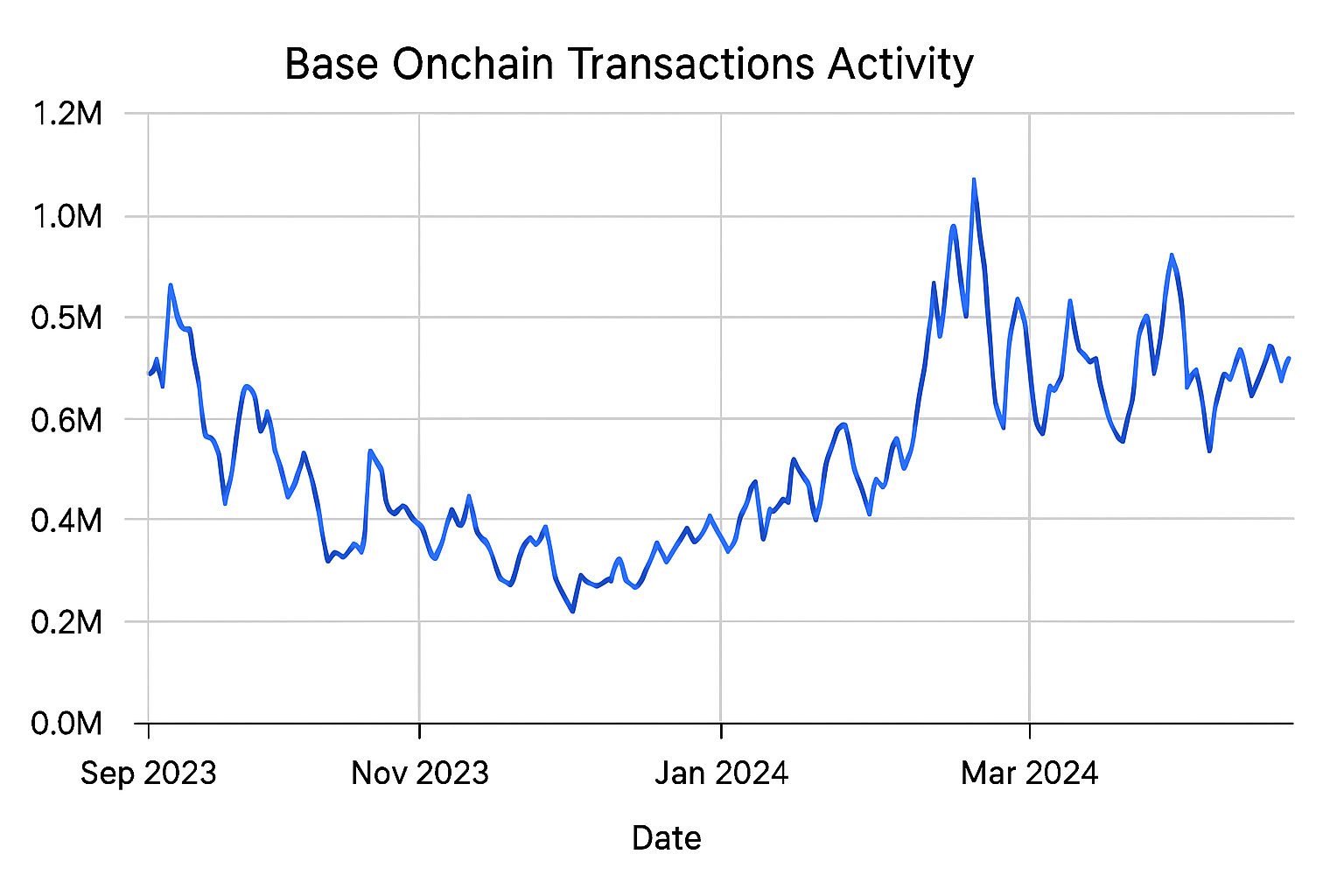

As Coinbase’s Layer-2 network Base continues to gain traction in decentralized finance, whispers of a native $BASE token airdrop have captivated the crypto community. With the token trading at $0.0653, down 0.1533% in the last 24 hours from a high of $0.0772 and low of $0.0574, speculation runs high following Jesse Pollak’s comments at BaseCamp 2025. Active users positioning themselves through on-chain activities, particularly unlocking transaction roles via 10 and transactions, stand to boost their $BASE token eligibility 2025 prospects significantly.

