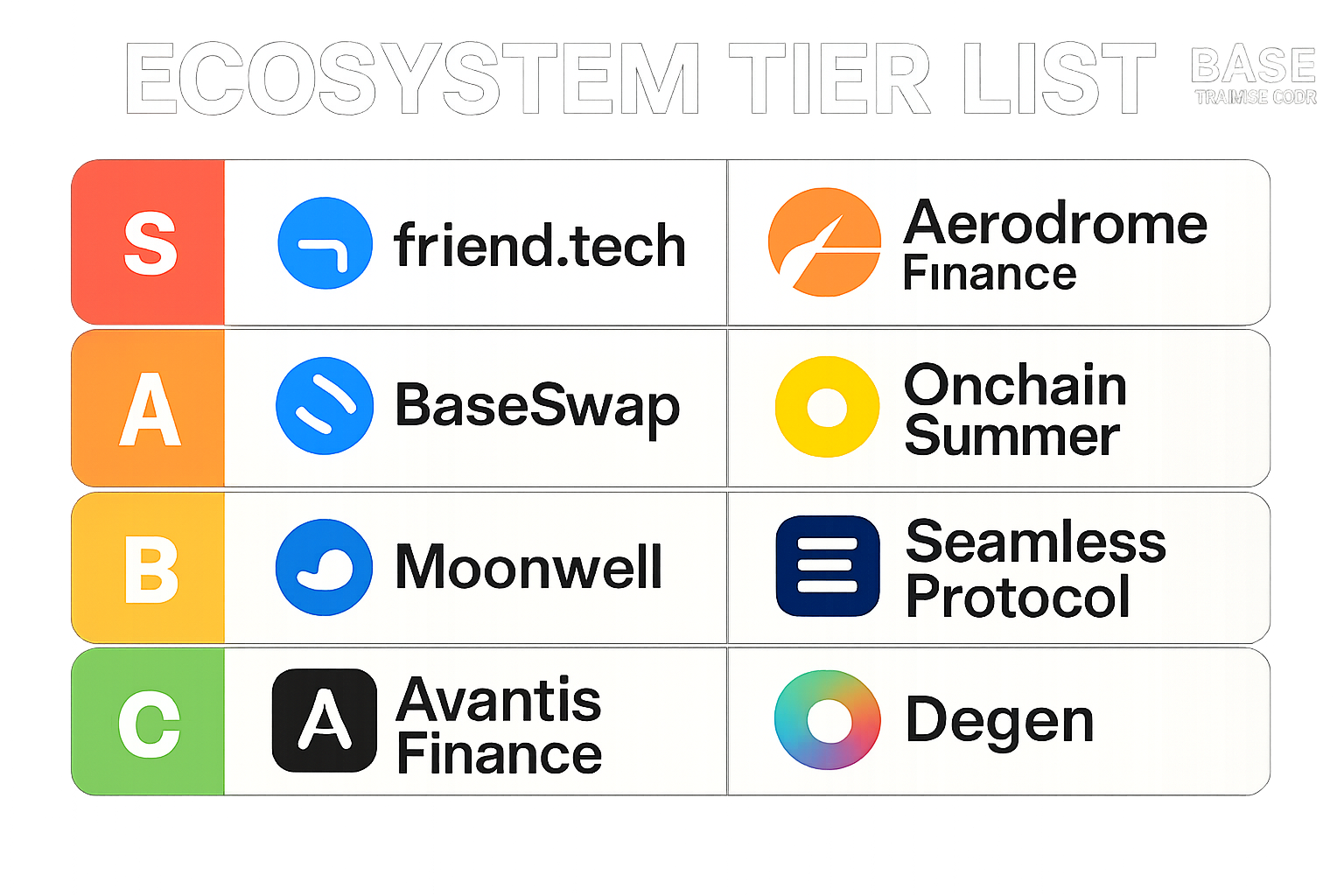

The Base ecosystem is on fire in 2025, and if you’re serious about maximizing your $BASE token airdrop eligibility, you need to know which projects actually matter. With Base Protocol (BASE) trading at $0.2495 as of November 2025, the race for airdrop positioning is more competitive than ever. The real alpha? Not all dApps and protocols are created equal when it comes to airdrop criteria. Let’s break down the official Base Ecosystem Tier List 2025: the eight projects every DeFi hunter and NFT degen should be using right now.

Why This Tier List Matters for $BASE Airdrop Eligibility

Coinbase’s Layer-2 network is aggressively expanding its user base, and all signals point toward a major $BASE token distribution event. The smart move? Engage with projects that have been consistently highlighted across top industry sources like CoinGecko, BingX, and KuCoin. These aren’t just trending dApps, they’re the core infrastructure of Base’s DeFi and social layers.

