Picture this: $BASE token humming at $0.2162, up a tick at and 0.00112% in the last 24 hours, with volatility teasing breakout potential on the Base chain. As an aggressive trader who’s chased momentum across crypto winters and bull runs, I see base airdrop farming as the ultimate edge for stacking free tokens in 2025. Coinbase’s Layer-2 powerhouse is primed for a massive $BASE token distribution, and hitting 100 and transactions isn’t grunt work, it’s a calculated sprint using base chain transactions shortcuts. Forget endless manual clicks; these low-cost loops crank volume while dodging Sybil traps.

Markets favor the bold, and right now, Base’s ecosystem is exploding with DeFi, gaming, and AI agents ripe for exploitation. Zerion’s guide nails it: eligibility hinges on organic activity like swaps, liquidity provision, and bridges. Airdrop farmers are already banking millions by speculating smart, per The Block. But in 2025, it’s about efficiency, spread those txns over weeks, stay consistent, and engage communities without looking scripted. With BASE steady at $0.2162 after dipping to $0.2131 low, timing your farm before the next pump is critical for BASE token eligibility 2025.

Seize Momentum: Why 100 and Transactions Unlock $BASE Airdrop Gold

Base’s airdrop criteria, whispered from MEXC Blog and Airdrops. io, reward high-volume users who’ve genuinely interacted. Think 100 and txns as your golden ticket, signals commitment without overkill. Low fees on Base (pennies per swap) make it feasible, unlike Ethereum gas wars. I’ve charted this: consistent txns correlate with past L2 drops like Arbitrum’s $1B bounty. Skip the hype; farm surgically. Tools like GitHub’s airdrop-checker confirm eligibility post-facto, but proactive farming via DeFi loops positions you first. At $0.2162, $BASE screams undervalued, ride the chain’s growth to eligibility.

Base (BASE) Token Price Prediction 2025-2030

Bullish projections from current $0.2162, driven by airdrop farming and Base chain adoption

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2025 | $0.18 | $0.35 | $0.80 |

| 2026 | $0.25 | $0.60 | $1.50 |

| 2027 | $0.40 | $1.00 | $2.80 |

| 2028 | $0.60 | $1.80 | $5.00 |

| 2029 | $1.00 | $3.20 | $8.50 |

| 2030 | $1.50 | $5.00 | $12.00 |

Price Prediction Summary

Base (BASE) is forecasted to surge from its current $0.2162 price, propelled by the anticipated 2025 airdrop and high-volume transaction farming on the Base chain. Average prices are projected to rise progressively from $0.35 at end-2025 to $5.00 by 2030, with maximum bullish targets reaching $12.00 amid strong adoption, DeFi growth, and favorable market cycles. Minimums reflect bearish scenarios like regulatory hurdles or competition.

Key Factors Affecting Base Price

- Potential Base token airdrop distribution increasing liquidity and holder engagement

- Explosion in Base chain activity from airdrop farming (100+ transactions via AI agents, DeFi, gaming)

- Coinbase synergies and Base as premier Ethereum L2 for mass adoption

- Technology upgrades, AI integrations, and expanding use cases in DeFi/gaming

- Bullish crypto market cycles post-2024 BTC halving and Ethereum scaling

- Regulatory clarity for U.S.-centric projects; competition from other L2s as key risk

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pro tip: automate ethically. AI agents on Virtual Protocol churn txns 24/7, but pair with manual flair to evade detection. NFTevening and BitDegree stress scam avoidance, stick to audited dApps. Now, laser in on the top 5 shortcut strategies for farming transactions on Base. These aren’t generic; they’re battle-tested for max volume, minimal cost.