This isn’t mere hype; methodical engagement with the Base ecosystem, including base chain tx farming and base rewards milestones, could differentiate early adopters from the crowd. Base’s exploration of a network token signals a maturing chain ready for broader utility, and those securing roles in the Base Guild are methodically stacking advantages.

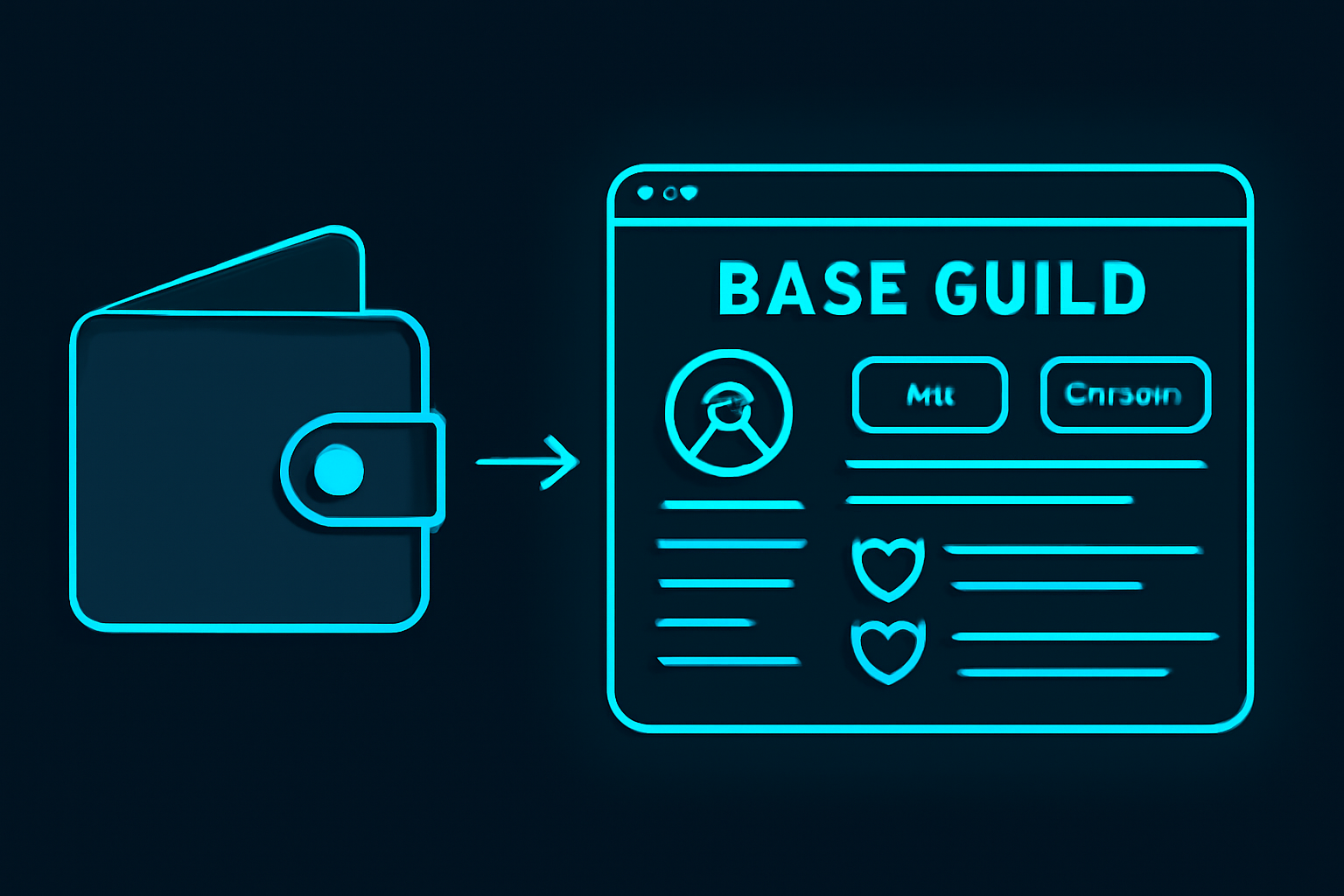

Base Guild Roles: Your Gateway to Enhanced Airdrop Eligibility

The Base Guild serves as a hub for recognizing on-chain commitment, offering roles that signal activity levels to potential airdrop algorithms. Think of it as a merit badge system in Web3: earn them through tangible actions, and you amplify your visibility. Key roles include the Based Role for Basename owners, Onchain Role for recent transactors, and USDC Saver Role for holders of USDC on Base. These aren’t just vanity metrics; sources like CryptoManiaks highlight how they correlate with eligibility in unconfirmed distributions.

In my view, overlooking these roles is a strategic misstep. Seasoned participants know that projects like Base reward consistency over volume spikes. With $BASE at $0.0653, the cost of entry remains accessible, making now the ideal window for base transaction roles unlock.

