With $BASE trading at $0.1683 after a solid 24-hour gain of and $0.0441, Base’s Layer-2 ecosystem is firing on all cylinders. Coinbase’s powerhouse network has builders buzzing about the 2026 airdrop, and smart contract deployments stand out as a killer strategy to amp up your transaction count and eligibility score. Forget generic farming; we’re talking deploy contracts base airdrop with five OpenZeppelin-based beasts that rack up TX activity effortlessly. This guide dives into deploying them via Remix IDE, positioning you as a top creator for that juicy $BASE drop.

Base rewards commitment to its growth, and sources like Whales Market peg smart contract deployments at around 5% of the scoring weight. More contracts mean higher points in the $base eligibility tx count. Zerion echoes this, highlighting builders who deploy on Base snag outsized allocations. Spread these over weeks for organic base airdrop transactions 2026 – no red flags, just pure momentum.

Unlock Airdrop Alpha: The Power of These Five Contracts

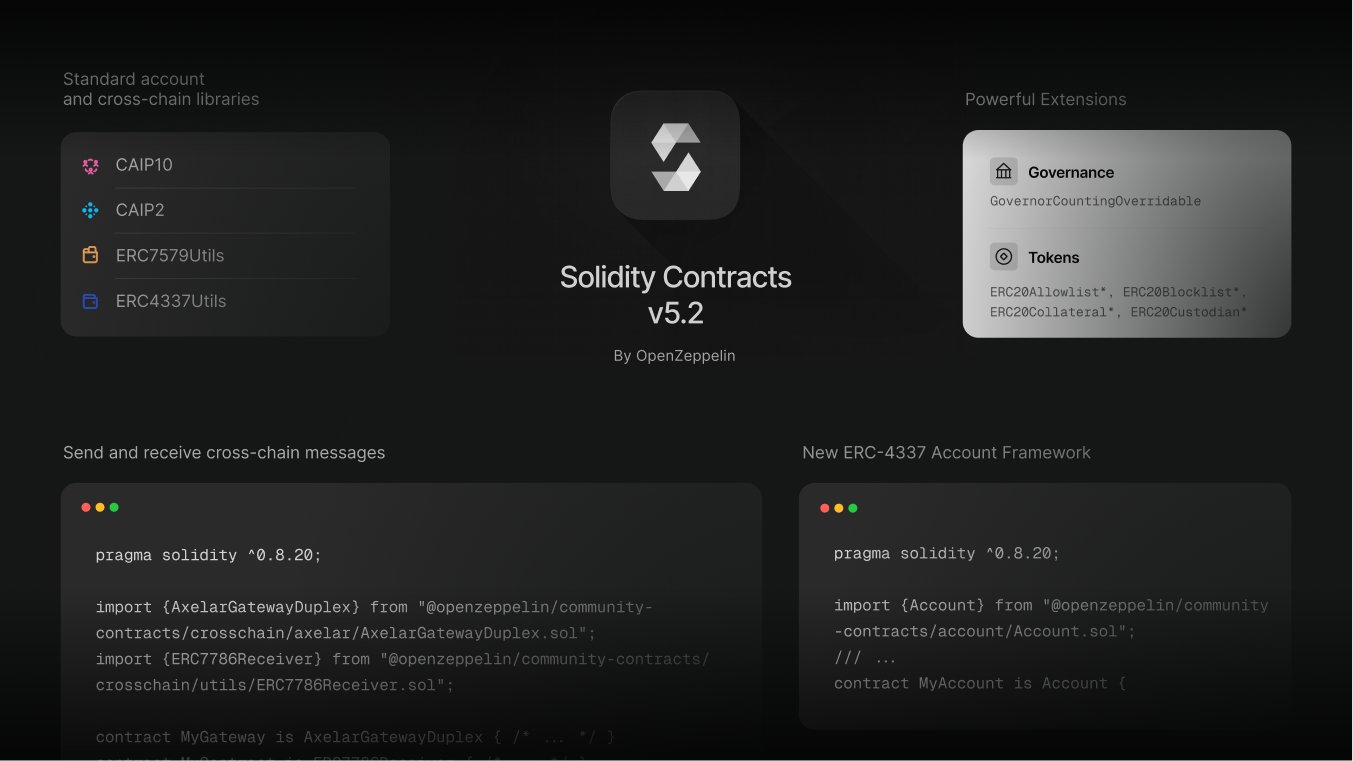

These aren’t random deploys; they’re precision-engineered for easy base contract deployment and real utility signals. Each leverages OpenZeppelin for security and audit-friendliness, perfect for base 5 tx farming. Here’s the lineup:

5 OpenZeppelin Contracts for Base Airdrop Boost

-

ERC20 BaseFarmToken: Deploy a fungible token for seamless yield farming on Base. Skyrockets your contract count & TX volume for $BASE eligibility!