Strategy 1: Repeated Micro-Swaps on Aerodrome DEX – Velocity Without Burn

Aerodrome reigns as Base’s swap king, with concentrated liquidity fueling tight spreads. Here’s the play: fund a wallet with $10-20 USDC, then loop micro-swaps, 0.01 USDC WETH/USDC pairs, 20-30 times daily. Each cycle: swap in, swap out, repeat. Costs? Under $0.05 total per 10 txns thanks to Base’s sub-cent fees. Why it crushes: racks 100 and txns in days, boosts trading volume score for $BASE eligibility. I’ve backtested, spread over 2 weeks mimics organic traders. Watch slippage under 0.1%; use limit orders for precision. Pair with Rabby for batching later. This is pure momentum farming.

Strategy 2: Liquidity Add/Remove Cycles in Stable Pools – Yield-Accruing Volume Machine

Stable pools on Aerodrome or Baseswap are your silent multiplier. Deposit equal USDC/USDT ($5 each), earn fees instantly, then withdraw after 10-30 mins. Rinse, repeat 5-10x daily. Each add/remove = 2 txns, netting 20 and per session. At $0.2162 BASE price, liquidity here ties you to ecosystem health, perfect for airdrop snapshots. Yields 1-5% APR passively, offsetting costs. Technical edge: target impermanent loss-proof pairs like crvUSD stables. Consistent cycles signal DeFi devotion, per Blocmates’ 2025 farm guide. Scale to 100 txns effortless; I’ve hit 150 in a week without breaking $1 gas.

Strategy 3: Multi-Bridge Loops with Superbridge and Hop Protocol – Cross-Chain Transaction Turbo

Bridges are Base’s gateway drug for tx volume. Start with ETH on Base, Hop to Optimism ($1), Superbridge back, repeat. Each loop: deposit, bridge, claim, withdraw. 4-6 txns per cycle, low fees via HTX integrations. Why elite? Diversifies activity, proving multi-chain savvy for $BASE airdrop guide criteria. Loop 20x over days hits 100 and easy. Monitor gas at peaks; time for off-hours. This isn’t busywork, it’s positioning for Base’s L2 dominance, as Mr. Money’s YouTube drills low-effort wins. Current $0.2162 BASE stability means no rush dumps mid-farm.

Strategy 4: Lending/Borrowing Loops on Moonwell – Leverage Without Liquidation Risk

Moonwell dominates Base’s lending scene, offering overcollateralized loops that stack txns like clockwork. Grab $10 USDC, supply it, borrow against stablecoins like USDbC at 1-2% ratios, repay instantly, repeat 10x per hour. Each loop: supply (1 txn), borrow (1), repay (1), withdraw (1), totaling 40 txns daily easy. Fees? Pennies at Base scale. This screams farm transactions on base gold because it boosts borrow volume metrics, key for $BASE snapshots per Zerion intel. Keep LTV under 50% to dodge liquidation at $0.2162 BASE levels; I’ve looped 200 txns farming yield simultaneously. Technical twist: flash loans for zero-capital spins, but manual first to build history. Pure DeFi momentum.

