Picture this: Base Protocol’s $BASE token is humming at $0.1067, up a slick and 0.60% in the last 24 hours with a high of $0.1070 and low of $0.0967. As of February 12,2026, whispers from Base creator Jesse Pollak and Coinbase CEO Brian Armstrong have the crypto streets buzzing about a native token drop. Analysts peg its potential market cap anywhere from $12 billion to $34 billion. That’s not chump change; it’s a base airdrop farming 2026 goldmine for those stacking onchain activity right now. Forget passive holding; to farm $BASE tokens, you need deliberate, high-signal moves on the Base chain. We’re talking bridging, liquidity provision, lending, swaps, voting locks, NFT mints, and smart wallet plays. This guide arms you with the exact playbook to qualify for those juicy rewards before Q1 wraps.

Why Base’s Onchain Activity Signals Massive $BASE Rewards in 2026

The shift from simple giveaways to engagement-based reward systems is crypto’s new normal, and Base leads the pack as Coinbase’s Ethereum L2 powerhouse. Onchain news screams that top airdrops reward genuine protocol use over sybil farms. Base’s deep ties to Farcaster’s social graph and native apps like Aerodrome and Moonwell mean your activity here could snapshot into millions. Prioritize base chain onchain activity airdrop eligibility by hitting protocols with real TVL and volume. No official points system yet, but patterns from past L2s like Optimism point to multipliers for consistent, diverse interactions. Allocate 2-4 hours weekly across 5-10 projects, but laser-focus on Base for compound gains. Jesse Pollak’s hints? Pure rocket fuel for bold movers.

Markets favor the aggressive, and with $BASE at $0.1067, early positioning crushes late FOMO. Bridging ETH, LPing on Aerodrome, lending on Moonwell, micro-swapping Uniswap V3, locking veAERO, minting NFTs on OpenSea, and gasless txns via Coinbase Smart Wallet: these are your seven battle-tested vectors. We’ve ranked them by signal strength and ease, pulling from blockeden. xyz intel on Q1 2026 hotspots.

Top Strategies to Dominate Base Airdrop Farming: Kickoff with Bridging and Liquidity

Dive straight into the trenches. Our prioritized list cuts the noise: 1) Bridge assets regularly via the official Base Bridge to establish chain presence; 2) Provide liquidity in high-volume pools on Aerodrome Finance for veAERO emissions; 3) Lend and borrow stablecoins on Moonwell Protocol to rack up borrow/lend volumes; 4) Execute frequent micro-swaps on Uniswap V3 deployed on Base for swap fees and activity points; 5) Lock AERO tokens for veAERO voting power on Aerodrome to influence emissions; 6) Mint and trade NFTs on Base marketplaces like OpenSea for social-proof txns; 7) Utilize Coinbase Smart Wallet for gasless onchain interactions scaling your volume effortlessly.

Strategy 1: Bridge Assets Regularly via Official Base Bridge. This is table stakes. Shuttle ETH or USDC from Ethereum mainnet weekly – aim for 10 and bridges by March. It logs your entry, boosts chain balance snapshots, and sets the stage for DeFi cascades. Use the Base Bridge to avoid sketchy third-parties; fees are negligible at sub-cent levels.

Strategy 2: Provide Liquidity in High-Volume Pools on Aerodrome Finance. Aerodrome’s the Base DEX king with billions in TVL. Pair ETH-USDbC or stablecoin pools – target 0.3% fee tiers for volume. Stake LP tokens for AERO rewards; this screams ‘real user’ to snapshot algos. Expect 20-50% APY while farming points.

Base Token (BASE) Price Prediction 2027-2032

Forecasts based on 2026 year-end average of $0.75, airdrop momentum, Base chain adoption, and crypto market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.50 | $1.00 | $2.00 | +33% |

| 2028 | $0.80 | $2.00 | $5.00 | +100% |

| 2029 | $1.20 | $3.50 | $8.00 | +75% |

| 2030 | $1.80 | $5.50 | $12.00 | +57% |

| 2031 | $2.50 | $8.00 | $18.00 | +45% |

| 2032 | $3.50 | $12.00 | $25.00 | +50% |

Price Prediction Summary

BASE token is projected to grow significantly post-2026 airdrop, with average prices rising from $1.00 in 2027 to $12.00 by 2032. Bullish maxima reach $25 amid L2 adoption and Coinbase synergies, while minima reflect bearish cycles and competition.

