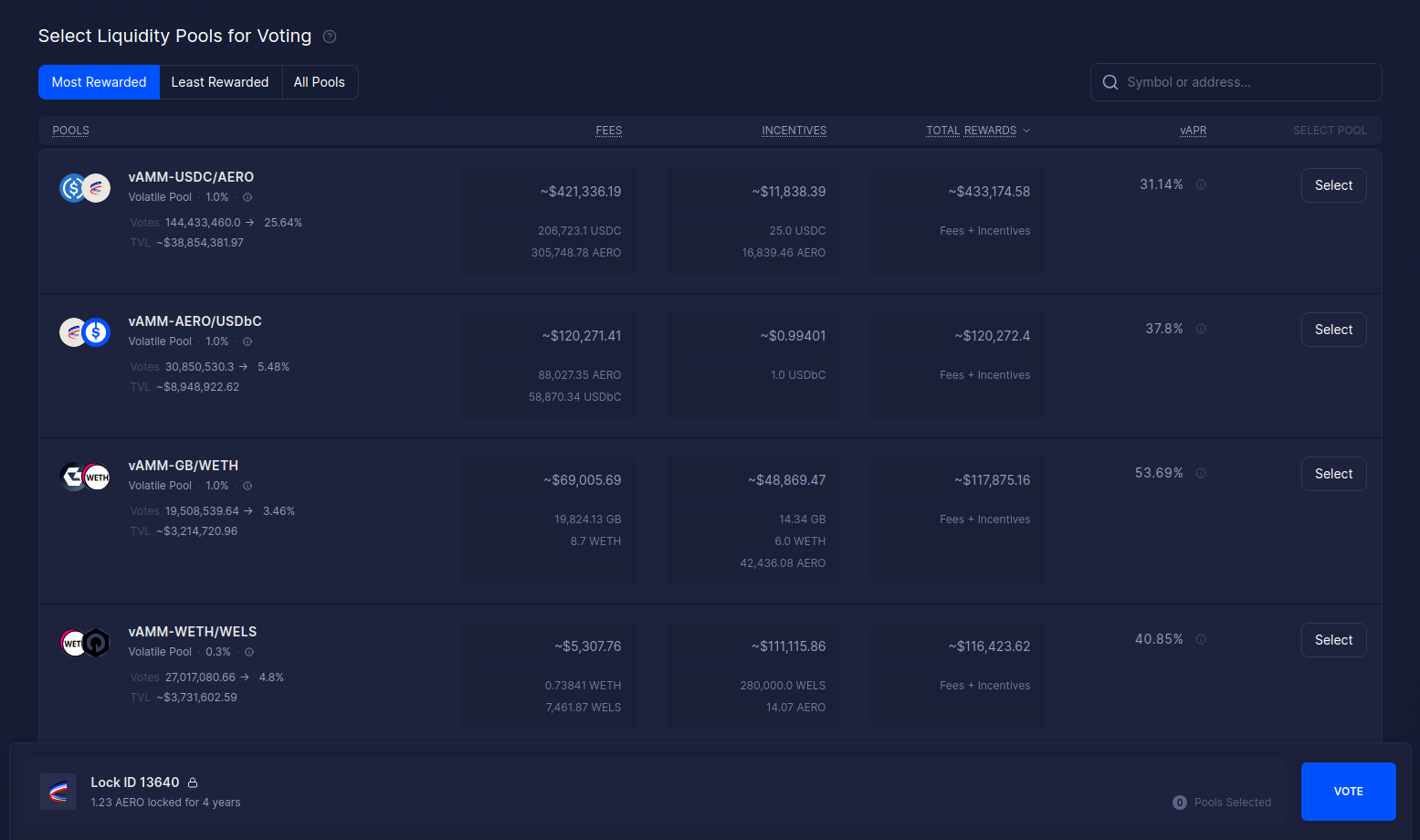

After bridging, deepen your on-chain footprint by interacting with the top dApps in the Base ecosystem. Focus on high-volume, reputable platforms like Aerodrome, Friend. tech, and Uniswap (Base). Don’t just make a single swap and disappear; instead, execute regular trades, experiment with new features, and diversify your activity across these protocols. This approach demonstrates authentic usage, a key metric in most airdrop criteria.