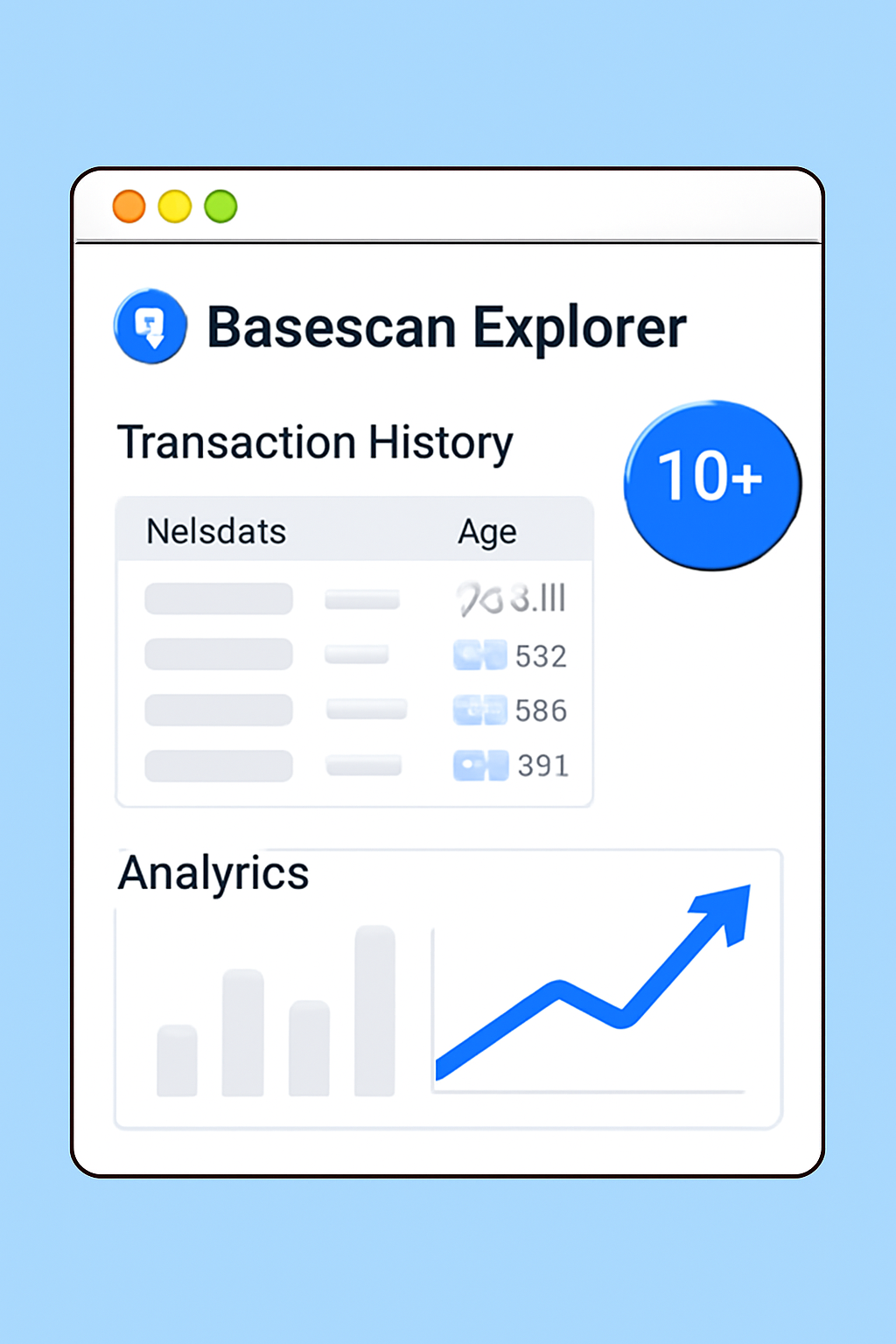

Why 10 and Transactions Matter for $BASE Token Eligibility 2025

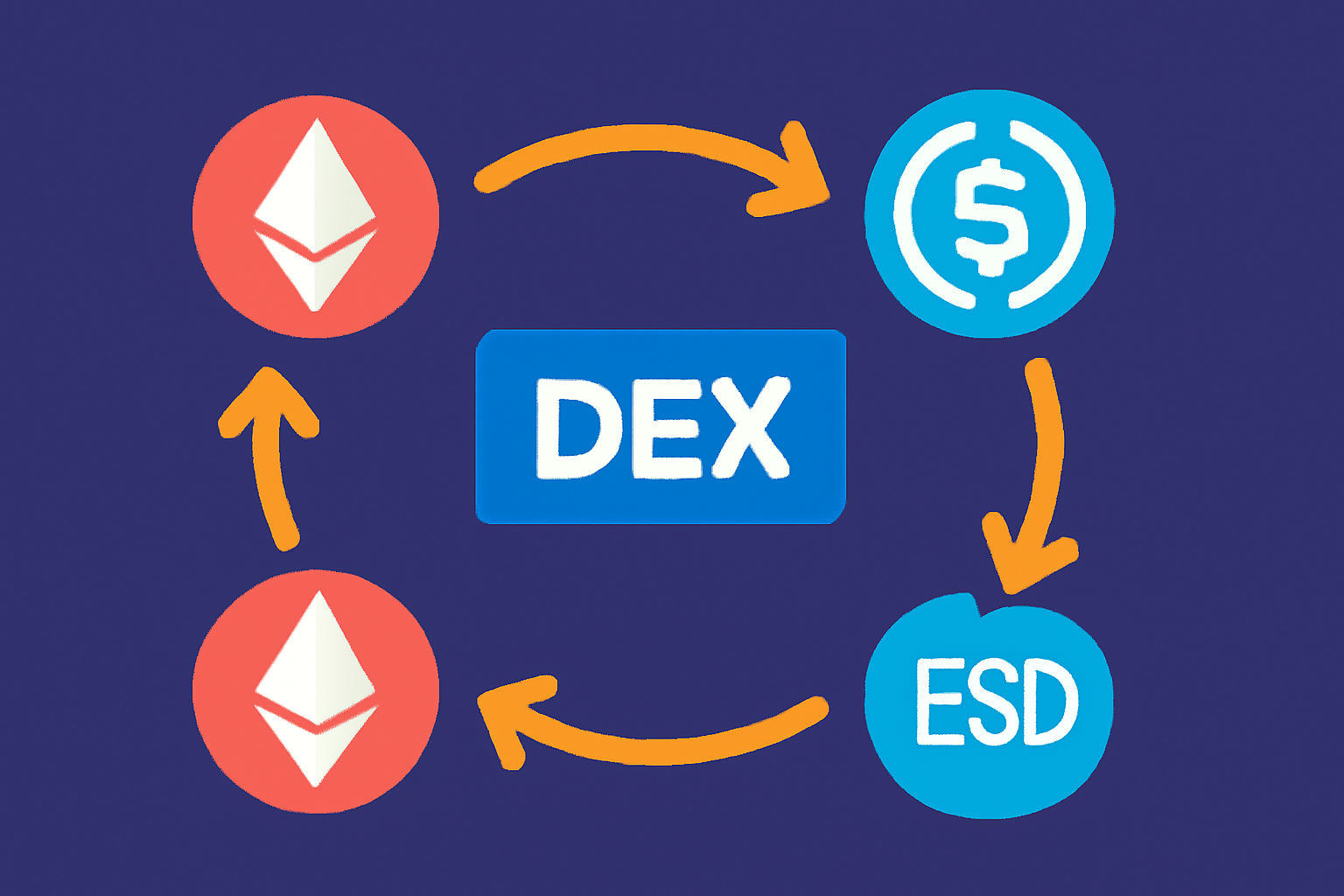

Transaction volume thresholds, starting at 10 transactions, act as base rewards milestones that unlock Onchain Roles. This isn’t arbitrary; it filters genuine users from bots or one-off speculators. Data from on-chain analytics suggests that wallets hitting these marks early have historically fared better in Layer-2 airdrops. Perform swaps on DEXes like Aerodrome, mint NFTs via Base’s vibrant marketplaces, or interact with dApps such as Friend. tech clones – each tx builds your profile.

Holding USDC further cements commitment, as liquidity provision underpins Base’s growth. At current prices, $0.0653 for BASE reflects market caution, yet on-chain metrics show robust activity. My analysis: prioritize quality transactions over quantity to avoid gas waste, focusing on high-impact protocols.