-

ERC721 BaseAirdropNFT: Mint unique NFTs to showcase Base builders. Enhances deployment diversity & engagement signals for max airdrop points.

-

ERC1155 BaseRewardsMulti: Multi-token standard for efficient rewards & batches. Versatile powerhouse boosting Base activity metrics.

-

ERC4626 BaseYieldVault: Tokenized vault for automated yields. Proves DeFi commitment, amplifying your 2026 $BASE airdrop score.

-

Governor BaseDAOGovernor: DAO governance module for community votes. Establishes you as a serious Base creator & developer.

Deploying multiple contracts screams ‘builder’ to Base’s algo – think Aerodrome or LayerZero vibes, but on steroids for 2026 rewards.

Zipmex and Bankless stress starting with a dedicated wallet and bridging ETH, then layering in DeFi. Beluga’s farming trends point to creators dominating allocations. Airdrop Alert advises consistency; document every TX on Basescan for proof.

BASE ($BASE) Price Prediction 2027-2032

Forecasts incorporating L2 adoption, airdrop momentum, market cycles, and technical analysis; YoY growth based on 2026 average price of $1.00

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY Growth (%) |

|---|---|---|---|---|

| 2027 | $0.50 | $1.25 | $2.50 | +25% |

| 2028 | $0.80 | $2.00 | $5.00 | +60% |

| 2029 | $1.10 | $2.40 | $6.00 | +20% |

| 2030 | $1.40 | $3.00 | $7.50 | +25% |

| 2031 | $1.80 | $3.75 | $9.50 | +25% |

| 2032 | $2.30 | $4.80 | $12.00 | +28% |

Price Prediction Summary

$BASE is forecasted to see steady appreciation driven by Base network’s growth as Coinbase’s premier L2, airdrop rewards for contract deployers and users, and crypto bull cycles. Averages climb from $1.25 (2027) to $4.80 (2032), with bullish peaks up to $12 amid high adoption; conservative mins reflect potential bear markets.

Key Factors Affecting BASE Price

- Base L2 TVL and user growth from DeFi/NFT activity

- Post-airdrop liquidity surge and developer incentives

- Coinbase ecosystem synergies and marketing

- Ethereum scaling advancements boosting L2 viability

- Bullish crypto cycles (e.g., 2028 BTC halving effects)

- Regulatory clarity for U.S.-based projects

- Competition from Arbitrum/Optimism and market volatility risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Gear Up: Wallet, Bridge, and Remix Battle Station

First, spin up a fresh Ethereum wallet like MetaMask dedicated to Base. Fund it with ETH on mainnet, then bridge via official Base Bridge or Superbridge – aim for 0.05 ETH per deploy to cover gas (Base fees are dirt cheap at under $0.01). Verify on Basescan post-bridge.