Top 5 Base dApps & Actions for Airdrop Eligibility

-

Bridge Assets to Base Network Using Official BridgesStart by moving ETH or stablecoins from Ethereum to Base via the official Base bridge. This step establishes your on-chain presence and signals genuine interest in the ecosystem—an essential move for airdrop eligibility.

-

Interact Regularly with Top Base Ecosystem dApps (e.g., Aerodrome, Friend.tech, Uniswap)Engage with leading Base-native dApps like Aerodrome (DEX and liquidity), Friend.tech (social trading), and Uniswap (swaps). Consistent, meaningful activity on these platforms builds a robust on-chain history.

-

Provide Liquidity or Stake in Base-based DeFi ProtocolsDeposit assets into liquidity pools or staking products on Base DeFi platforms such as Aerodrome or Uniswap. These actions show deeper ecosystem participation and may be weighted heavily in airdrop criteria.

-

Claim and Maintain Base Guild Roles or Participate in Community QuestsJoin the Base Guild to earn roles like ‘Based’ and ‘Onchain,’ or participate in campaigns such as Onchain Summer. Community involvement demonstrates authentic engagement beyond just transactions.

-

Register a .base Name via Base Name Service (BNS) and Use it On-ChainSecure your identity by registering a .base domain through the Base Name Service (BNS). Using your .base name in transactions can further boost your airdrop eligibility profile.

Provide Liquidity or Stake in Base-based DeFi Protocols

Liquidity providers and stakers are often the backbone of any Layer 2 ecosystem, and Base is no exception. By supplying liquidity to pools on Aerodrome or staking assets in other Base-native DeFi protocols, you not only earn yield but also signal deeper engagement to the network. Distribute your liquidity across multiple pools and avoid withdrawing everything immediately after providing, sustained participation is typically favored in airdrop allocations.

Claim and Maintain Base Guild Roles or Participate in Community Quests

Social and community engagement is increasingly relevant for airdrop eligibility. Join the Base Guild, claim roles like ‘Based’ or ‘Onchain, ’ and participate in ongoing quests or campaigns (such as Onchain Summer). These actions create a public record of your involvement and help you stand out in the snapshot process. Be active, not passive, regular participation in quests and events is more valuable than a single check-in.

Register a. base Name via Base Name Service (BNS) and Use it On-Chain

Registering a . base domain through the Base Name Service (BNS) is more than vanity, it’s a way to tie your wallet’s activity to a unique, verifiable identity. Use your. base name for transactions and community engagement to further distinguish your wallet during eligibility reviews. This small investment can be a powerful differentiator if BNS registration is factored into future airdrop criteria.

For a deep dive into these tactics and how to layer them for maximum effect, check out our comprehensive step-by-step guide for users, creators, and builders.

Base (BASE) Token Price Prediction 2026-2031

Professional forecast based on current market data, adoption trends, and potential airdrop-driven catalysts.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.22 | $0.38 | $0.65 | +19% | Initial airdrop aftermath; volatility as tokens enter the market. Adoption grows, but sell pressure possible. |

| 2027 | $0.28 | $0.55 | $1.05 | +45% | Base ecosystem gains traction, DeFi protocols expand. Regulatory clarity helps sentiment. |

| 2028 | $0.35 | $0.72 | $1.55 | +31% | Layer-2 adoption accelerates, Coinbase integration deepens. Competition from other L2s moderates growth. |

| 2029 | $0.42 | $0.89 | $2.00 | +24% | Sustained user growth, new use cases emerge. Broader crypto bull market possible. |

| 2030 | $0.51 | $1.18 | $2.75 | +33% | Base matures as a top Layer-2, institutional adoption rises. Regulatory headwinds could cap upside. |

| 2031 | $0.68 | $1.45 | $3.40 | +23% | Ecosystem fully developed, recurring revenue models. Macro trends and new tech integrations drive valuation. |

Price Prediction Summary

The BASE token is expected to appreciate steadily from 2026 to 2031, with average prices growing from $0.38 in 2026 to $1.45 in 2031. Bullish scenarios could see prices reaching $3.40 by 2031 if Base achieves dominant Layer-2 status and broad adoption. However, market volatility, regulatory uncertainties, and competition from other Ethereum scaling solutions may limit upside in bearish scenarios. Early airdrop recipients may influence initial volatility, but sustained ecosystem growth and integration with Coinbase could provide strong long-term support.