Base Token (BASE) Price Prediction 2026-2031

Realistic forecasts based on airdrop potential, Base L2 adoption, market cycles, and current price of $0.0653 (Dec 2025)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $0.035 | $0.11 | $0.25 |

| 2027 | $0.045 | $0.16 | $0.38 |

| 2028 | $0.065 | $0.24 | $0.60 |

| 2029 | $0.12 | $0.42 | $1.10 |

| 2030 | $0.22 | $0.70 | $1.80 |

| 2031 | $0.35 | $1.05 | $2.50 |

Price Prediction Summary

Base Token (BASE) is forecasted to grow significantly through 2031, driven by potential airdrop rewards, Base network expansion as a leading Coinbase L2, and crypto bull cycles. Average prices are projected to rise ~45% CAGR from $0.11 in 2026 to $1.05 by 2031, with bearish lows reflecting market corrections and bullish highs capturing adoption surges.

Key Factors Affecting Base Token Price

- Potential Base token airdrop and eligibility via on-chain activity (10+ tx, roles like Based/Onchain/USDC Saver)

- Rising TVL and dApp usage on Base network

- Coinbase integration and ecosystem synergies

- Layer-2 competition from Optimism/Arbitrum and regulatory developments

- Crypto market cycles with bull runs in 2025/2029

- Technological upgrades and scalability improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Getting Started: Join Base Guild and Rack Up Those Transactions

First, connect your wallet to the Base Guild platform. This simple step verifies your presence and sets the stage for role claims. Next, bridge assets to Base via official ramps – keep it under $100 initially to test waters efficiently.

- Execute at least 10 transactions: Mix swaps, bridges, and dApp interactions for diversified signals.