This list is laser-focused on:

- User activity: Projects driving high transaction volumes and unique wallet interactions

- Ecosystem integration: Platforms closely tied to Coinbase or Base-native development

- Airdrop signaling: Teams with a history of rewarding early adopters or explicit hints at token launches

If you want to go deeper on strategy, check out our full step-by-step guide: How to Maximize Your Base Token Airdrop Eligibility: Step-by-Step Guide for Base Ecosystem Users.

The Top 8 Base Ecosystem Projects for $BASE Token Opportunities (2025)

Here’s your definitive shortlist, the projects you absolutely must interact with if you want to stack the odds in your favor for the coming airdrop:

- Friend. tech: The original social trading protocol that kicked off the on-chain social craze on Base. Buying, selling, or simply holding “keys” here has historically been rewarded by similar projects, don’t sleep on Friend. tech’s role in wallet activity metrics.

- Aerodrome Finance: As Base’s central liquidity hub, Aerodrome combines vote-lock governance with powerful liquidity incentives. Providing liquidity or locking AERO tokens here isn’t just good yield farming, it’s also one of the most visible signals of real ecosystem engagement.

- BaseSwap: This DEX has become synonymous with fast swaps and deep liquidity on Base. Swapping tokens here not only saves gas compared to Ethereum mainnet but also establishes your address as an active participant in one of the chain’s most important trading venues.

- Onchain Summer: More than just an event, Onchain Summer represents an entire suite of quests, NFT mints, and campaign tasks designed to onboard users into every corner of the Base ecosystem. Completing Onchain Summer challenges often results in exclusive badges or roles that can be tracked by future snapshot tools.

- Moonwell: Lending protocols are always prime territory for airdrops, and Moonwell stands out as one of Base’s top money markets. Supplying or borrowing assets here increases your on-chain footprint while potentially earning additional rewards from protocol incentives.

- Seamless Protocol: Another lending giant within Base, Seamless Protocol offers unique features like isolated pools and advanced collateral management. Regular interaction, especially across multiple pools, can help diversify your eligibility profile.

- Avantis Finance: If you’re hunting leveraged trading opportunities (and who isn’t in this market?), Avantis delivers perpetuals action plus deposit vaults that may get factored into future distribution formulas.

- Degen (DEGEN): No tier list would be complete without DEGEN, the memecoin phenomenon that has become synonymous with high-risk/high-reward speculation on Base. Trading DEGEN isn’t just about chasing pumps; it demonstrates active risk-taking behavior that many protocols love to reward during token launches.

Top 8 Base Ecosystem Projects for $BASE Airdrop Eligibility (2025)

| Rank | Project Name | Category | Key Utility for Airdrop Eligibility | Notable Features |

|---|---|---|---|---|

| 1 | Aerodrome Finance | Liquidity Hub | Provide liquidity, lock AERO tokens, participate in governance | Central liquidity hub, vote-lock governance, Pool Launcher |

| 2 | Seamless Protocol | Lending/Borrowing | Lend or borrow assets to demonstrate engagement | Decentralized lending/borrowing, active Base integration |

| 3 | Avantis Finance | Leveraged Trading | Trade, deposit to vaults, use mortgage lending | Leveraged trading, strong investor backing (Pantera Capital) |

| 4 | Moonwell | Lending/Borrowing | Lend and borrow assets, supply liquidity | Popular lending protocol, supports major assets |

| 5 | BaseSwap | DEX (Decentralized Exchange) | Swap tokens, provide liquidity | Active DEX on Base, high trading volume |

| 6 | Friend.tech | SocialFi | Engage in social trading, buy/sell keys | Social trading platform, high user activity |

| 7 | Onchain Summer | NFT/Events | Participate in NFT mints and ecosystem events | NFT campaigns, ecosystem-wide engagement |

| 8 | Degen (DEGEN) | Memecoin/Community | Trade or hold DEGEN token, join community activities | Popular Base memecoin, strong community presence |

Tactics for Maximizing Your Airdrop Profile Across These Projects

If you want more than just participation trophies, you need to go beyond basic transactions:

- Diversify actions: Don’t just swap once, provide liquidity, stake tokens, borrow/lend across multiple platforms.

- Pace your engagement: Spreading interactions over weeks (not hours) helps avoid being flagged as a bot or sybil farmer.

- Pursue quests and campaigns: Onchain Summer-style events frequently offer bonus points toward eligibility via NFTs or badges tracked by snapshot tools.

- Add social layers: Engage in Friend. tech communities or participate in DEGEN meme contests; social proof matters!

