With Base Protocol (BASE) trading at $0.0599, down 0.1647% over the last 24 hours from a high of $0.0776, the ecosystem’s momentum shows no signs of slowing. Coinbase’s Layer 2 network is buzzing with anticipation for the 2025 $BASE airdrop, and smart farmers are stacking advantages like Basenames and elevated onchain scores to secure bigger allocations. Registering a Basename isn’t just about vanity; it’s a direct signal of commitment that could tip the scales in snapshot criteria, while targeted onchain activity builds the profile teams notice.

Why Basenames Are Your Airdrop Edge

Basenames act as human-readable wallet identifiers on Base, simplifying interactions and boosting visibility. In airdrop contexts, they demonstrate early adoption and ecosystem loyalty, often correlating with higher eligibility scores. Longer registrations signal deeper commitment, and with fees scaled by name length, even short premium ones pack punch without breaking the bank. Sources across Airdrop Alert and Zerion highlight how such onchain identifiers feature in farming checklists, positioning you ahead of casual bridgers.

Buy Your Basename: Precise Walkthrough

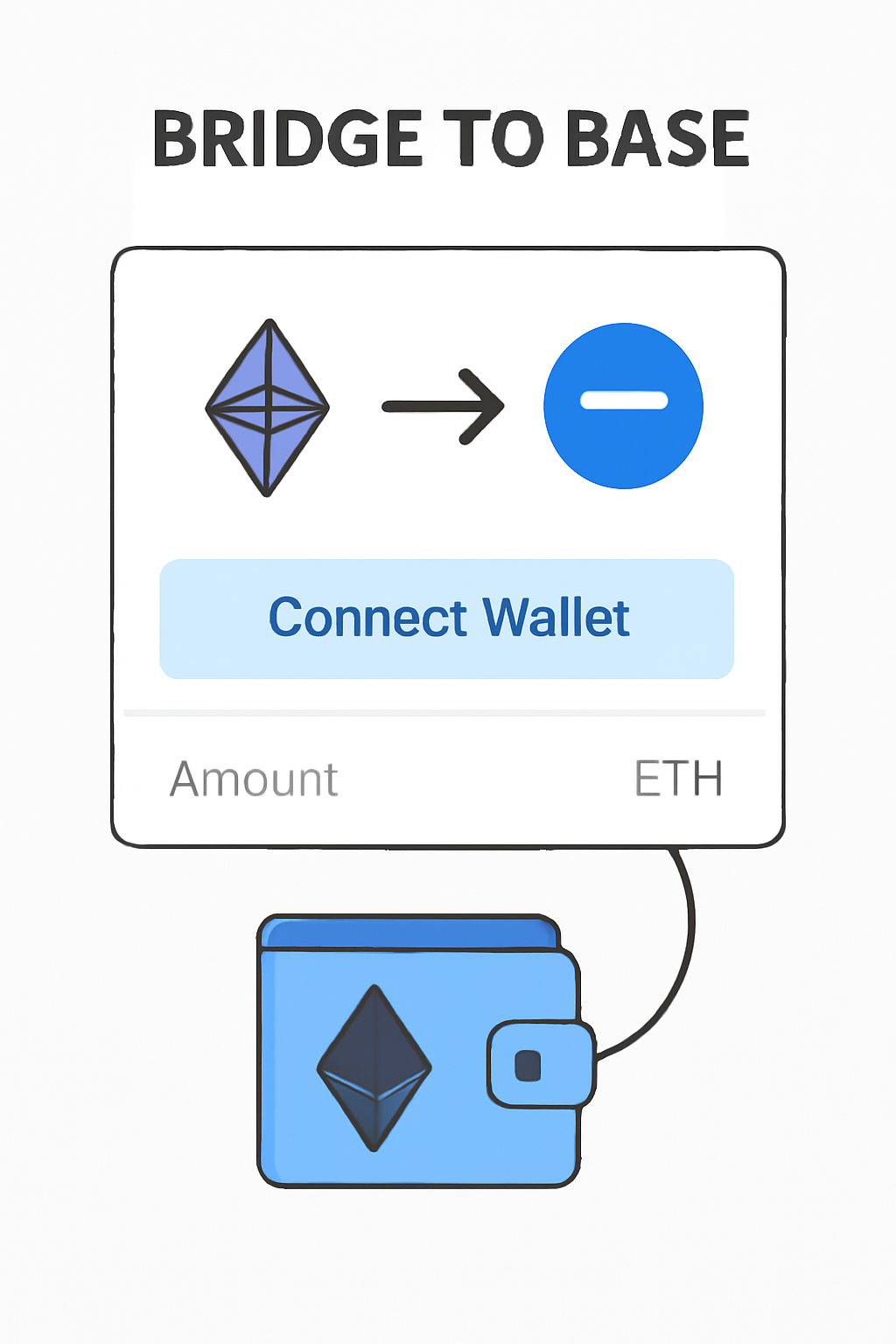

- Bridge Funds to Base: Head to the official Base Bridge and transfer ETH from mainnet Ethereum. You’ll need it for fees – aim for 0.1 ETH minimum to cover premiums.