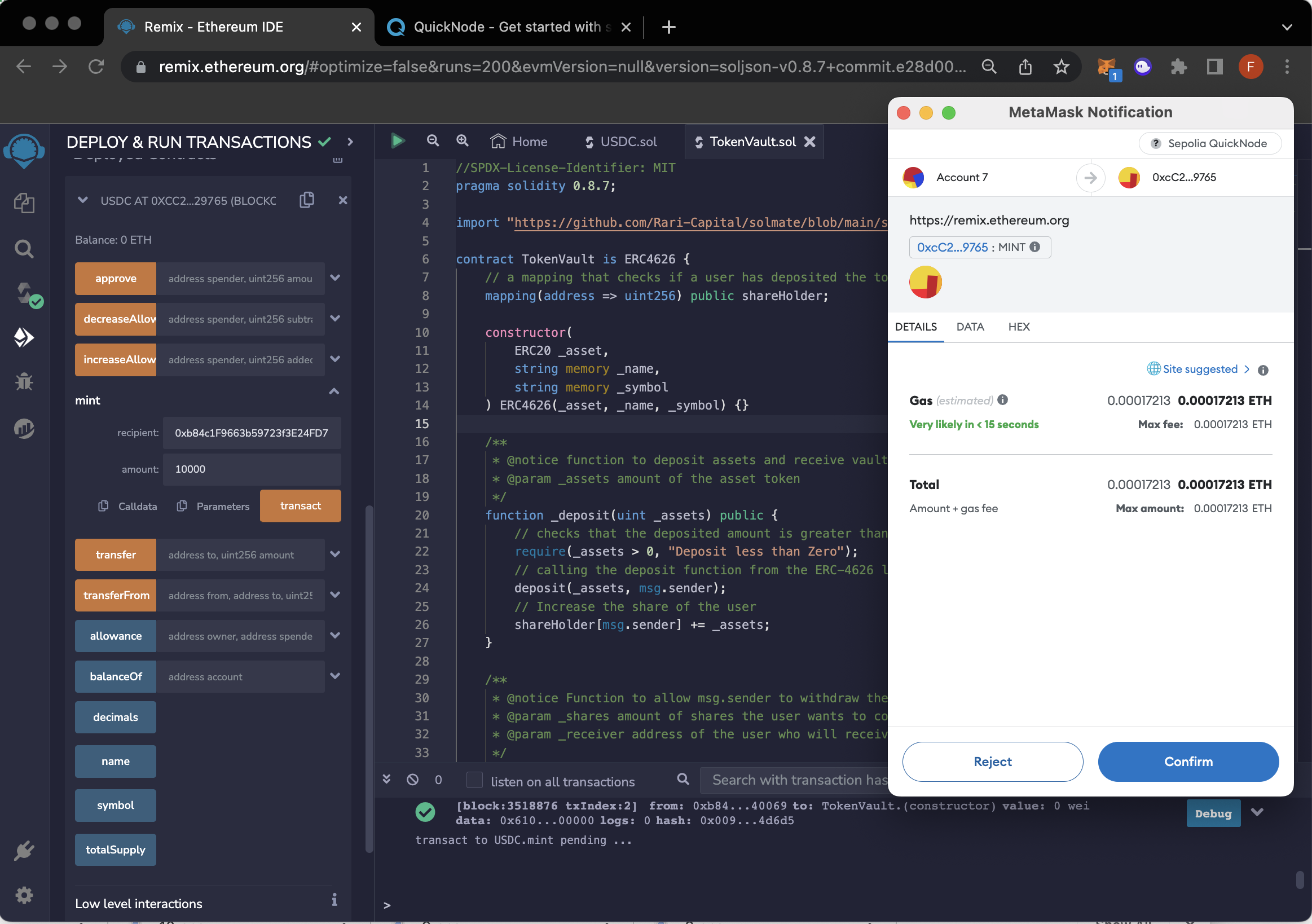

- Head to remix. ethereum. org – the no-install Solidity playground.

- Create a new workspace, import OpenZeppelin contracts via GitHub URLs.

- Switch Environment to Injected Provider (MetaMask), select Base Mainnet (chain ID 8453).

Pro tip: Test on Base Sepolia first if paranoid, but mainnet deploys count for airdrop. Gas limit? 5M per deploy keeps it smooth. Now, let’s deploy.

Contract 1: Launch Your ERC20 BaseFarmToken

ERC20s are the bread-and-butter of DeFi. Paste this into Remix’s Solidity compiler (0.8.20 and ):

Contract 2: Mint ERC721 BaseAirdropNFT Glory

NFTs signal creator cred. ERC721 from OpenZeppelin delivers provenance. Code skeleton:

Contract 3: ERC1155 BaseRewardsMulti for Versatility

Multi-token power in one deploy. Handles fungible and non-fungible. Snippet:

Contract 4: ERC4626 BaseYieldVault for DeFi Cred

Tokenized vaults scream sophisticated builder. ERC4626 standardizes yield-bearing shares, perfect for signaling DeFi depth on Base. OpenZeppelin’s implementation keeps it battle-tested. Load this into Remix:

