As Base Protocol (BASE) trades at $0.1180 amid a 24-hour dip of -0.2883%, with highs at $0.1666 and lows scraping $0.1024, speculation around a 2026 token airdrop intensifies. No official announcement exists yet, but ecosystem signals point to social engagement as a key qualifier alongside on-chain activity. For base airdrop eligibility 2026, hitting metrics like a 500 followers base airdrop minimum, targeted likes, and retweets could separate eligible wallets from the pack. This guide breaks down the systematic approach to these base token tasks followers and beyond, prioritizing verifiable actions that align with observed trends from Base’s community initiatives.

Why Social Proof Drives BASE Token Eligibility Criteria

Base’s Layer 2 ecosystem thrives on network effects, and projects like this often reward vocal supporters. Recent acknowledgments from the team about exploring a native token shift the focus from pure on-chain volume to holistic participation. BASE token eligibility criteria likely weigh X (formerly Twitter) activity heavily, as it demonstrates evangelism and reach. Data from early user strategies and guild roles underscores this: accounts with 500 and followers gain visibility in verification snapshots. Pair this with likes and retweets on core announcements, and you build a profile that screams commitment. Skip the hype; execute these tasks methodically to position for potential rewards.

Sustained social engagement ties your identity to Base, much like claiming a Basename does on-chain.

Current market volatility at $0.1180 reinforces the need for diversified preparation. While bridging to Aerodrome or completing Base Learn modules bolsters your case, social tasks provide the proof-of-effort edge. Let’s dissect the four core requirements, starting with follower growth.

Task 1: Grow Your X Account to 500 and Followers

The cornerstone of 500 followers base airdrop eligibility demands a minimum threshold for verification. Base’s dashboard checks will scan for organic growth, not bots. Follow this daily regimen: tail 50 Base- and Coinbase-aligned accounts, from @base and @coinbase to influencers in the L2 space. Engage meaningfully with 20 posts per day, commenting on Base L2 scalability, airdrop rumors, or ecosystem dApps like Friend. tech.

- Target: 500 and followers within 3-6 months, verifiable via screenshot.

- Strategy: Post original content weekly about your Base activities, tagging key accounts for reciprocal follows.

- Risk control: Avoid mass-follow tools; focus on quality interactions to evade shadowbans.

Track progress weekly. At $0.1180 per BASE, even modest allocations from an airdrop justify the time investment. This task sets the foundation, signaling you’re not a casual observer but a network builder.

Task 2: Like 100 and Official Base Airdrop Posts

Likes serve as low-effort, high-signal actions in base airdrop likes retweets metrics. Aim for 100 and on posts from authoritative sources: @base ecosystem updates, @coinbase announcements, and projects like Aerodrome or Friend. tech. Prioritize tweets on token distribution hints, L2 activity spikes, or 2026 roadmap teases. These accumulate “points” in algorithmic tallies, as seen in similar airdrops.

- Curate a watchlist of 20-30 handles daily.

- Like within the first hour of posting for amplified visibility.

- Combine with replies like “Boosting Base activity ahead of 2026 airdrop” to layer engagement.

Discipline here pays off. With BASE at $0.1180, consistent liking builds your eligibility score without capital risk. Expect dashboards to aggregate these via API pulls, so authenticity matters.

Base Token (BASE) Price Prediction 2027-2032

Realistic forecasts based on current price of $0.1180 (Jan 2026), potential airdrop impact, Base network adoption, market cycles, and L2 competition

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.05 | $0.30 | $1.00 |

| 2028 | $0.10 | $0.65 | $2.20 |

| 2029 | $0.25 | $1.40 | $4.50 |

| 2030 | $0.50 | $2.80 | $8.00 |

| 2031 | $1.00 | $4.50 | $12.00 |

| 2032 | $1.50 | $6.50 | $18.00 |

Price Prediction Summary

Base Token (BASE) shows strong growth potential from its current $0.1180 level, driven by possible airdrop rewards, increasing Base L2 activity, and crypto bull cycles. Conservative min prices reflect bearish scenarios like delayed airdrops or regulation; average assumes steady adoption; max envisions explosive growth with successful token launch and TVL surge. YoY avg growth projected at 80-100% in early years, tapering to 40-50% later.

Key Factors Affecting Base Token Price

- Potential Base airdrop confirmation and distribution boosting demand

- Base network TVL growth and dApp adoption (e.g., Aerodrome, Basenames)

- Ethereum L2 competition (vs. Optimism, Arbitrum) and scaling improvements

- Regulatory clarity for Coinbase-linked assets

- Broader market cycles, Bitcoin halving effects, and institutional inflows

- Community engagement tasks enhancing eligibility and hype

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Task 3: Retweet 50 Key Base Announcements Strategically

Retweets amplify reach, turning passive support into active promotion. Select 50 high-engagement posts on Base L2 metrics, airdrop speculation, and 2026 token plans. Add value with comments: “This L2 surge positions Base for massive $BASE rewards – who’s farming?” Target viral threads for bonus exposure.