Key Factors Affecting Base Price

- Airdrop distribution and post-airdrop sell pressure

- Adoption of the Base network for DeFi, NFTs, and real-world assets

- Coinbase’s support and integration with Base

- Regulatory clarity for Layer-2 and airdrop tokens

- Competition from other Layer-2 solutions (e.g., Optimism, Arbitrum, zkSync)

- Broader crypto market cycles (bull/bear markets)

- Technological improvements and new use cases within the Base ecosystem

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Consistency and breadth of on-chain activity are what separate airdrop maximizers from casual users. Rather than treating these steps as a checklist to complete in a single session, spread your actions out over weeks or months. Base’s snapshot methodology (like other major L2s) often rewards wallets that demonstrate sustained interaction, not just one-time engagement. This means recurring swaps, ongoing liquidity provision, and regular participation in community quests all work in your favor.

Pro tip: Pair your Base Guild activity with on-chain actions for a synergistic boost. For example, after joining a campaign or earning a new role, execute a swap or provide liquidity within the same week. This pattern of engagement is highly visible to snapshot algorithms and can enhance your eligibility profile.

Security, Transparency, and Staying Ahead

As Base Protocol (BASE) sits at $0.32062, the ecosystem is drawing both legitimate users and opportunists. Make sure to use only official bridges, verified dApps, and the authentic Base Name Service. Scammers often target moments of high anticipation around airdrops with phishing links and fake interfaces. Always double-check URLs and never share your seed phrase or private keys.

Transparency is also key: consider linking your. base name to your public profiles, or sharing your Base Guild role badges on social media to signal your involvement. This not only helps build your reputation but may also play a role in future community-driven reward schemes. If you’re active in Discord, Telegram, or Twitter communities, document your participation, sometimes off-chain contributions are recognized in retroactive airdrops.

Optimize for the Next Snapshot

While there’s no guarantee of a $BASE token airdrop, the best strategy is to prepare as if the snapshot could occur at any moment. Review your wallet’s activity: have you bridged assets, interacted with leading dApps, provided liquidity, claimed Base Guild roles, and registered a. base name? If not, prioritize these actions now. Diversifying your on-chain footprint across these five areas not only maximizes eligibility but also positions you for ecosystem rewards beyond the airdrop itself.

If you’re looking for a detailed, actionable playbook on these strategies, our step-by-step Base airdrop guide breaks down each action with screenshots and expert commentary.

5 Essential Actions for $BASE Airdrop Eligibility

-

Bridge Assets to Base Network Using Official Bridges: Move your ETH or stablecoins from Ethereum mainnet to the Base network via the official Base bridge. Early bridging demonstrates genuine adoption and is a key eligibility signal for the $BASE airdrop.

-

Interact Regularly with Top Base Ecosystem dApps (e.g., Aerodrome, Friend.tech, Uniswap): Swap tokens, provide liquidity, or mint NFTs on leading Base-native dApps like Aerodrome, Friend.tech, and Uniswap. Consistent, meaningful activity builds a robust on-chain profile.

-

Provide Liquidity or Stake in Base-based DeFi Protocols: Supply assets to Base-native DeFi platforms such as Aerodrome or Velodrome. Staking or liquidity provision signals deeper ecosystem engagement and may boost airdrop eligibility.

-

Claim and Maintain Base Guild Roles or Participate in Community Quests: Join the Base Guild to earn roles like ‘Based’ or ‘Onchain’, or take part in campaigns such as Onchain Summer. Active community participation is often rewarded in airdrop criteria.

-

Register a .base Name via Base Name Service (BNS) and Use it On-Chain: Secure your identity by registering a .base domain through the Base Name Service. Using your .base name in transactions may further strengthen your eligibility profile.

Monitor, Adapt, and Stay Engaged

Finally, Base’s airdrop eligibility criteria may evolve as the network matures. Stay agile by monitoring official announcements, tracking your on-chain activity, and adapting as new opportunities arise, such as emerging DeFi protocols or fresh community quests. Remember, the most successful airdrop participants are those who treat Base not just as a speculative opportunity but as a living, growing ecosystem worth supporting for the long haul.

For further reading on wallet age, on-chain footprint, and additional eligibility factors, see our full criteria and guide.