Key Factors Affecting Base Token Price

- Base chain’s growth as Coinbase L2 with high on-chain activity from airdrop farming

- Potential $12B-$34B market cap realization driving token value

- Crypto market cycles, including 2028 Bitcoin halving bull run

- Regulatory clarity favoring Coinbase ecosystem

- Technological improvements in scalability and DeFi/NFT integrations

- Competition from other L2s like Optimism and Arbitrum

- Community engagement via Farcaster and protocols like Aerodrome

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategy 3: Lend and Borrow Stablecoins on Moonwell Protocol. Moonwell’s lending market dominates Base yields. Deposit USDC, borrow against it at 1-2% ratios – loop 2-3x for amplified volume without liquidation risk. Track health factors religiously; this dual-action (lend and borrow) multiplies your signal over pure deposits.

These first three form your core loop: bridge in, LP up, lend/borrow out. Rinse weekly for organic growth. With $BASE steady at $0.1067, your onchain footprint compounds faster than any farm elsewhere.

Strategy 4: Execute Frequent Micro-Swaps on Uniswap V3 Deployed on Base. Don’t sleep on swaps – they’re the stealth volume booster. Fire off 20-50 tiny ETH-USDC trades weekly at 0.05% slippage. Uniswap V3’s concentrated liquidity on Base chews low gas, spits high activity scores. Rotate pairs to dodge patterns; algos love organic churn. Pair this with your LP positions for fee capture while farming base points system 2026 vibes.

Strategy 5: Lock AERO Tokens for veAERO Voting Power on Aerodrome. Level up your LP game. Grab AERO from emissions, lock 1-4 years for max veAERO multiplier. Vote for high-volume pools weekly – it’s governance signal gold. This isn’t yield chasing; it’s directing emissions to amp your own positions. veAERO holders snag bribes too, turning votes into extra $BASE farm fuel. Bold? Absolutely. Rewarding? Exponentially.

Strategy 6: Mint and Trade NFTs on Base Marketplaces like OpenSea. Social graph integration via Farcaster makes NFTs a multiplier. Mint cheap Base-native collections, flip 5-10 weekly on OpenSea. List at 0.1 ETH floors, bid aggressively on blue-chips. This logs creator/trader txns, ties into Base’s NFT boom, and snapshots your cultural footprint. With Farcaster frames exploding, one viral mint could 10x your eligibility signal.