Systematic execution: Dedicate 10 minutes daily to scouting, retweet 2-3 per session. This not only boosts your metrics but fosters community ties, potentially earning guild nods. As BASE holds $0.1180 amid dips, these actions hedge against uncertainty.

Keep records of each retweet’s date and engagement stats; these will corroborate your efforts during verification. In a landscape where BASE lingers at $0.1180, retweeting strategically elevates your profile from lurker to advocate.

- Threshold: 50 retweets over 30-60 days.

- Bonus: Comments increase algorithmic weight, mimicking guild participation signals.

- Metric: Dashboard tallies via X API for authenticity.

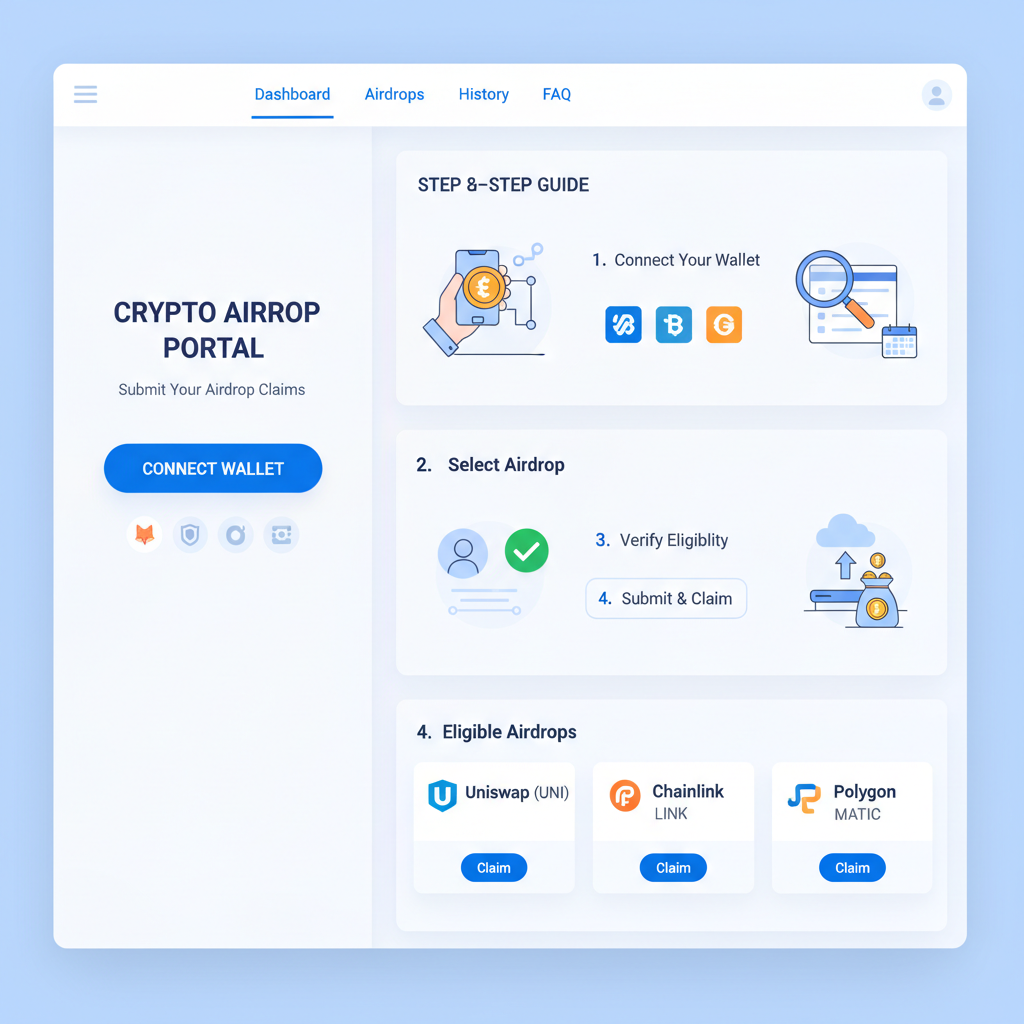

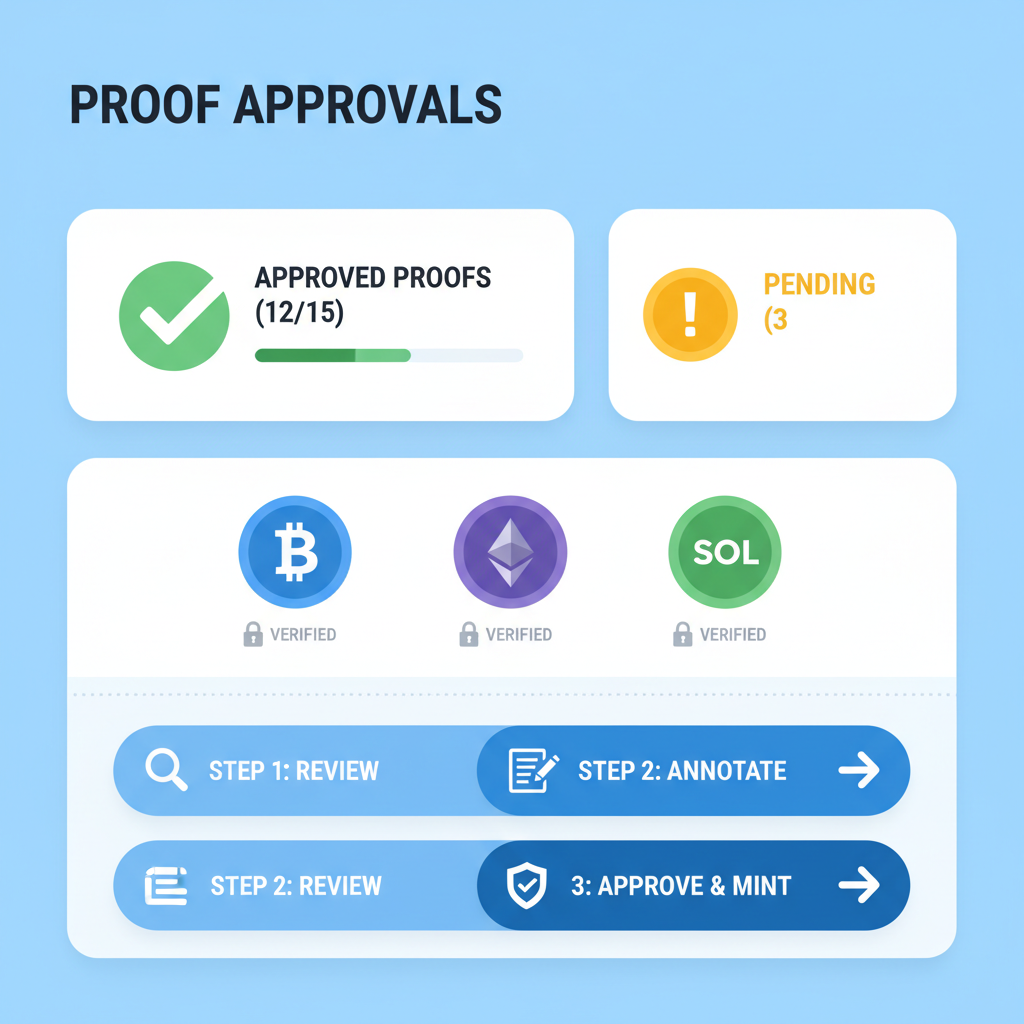

Task 4: Submit Task Proofs via Base Airdrop Dashboard

The final lock-in for BASE token eligibility criteria demands proof. Once you’ve hit 500 and followers, 100 and likes, and 50 retweets, compile screenshots showing metrics tied to your wallet address. Access the Base Airdrop Dashboard – expected to launch via official channels like base. org or Coinbase updates – and upload directly. This step verifies your base token tasks followers execution, bridging social proof to on-chain rewards.

Why it matters: Snapshots ignore unverified claims. With BASE’s price at $0.1180 after dipping -0.2883% in 24 hours (high $0.1666, low $0.1024), nailing submission timing could capture peak eligibility windows. Combine with on-chain moves like bridging to Aerodrome or claiming a Basename for compounded strength, as these tie your social identity to wallet activity.

- Gather evidence: Full-screen captures of X profile (followers), liked tweets list, retweet history.