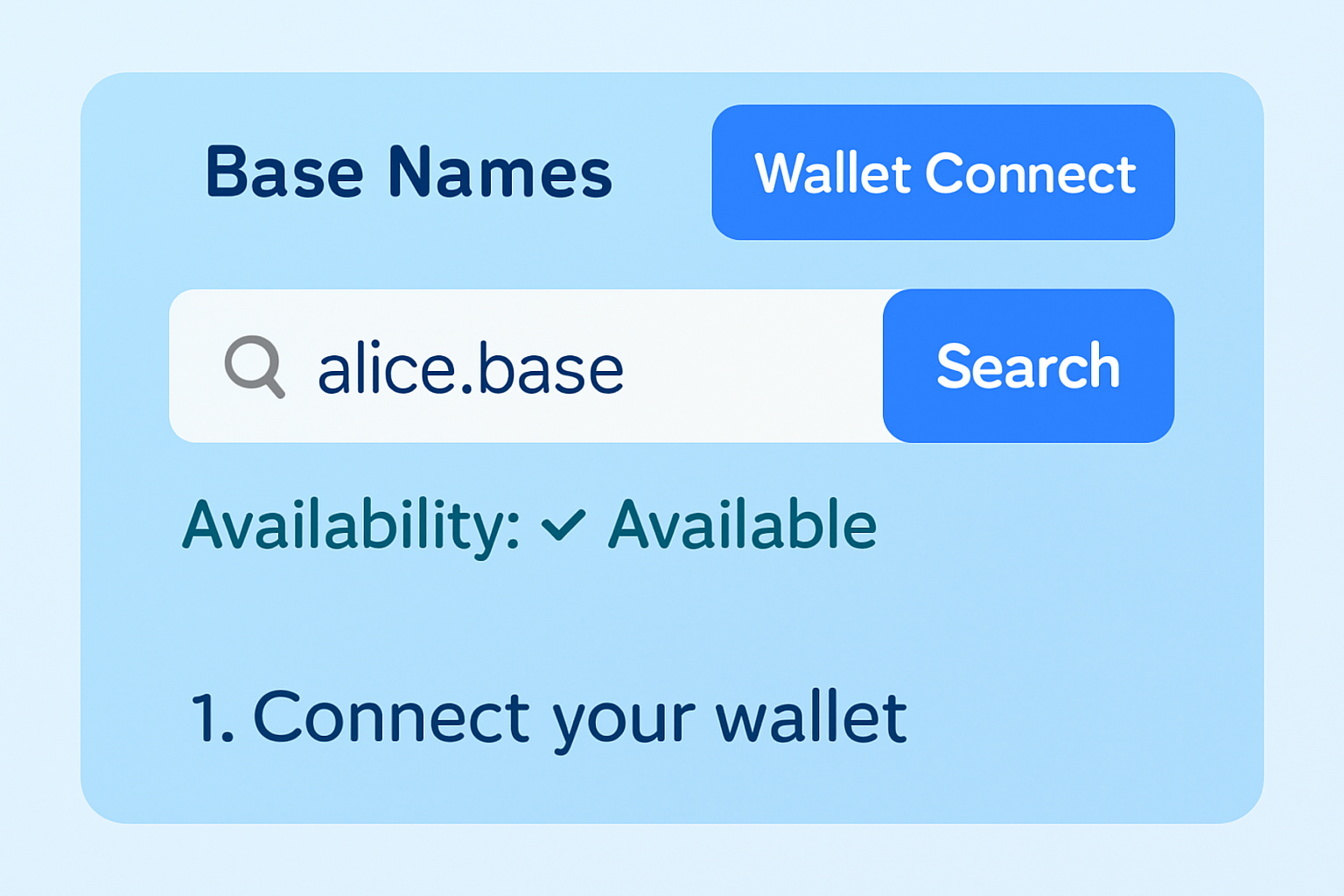

- Hit the Portal: Go to base.org/names. Connect your wallet, preferably a Base Account for gasless perks.