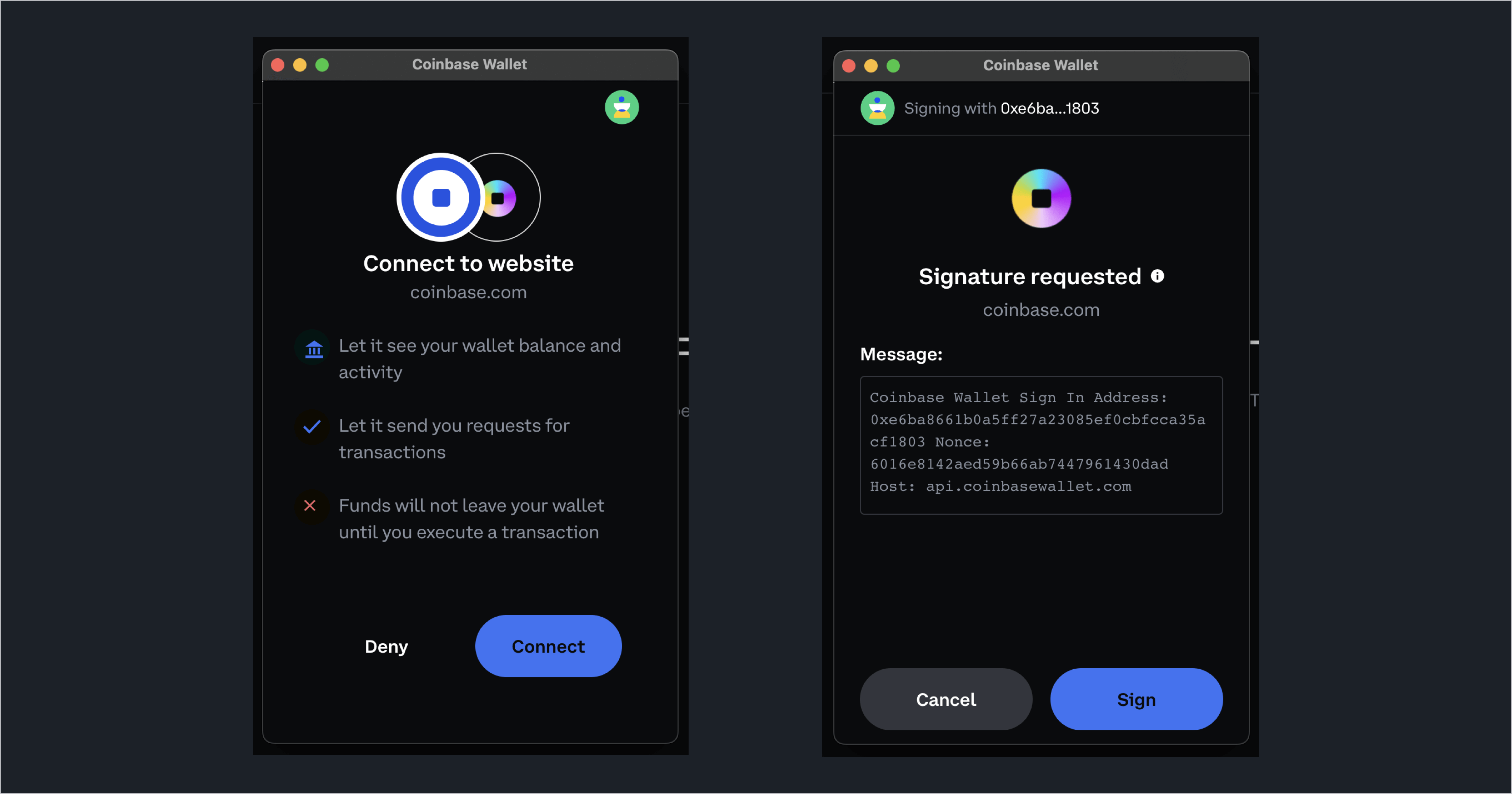

Strategy 7: Utilize Coinbase Smart Wallet for Gasless Onchain Interactions. The efficiency hack. Ditch MetaMask gas wars; Coinbase Smart Wallet batches txns gasless via passkeys. Spam micro-actions – approvals, zaps, tips – at zero cost. Scale to 100 and txns/week without bleeding ETH. Sponsored gas screams ‘powered user’ to Base metrics, especially with Coinbase’s native backing. Pro tip: chain it with bridges for seamless loops.

Weaponize These 7 Strategies: Your Weekly Base Farming Assault

Stack ’em ruthlessly. Monday: Bridge $500 USDC. Tuesday: LP on Aerodrome ETH-USDC, stake for AERO. Wednesday: Moonwell deposit/borrow loop. Thursday: 30 Uniswap micro-swaps. Friday: Lock/revote veAERO. Weekend: Mint/trade 3 NFTs via Smart Wallet. Track via Basescan; aim 200 and txns/month diversified. This isn’t scattershot; it’s momentum trading onchain. With $BASE locked at $0.1067 and Q1 heat building, your footprint hits escape velocity.

7 Base Airdrop Farming Strategies

-

1. Bridge Assets Regularly via Official Base BridgeBridge ETH or USDC weekly from Ethereum to Base using bridge.base.org to demonstrate consistent network usage and boost eligibility.

-

2. Provide Liquidity in High-Volume Pools on Aerodrome FinanceAdd liquidity to top pairs like ETH/USDC on Aerodrome for fees and potential $AERO emissions signaling deep ecosystem engagement.

-

3. Lend and Borrow Stablecoins on Moonwell ProtocolSupply USDC and borrow against it on Moonwell to rack up points and show lending market activity on Base.

-

4. Execute Frequent Micro-Swaps on Uniswap V3 Deployed on BasePerform small daily swaps (e.g., $10 USDC <-> WETH) on Uniswap V3 Base to build organic trading volume.

-

5. Lock AERO Tokens for veAERO Voting Power on AerodromeStake $AERO into veAERO on Aerodrome for emissions boosts and governance—key for proving long-term commitment.

-

6. Mint and Trade NFTs on Base Marketplaces like OpenSeaMint low-cost Base NFTs and list/trade on OpenSea Base to engage the NFT ecosystem.

-

7. Utilize Coinbase Smart Wallet for Gasless Onchain InteractionsUse Coinbase Smart Wallet for seamless, abstracted txns on Base—ideal for multi-action farming without gas hassles.

Risks? Impermanent loss on LPs, liquidation slips on borrows, NFT rugs. Mitigate with 20% position sizing, health factor >1.5, DYOR collections. No sybil scripting – Base sniffs multis. Real volume trumps farmed points every time.

Farcaster chatter and Pollak’s nods confirm: onchain heroes feast first. $BASE’s $12-34B MC potential dwarfs current $0.1067 price. Farm now, claim later. Your aggressive edge? Executing this playbook while normies speculate. Bridge today; the chain favors the bold. Dive deeper on transaction scaling at our 100 txns shortcut guide. Positioned? You’re not just farming base airdrop rewards – you’re owning the snapshot.