This approach aligns perfectly with recent trends highlighted by industry trackers like BitDegree and AirdropBuzz: consistent multi-protocol usage almost always trumps single-platform farming when it comes to major L2 airdrops.

Base (BASE) Price Prediction 2026-2031

Professional price outlook for BASE post-airdrop, considering ecosystem growth, market cycles, and adoption.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.21 | $0.32 | $0.49 | +28% | Initial post-airdrop volatility; price discovery phase as BASE gains exchange listings and liquidity. |

| 2027 | $0.27 | $0.44 | $0.75 | +38% | Ecosystem growth with more dApps, higher TVL; possible Coinbase integration boosts sentiment. |

| 2028 | $0.36 | $0.58 | $1.07 | +32% | Broader Layer 2 adoption; BASE benefits from Ethereum scaling, but faces increased L2 competition. |

| 2029 | $0.45 | $0.71 | $1.35 | +22% | Potential regulatory clarity for L2 tokens; BASE may see institutional interest and increased DeFi/NFT activity. |

| 2030 | $0.55 | $0.86 | $1.72 | +21% | Maturing ecosystem, more real-world use cases. Bullish scenario: BASE becomes a key L2 settlement token. |

| 2031 | $0.69 | $1.03 | $2.15 | +20% | Full market cycle effects; if BASE maintains relevance, price reflects widespread adoption, but downside if L2 competition outpaces BASE. |

Price Prediction Summary

The BASE token is expected to experience significant volatility after its airdrop, with 2026 serving as a price discovery period. As the Base ecosystem matures and adoption increases, average prices are projected to rise steadily, potentially surpassing the $1 mark by 2030-2031 in bullish scenarios. However, competitive pressures from other Layer 2s and shifting regulatory landscapes could impact upside potential. Minimum price ranges account for bear market or ecosystem stagnation risks, while maximum prices reflect strong adoption and market cycle peaks.

Key Factors Affecting Base Price

- Growth and adoption of Base ecosystem dApps (DeFi, NFTs, bridges)

- Coinbase support and integration (on/off ramps, institutional access)

- Overall Layer 2 (L2) sector adoption and competition (e.g., Arbitrum, Optimism, zkSync)

- Regulatory clarity for L2 tokens and airdropped assets

- Ethereum mainnet upgrades and their effect on Layer 2 scaling demand

- Base’s ability to attract liquidity, users, and developers

- Macro crypto market cycles and risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Every project on this tier list offers a unique angle for $BASE airdrop eligibility, but the real edge comes from leveraging their combined strengths. For example, using BaseSwap for frequent swaps, then locking liquidity on Aerodrome Finance, and participating in lending on both Moonwell and Seamless Protocol, demonstrates broad-based engagement that is highly favored by snapshot algorithms.

Don’t underestimate the power of social and campaign-based participation: The Onchain Summer event isn’t just about fun or NFTs, it’s a pipeline to exclusive roles and badges that have historically been used for eligibility filtering. Likewise, building your network on Friend. tech, or even speculating with Degen (DEGEN), can signal authentic user behavior that automated Sybil filters struggle to fake.

Checklist: Are You Covering All Your Bases?

The most successful airdrop farmers in 2025 are those who:

- Bridge assets into Base regularly: not just once.

- Diversify protocol usage: Swap, lend, borrow, provide liquidity across at least 4-5 of these projects.

- Pace your activity: Avoid large bursts; instead aim for sustained engagement over several weeks or months.

- Pursue official quests and campaigns, especially during high-visibility events like Onchain Summer.

- Add social proof: Participate in Friend. tech communities or DEGEN meme contests, these signals are increasingly being tracked by snapshot tools.

If you want a deep dive into optimizing your wallet footprint across these platforms (without tripping Sybil alarms), check out our advanced strategies here: How to Maximize Your Base Token Airdrop Eligibility: Step-by-Step Actions for Early Adopters.

$BASE Token Distribution Outlook and What Comes Next

The final snapshot date remains unconfirmed, but if we look at previous L2 launches and recent industry chatter, there’s mounting evidence that active users through Q4 2025 will be prioritized. With BASE trading at $0.2495, market anticipation is building fast. If you haven’t already diversified your activity across these eight projects, now is the time to act decisively. Remember: markets favor the bold, and so do airdrops!

If you’re hungry for more technical breakdowns or want to compare your strategy with other top hunters, don’t miss our comprehensive guide here: Base Airdrop Eligibility: Full Criteria and Step-by-Step Guide for Base Token Rewards.

The window is closing quickly as competition ramps up. Don’t get left behind while others claim their share of the $BASE token distribution in 2025!