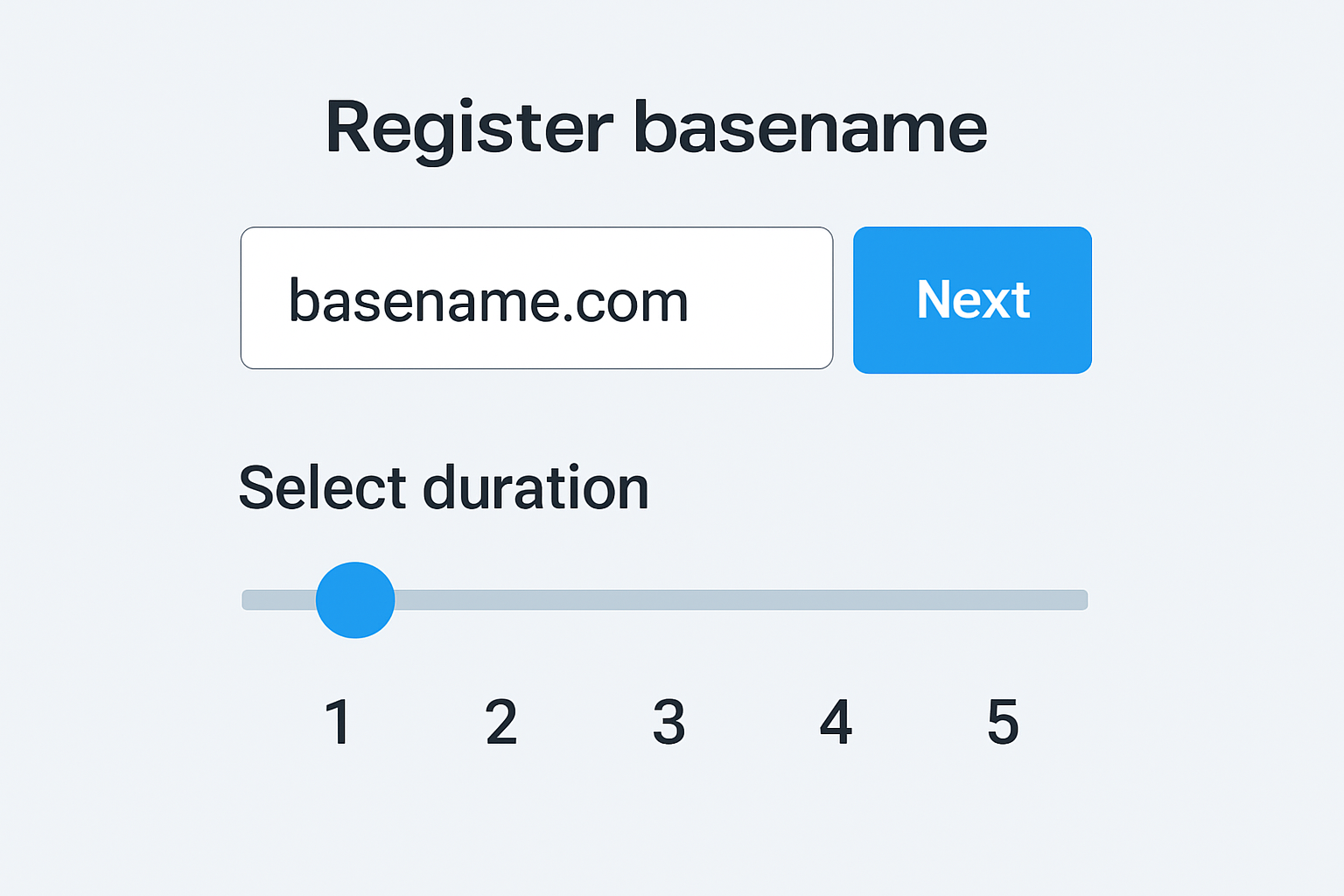

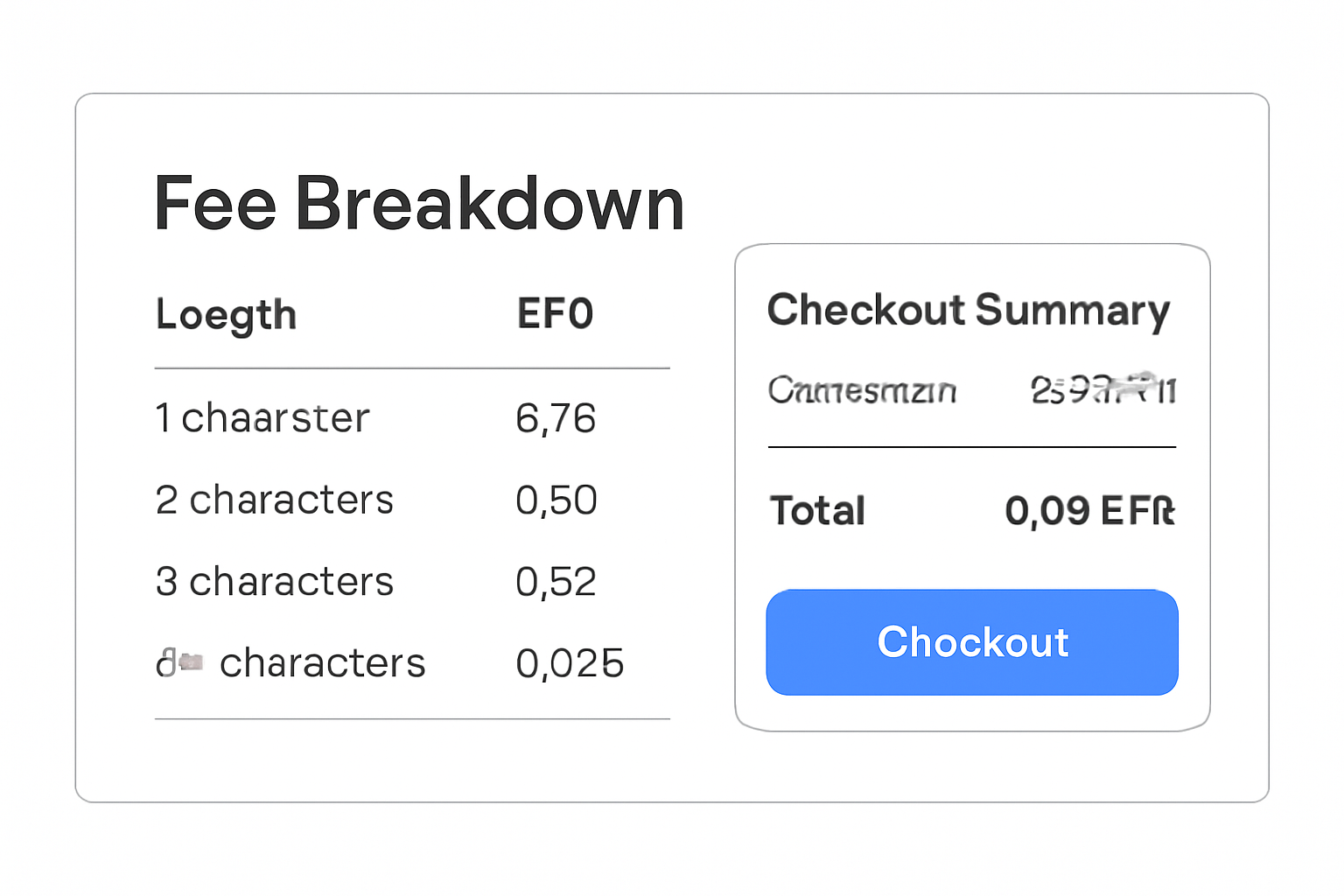

- Claim Your Name: Search desired handle. Premium 3-letter names run 0.1 ETH/year; 4-letters drop to 0.01 ETH, 5-9 letters at 0.001 ETH, and 10 and at 0.0001 ETH. Pick duration – multi-year locks commitment.

- Sign and Secure: Approve the tx. Boom, your. base is live, enhancing every future interaction.

These tiers, per Base docs, keep entry accessible while curbing squatters. I favor 4-5 letter combos blending personal brand with availability – think tradeable assets if hype builds.

Post-registration, track impact via onchain analytics. This move alone diversifies your profile beyond swaps.

Supercharge Onchain Score Fundamentals

Onchain score aggregates your Base activity – swaps, liquidity, NFTs, quests – into a eligibility proxy. Consistent, diverse engagement trumps volume farming; think quality over spam. Check this deep dive on score maximization for advanced tactics. Start with dApp rotations: Uniswap swaps, Aave borrows, Aerodrome pools. Each tx layers your footprint.

Provide liquidity next – deposit into Base DEX pools for yields that compound while signaling support. NFT plays amplify: Mint on Mint. fun or trade OpenSea Base listings. Guild roles from Onchain Summer quests add badges; YouTube tutorials from Atoms Research break them down efficiently.

Layer in campaigns via Galxe or Layer3 – free points toward roles that whisper ‘serious player’ to allocators. Bridge regularly, vary actions weekly. With $BASE at $0.0599, every point counts toward outsized drops.