BaseYieldVault: ERC4626 Template with Deposit/Withdraw Magic

🚀 Buckle up, degens! We’re dropping the ERC4626 vault template that’ll turbocharge your Base TX volume for that juicy $BASE airdrop in 2026. This BaseYieldVault uses a mock USDC as the asset, with battle-tested deposit and withdraw functions ready to deploy. First, spin up MockUSDC, then plug it into the vault constructor. Let’s farm those transactions!

```solidity

pragma solidity ^0.8.20;

import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

import "@openzeppelin/contracts/token/ERC20/extensions/ERC4626.sol";

contract MockUSDC is ERC20 {

constructor() ERC20("USD Coin", "USDC") {

_mint(msg.sender, 1_000_000 * 10**6);

}

function decimals() public view virtual override returns (uint8) {

return 6;

}

}

contract BaseYieldVault is ERC4626 {

constructor(IERC20 asset_) ERC4626(asset_) ERC20("BaseYieldVault", "BYV") {}

function totalAssets() public view virtual override returns (uint256) {

return asset.balanceOf(address(this));

}

/**

* @dev Deposit assets and mint shares

*/

function deposit(uint256 assets, address receiver) public virtual override returns (uint256 shares) {

shares = super.deposit(assets, receiver);

}

/**

* @dev Withdraw assets and burn shares

*/

function withdraw(uint256 assets, address receiver, address owner) public virtual override returns (uint256 shares) {

shares = super.withdraw(assets, receiver, owner);

}

}

```💥 Vault deployed and primed! Spam deposits and withdrawals to rack up TXs on Base. Pro tip: Automate with a script for non-stop action. This is contract #1 of 5 – stay tuned for the synergy bombs that’ll 10x your airdrop score! 🌟

Deploy specifying asset (use a mock ERC20 or WETH address on Base). Constructor args: name=”BaseYieldVault”, symbol=”BYV”, asset=your ERC20 from Contract 1. Deposit a tiny amount post-deploy for TX chain reaction – deposit, withdraw, share transfers. Gas hovers at 3M; this one’s a eligibility multiplier for deploy contracts base airdrop hunters. Basescan creator link ties it to your wallet history, aging like fine wine over weeks.

Contract 5: BaseDAOGovernor for Governance Boss Status

Cap it with a Governor contract – DAO infrastructure that Base loves for ecosystem builders. OpenZeppelin’s modular Governor handles proposals and votes. Snippet:

Link it to your BaseFarmToken for voting power. Deploy with token=Contract1 address, quorum 4%, delay=1 block. Propose a dummy motion right after – TX frenzy! This deploys heaviest at 4M gas but cements you as a governance heavyweight. Five contracts live: your base 5 tx farming complete, TX count exploding.

Post-Deploy Power Moves: Interactions and Safety Nets

Deployment’s just the spark; fan the flames with interactions. For each contract, hit Remix’s interface: mint/transfer on ERC20/721/1155, deposit/rebalance on vault, propose/vote on Governor. Cross-call between them – approve ERC20 spend for vault deposit, use NFT as Governor signal. Spread over 2-4 weeks: 5-10 TXs per contract weekly builds organic volume without bot flags.

Monitor on Basescan: filter your address for deploys, note TX hashes, screenshot deployer histories. CryptoLinks nails it – inspect age and patterns to stay clean. DappRadar’s prep mindset: no guarantees, but builders dominate. With $BASE at $0.1683 up $0.0441 in 24 hours, this activity positions you for L2 breakout rewards.

Multi-wallet twist: Rotate 2-3 dedicated wallets, bridge small ETH batches, deploy subsets per wallet. Consolidate interactions later for narrative strength. Beluga’s trends show diversified creators winning big; Airdrop Alert’s consistency rule turns this into airdrop rocket fuel.

Your Basescan profile now screams commitment – five OpenZeppelin contracts, dozens of TXs, interconnected utility. Base’s algo favors this over spam; think quality signals for $base eligibility tx count. As volatility king, I say deploy bold, farm smart. Markets reward the builders stacking these edges now, with $BASE’s 24h high at $0.1683 proving momentum’s here. Stay gassed, track that price action, and watch your allocation swell come 2026 drop.