- Claim a Basename: Like ENS, it personalizes your address and unlocks the Based Role.

- Hold USDC: Even modest amounts qualify you for Saver status, signaling long-term alignment.

Once activities register, claim roles directly in the Guild dashboard. This process, detailed in community guides, positions you for base $BASE airdrop rewards. I’ve seen similar mechanics reward persistent users handsomely in past cycles; Base follows suit.

Consistent base chain tx farming pays dividends. Monitor your progress weekly, adjusting based on network updates. With $BASE steady at $0.0653 despite volatility, the risk-reward skews favorably for proactive builders. For deeper dives, check our guide on claiming Base Guild roles.

While the initial 10 transactions unlock basic Onchain status, scaling to 50,100, or even 1,000 txs through deliberate base chain tx farming elevates your profile. These base rewards milestones aren’t just checkboxes; they demonstrate sustained ecosystem support, a factor I’ve observed correlating strongly with allocations in Layer-2 distributions like Optimism and Arbitrum. At $0.0653, $BASE’s subdued price masks underlying network strength, where daily active addresses continue climbing despite the 24-hour dip to a low of $0.0574.

Advanced Tactics: Beyond 10 Tx – Scaling for Maximum $BASE Token Eligibility 2025

Quality trumps sheer volume in my assessment. Focus on protocols driving Base’s TVL: provide liquidity on Aerodrome Finance, participate in Zora NFT drops, or stake in yield farms via Baseswap. Diversify to avoid pattern detection, blending DeFi, social dApps, and bridges. Holding USDC isn’t passive; deploy it in lending pools on Moonwell to compound signals. Basename auctions favor memorable handles under. base, costing pennies in gas but yielding outsized identity value.

Avoid common pitfalls like multi-wallet sybil farming, which projects increasingly penalize via sophisticated analytics. My advice: one primary wallet, organic activity, tracked via Dune dashboards. With $BASE hovering at $0.0653 after touching $0.0772 highs, gas fees remain negligible, amplifying returns on minimal capital.

Track progress in Base Guild; roles update dynamically, reflecting real-time tx counts. This transparency builds trust, positioning Base ahead of opaque competitors.

Key Benefits of Base Guild Roles

-

Boosted $BASE Airdrop Odds: Unlocking Based, Onchain, and USDC Saver roles signals active Base ecosystem participation, enhancing eligibility for potential 2025 token distributions.

-

Unique Network Identity: Based Role via Basename ownership establishes a distinct on-chain profile, similar to ENS domains on Base.

-

Proven Transaction Activity: Onchain Role requires 10+ recent transactions (swaps, NFTs, dApps), proving genuine engagement.

-

Commitment Signal: USDC Saver Role from holding USDC on Base demonstrates long-term ecosystem loyalty.

Navigating Risks and Staying Ahead in Base $BASE Airdrop Preparation

Volatility defines crypto, yet Base’s ties to Coinbase confer stability. The 24-hour change of -0.1533% underscores short-term caution, but fundamentals – surging TVL past $2 billion – point upward. Risks include delayed token launches or diluted rewards from mass participation; counter this with early, consistent engagement. Monitor Jesse Pollak’s updates and Base’s X account for pivots.

For those verifying setups, our eligibility checker guide outlines wallet scans and snapshot previews. Pair this with maximization strategies to refine your approach.

Layer-2 ecosystems reward builders over spectators. Base’s methodical rollout, from testnets to mainnet dominance, mirrors proven winners. Securing these transaction roles now, amid $0.0653 pricing, hedges against FOMO spikes.

Persistent users hitting these milestones often uncover hidden multipliers, like guild-exclusive quests or retroactive badges. In past cycles, such edges separated modest drops from life-changing windfalls. Base, with its Coinbase backing and developer momentum, shapes up similarly. Position accordingly: bridge in, transact deliberately, claim roles, and watch on-chain proof compound. The network’s trajectory, decoupled from today’s $0.0653 mark, favors the prepared.