Base ($BASE) Price Prediction 2026-2031

Post-2025 Airdrop Scenarios Based on Current $0.0599 Price Level

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $0.08 | $0.20 | $0.60 |

| 2027 | $0.15 | $0.40 | $1.20 |

| 2028 | $0.25 | $0.70 | $2.00 |

| 2029 | $0.40 | $1.10 | $3.00 |

| 2030 | $0.60 | $1.60 | $4.20 |

| 2031 | $0.90 | $2.20 | $5.50 |

Price Prediction Summary

Post the anticipated 2025 $BASE airdrop, the token is projected to see significant appreciation driven by Base ecosystem growth, Coinbase backing, and L2 adoption trends. Average prices could rise from $0.20 in 2026 to $2.20 by 2031 (over 35x from current levels), with maximum bullish targets reaching $5.50 amid favorable bull cycles, while minimums reflect conservative bearish corrections.

Key Factors Affecting Base Price

- $BASE airdrop liquidity boost and wide distribution enhancing holder base

- Rapid Base network TVL growth and dApp activity (swaps, lending, NFTs)

- Coinbase integration, regulatory clarity, and institutional inflows

- Crypto market cycles with bull runs projected for 2026-2027 and 2029-2031

- Technological upgrades to Base L2 scalability and Basename/Onchain Score features

- Competition from other L2s like Optimism and Arbitrum

- Macroeconomic factors including interest rates and global adoption trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Bridge assets now, claim that name, then rotate these activities. Your score climbs methodically, wallet readies for snapshot.

Target guild roles next – they act as multipliers in eligibility formulas. Onchain Summer campaigns reward XP through Layer3 quests and Zealy tasks, unlocking roles like ‘Base Builder’ or ‘Onchain Voyager. ‘ These badges show up in wallet scans, separating farmers from tourists. Prioritize quests blending swaps with social proof, like minting a Base NFT and sharing on Farcaster.

Top Activities Ranked by Score Impact

Top Base Ecosystem Activities for Onchain Score Farming

| Activity | Score Boost Estimate | Cost | Platforms |

|---|---|---|---|

| Register a Basename | High (+++) Unique identifier boost |

0.0001-0.1 ETH (depending on name length) |

base.org/names |

| Token Swaps | Medium (++) Per transaction |

Gas fees (~0.0001-0.001 ETH) |

Uniswap |

| Provide Liquidity | High (+++) Ongoing activity |

Assets + gas Impermanent loss risk |

Aerodrome |

| Lending & Borrowing | Medium (++) Per interaction |

Gas fees | Aave |

| NFT Mint/Trade/Hold | Medium-High (+++) Profile enhancement |

NFT price + gas | OpenSea (Base), Mint.fun |

| Quests & Campaigns | High (+++) Badges & roles |

Free to low gas | Galxe, Layer3, Zealy |

Expect diminishing returns on repeats, so diversify: one week heavy on liquidity, next NFTs and loans. Aerodrome pools shine for stable yields around 10-20% APY, padding costs while stacking points. Avoid overleveraging – Aave borrows at low LTV keep risk tight.

Track everything at onchainscore. xyz. Input your wallet for a real-time breakdown: power users hit 80 and scores via 50 and tx diversity. If lagging, bridge fresh assets weekly – patterns like monthly inflows flag commitment. This guide details score checks, but start simple: connect wallet, review categories, plug gaps.

Risk Controls and Cost Optimization

Farming isn’t free – basename fees plus gas and impermanent loss nibble edges. At current tiers, a solid 5-letter name costs 0.001 ETH yearly, or about $2-3 at ETH $2,500. Factor 0.05 ETH monthly for activities to stay under $100 total pre-airdrop. Watch sybil hunts: use one clean wallet, organic volume, no bots. Coinbase patterns suggest multi-wallet flags slash allocations.

Opinion: Skip hype-chasing; Base rewards builders. A 4-letter basename plus 100 diverse tx beats 1,000 spam swaps. With $BASE holding $0.0599 amid dips, ecosystem TVL climbs signal snapshot proximity. Guild roles from Zealy quests edge out pure traders – they’re verifiable loyalty.

Base isn’t Arbitrum; it’s Coinbase’s L2 bet on mass adoption. Farm smart, not hard – your wallet’s resume matters more than volume.

Rotate these plays: Basename anchors identity, dApps build depth, quests add flair. Scores compound weekly, positioning for 2025 drops potentially rivaling Optimism’s haul. Monitor Base. org updates; official hints drop via Twitter. Your edge? Action now over endless reading.

Stack that basename, grind scores, watch allocations swell. Base ecosystem thrives on doers – join them before the bridge congests.