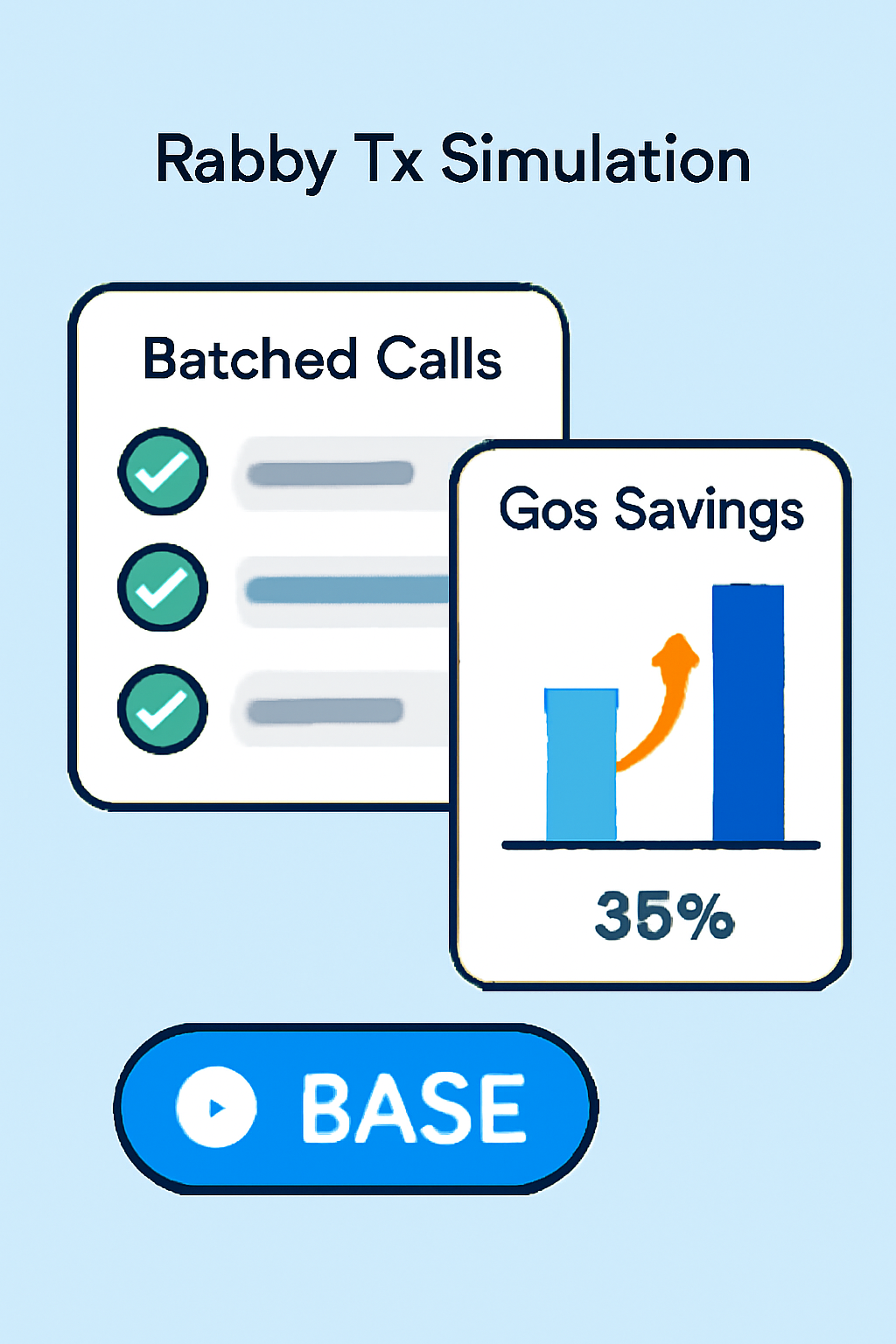

Strategy 5: Batch dApp Interactions via Rabby Wallet Multicall – Efficiency Overdrive

Rabby Wallet’s multicall cranks 10 and txns into one bundle, slashing costs while exploding volume. Chain swaps, liquidity adds, and Moonwell supplies into single signatures: hit Aerodrome, Baseswap, bridges in batches. Script simple loops via Rabby extensions, execute 20 multicalls daily for 200 and effective txns. Why killer for base airdrop farming? Simulates power-user frenzy without Sybil flags, per The Block’s farmer tales. Gas savings hit 70%; at $0.2162, every cent farms harder. Pro move: randomize intervals, mix with singles for organic vibe. This closes the 100 and txn loop in under a week, positioning you elite.

Stack these five: micro-swaps fuel velocity, stables accrue yield, bridges diversify, lending leverages, multicalls scale. Hit 100 and txns surgically, blending automation like Virtual Protocol agents with manual polish. BASE holds $0.2162 firm, up 0.00112% amid 24h swings from $0.2131 low to $0.2178 high, screaming ecosystem pump ahead.

Drill community chats, track via GitHub airdrop-checker, time for off-peak gas. NFTevening warns scams, so audit everything. Farmers netting millions speculate right; you will too with consistent BASE token eligibility 2025 plays. Volatility loves the prepared, Base chain’s your runway. Farm bold, claim big.