Farming the largest possible $BASE airdrop allocation is not about luck, it’s about disciplined, systematic engagement with the Base ecosystem. With Base Protocol (BASE) currently trading at $0.451173, and the airdrop landscape becoming increasingly competitive, maximizing your eligibility requires a focused, multi-pronged approach. Below, I break down the top five expert strategies to help you secure the biggest slice of the $BASE token distribution.

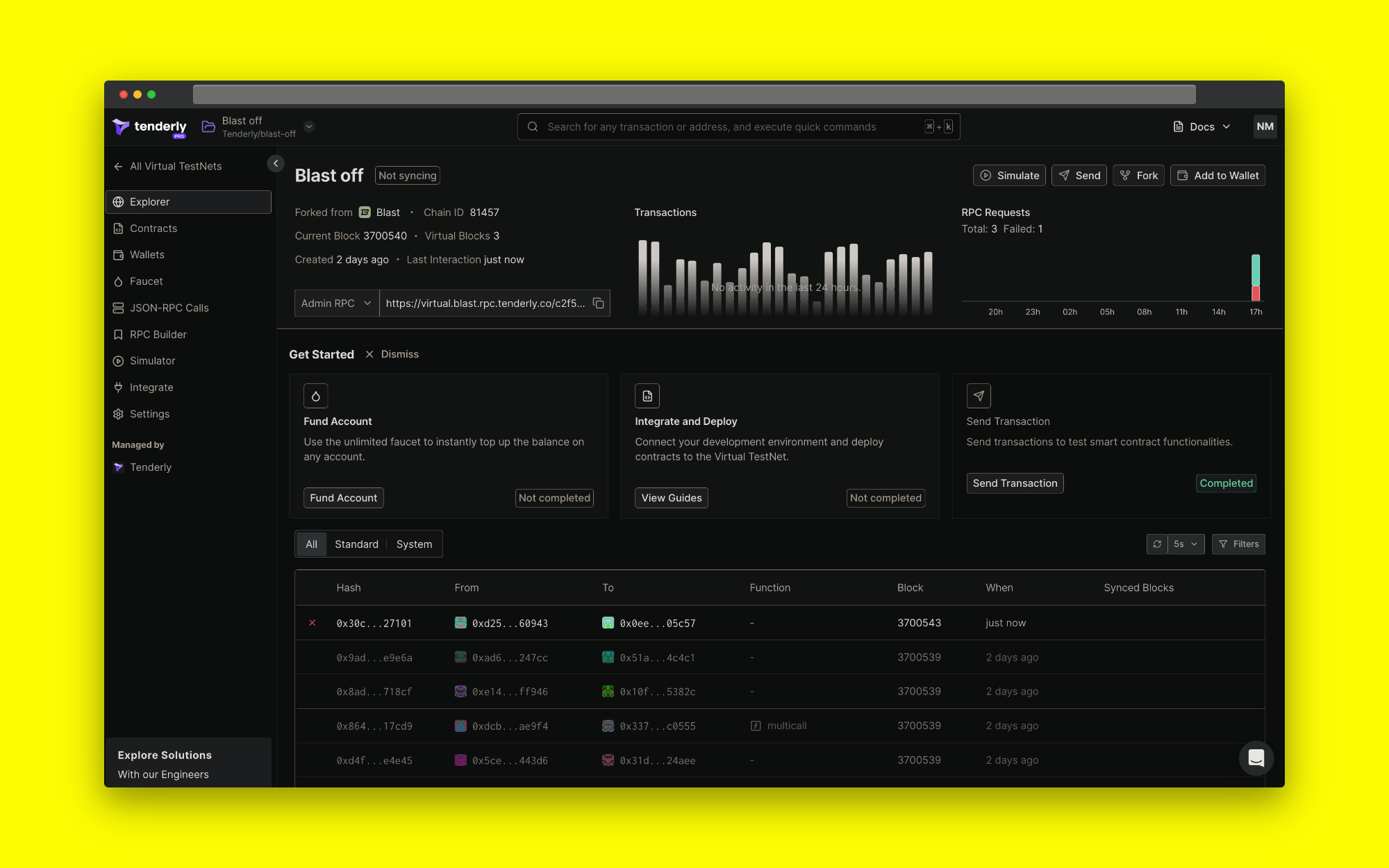

1. Maximize On-Chain Activity on Base

The single most important factor in airdrop eligibility is genuine, consistent on-chain activity. This means interacting with key decentralized applications (dApps) across the Base network, not just once, but regularly over time. Swap tokens on DEXs like Uniswap or Aerodrome, mint NFTs, bridge assets, and use lending protocols. The goal: signal to airdrop algorithms that you’re a real user deeply engaged with Base’s core infrastructure.