- Link wallet: Ensure your submission address matches on-chain Base interactions.

- Review and submit: Double-check for completeness before finalizing.

Expect phased rollouts; monitor @base for dashboard links. This disciplined closeout turns effort into audited eligibility.

Layer On-Chain Activity for Maximum Edge

Social tasks alone won’t suffice in a competitive field. As base airdrop eligibility 2026 rumors evolve, integrate ecosystem use: bridge ETH weekly, swap on Aerodrome, complete Base Learn quests. These generate verifiable tx history, weighted alongside your 500-follower badge. Diversify contracts – touch 10 and dApps monthly – to avoid single-project flags. Claim a Basename early; it anchors your persona across proofs.

Pragmatism rules: Allocate 30 minutes daily to social, 1 hour weekly to chain. At $0.1180, low gas on Base makes this efficient. Track via tools like onchainscore. xyz, but prioritize official metrics.

Risks and Discipline in Execution

Farming isn’t gambling; it’s systematic positioning. Bots trigger bans, inflating follower counts without credibility. Over-engagement risks spam flags, nullifying base airdrop likes retweets gains. Cap follows at 50 daily, space likes/retweets. If BASE climbs from $0.1180, your prepared wallet captures upside without FOMO buys.

Community whispers from X highlight guilds rewarding top engagers. Post originals: “Hit 500 followers farming Base L2 – who’s joining?” Tag @base for visibility. This builds organic reciprocity, amplifying tasks 1-3.

Volatility persists – 24h low $0.1024 tests resolve – yet preparation endures. Execute these four tasks, submit proofs, layer chain activity. Your disciplined profile stands ready when announcements drop, turning speculation into allocation.