Tools such as onchainscore.xyz can help you track your wallet’s activity score and identify areas for improvement. Aim for daily or weekly transactions, spread across swaps, staking, lending, and NFT interactions, to build a robust transaction history that stands out during snapshot evaluations.

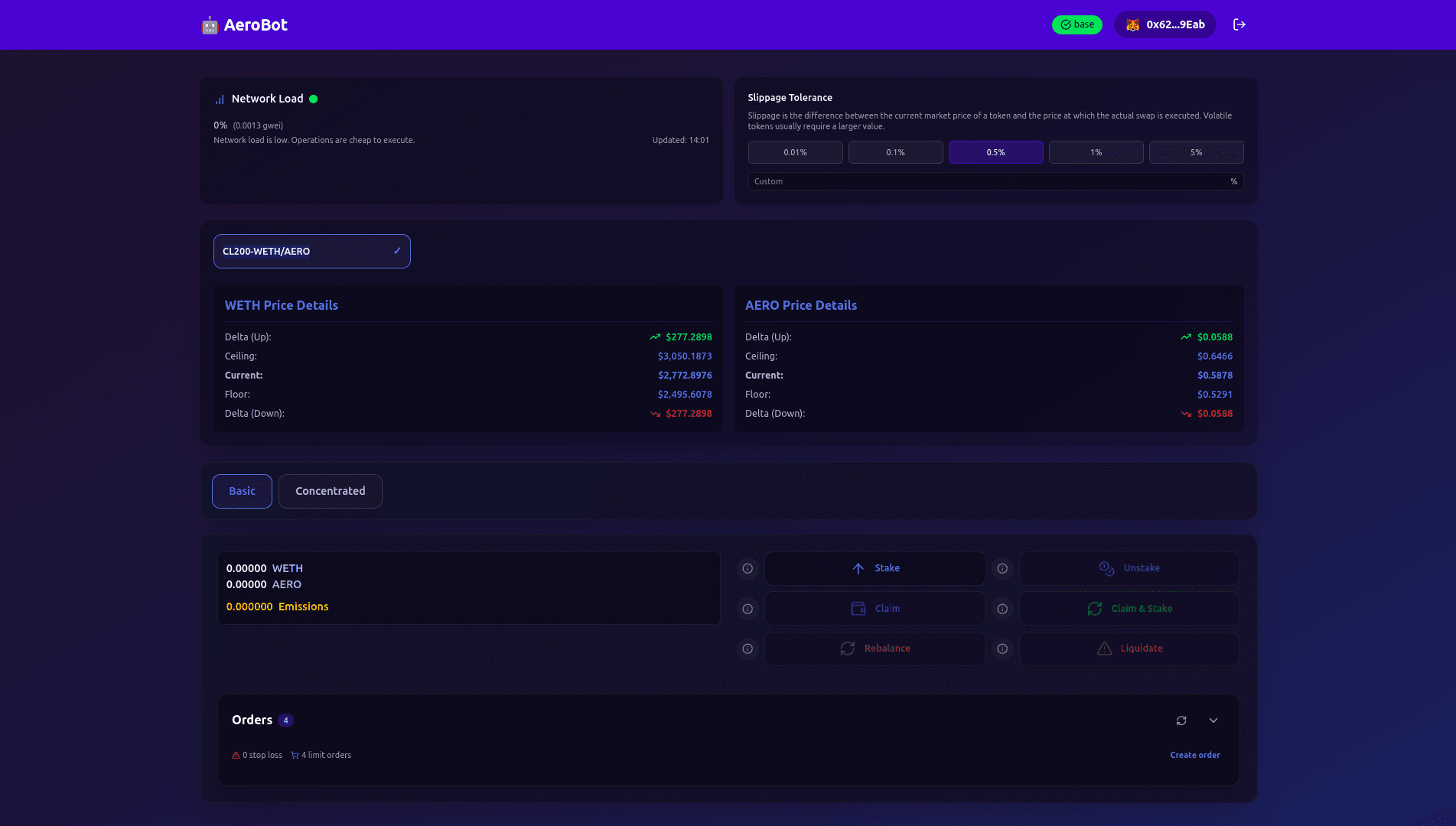

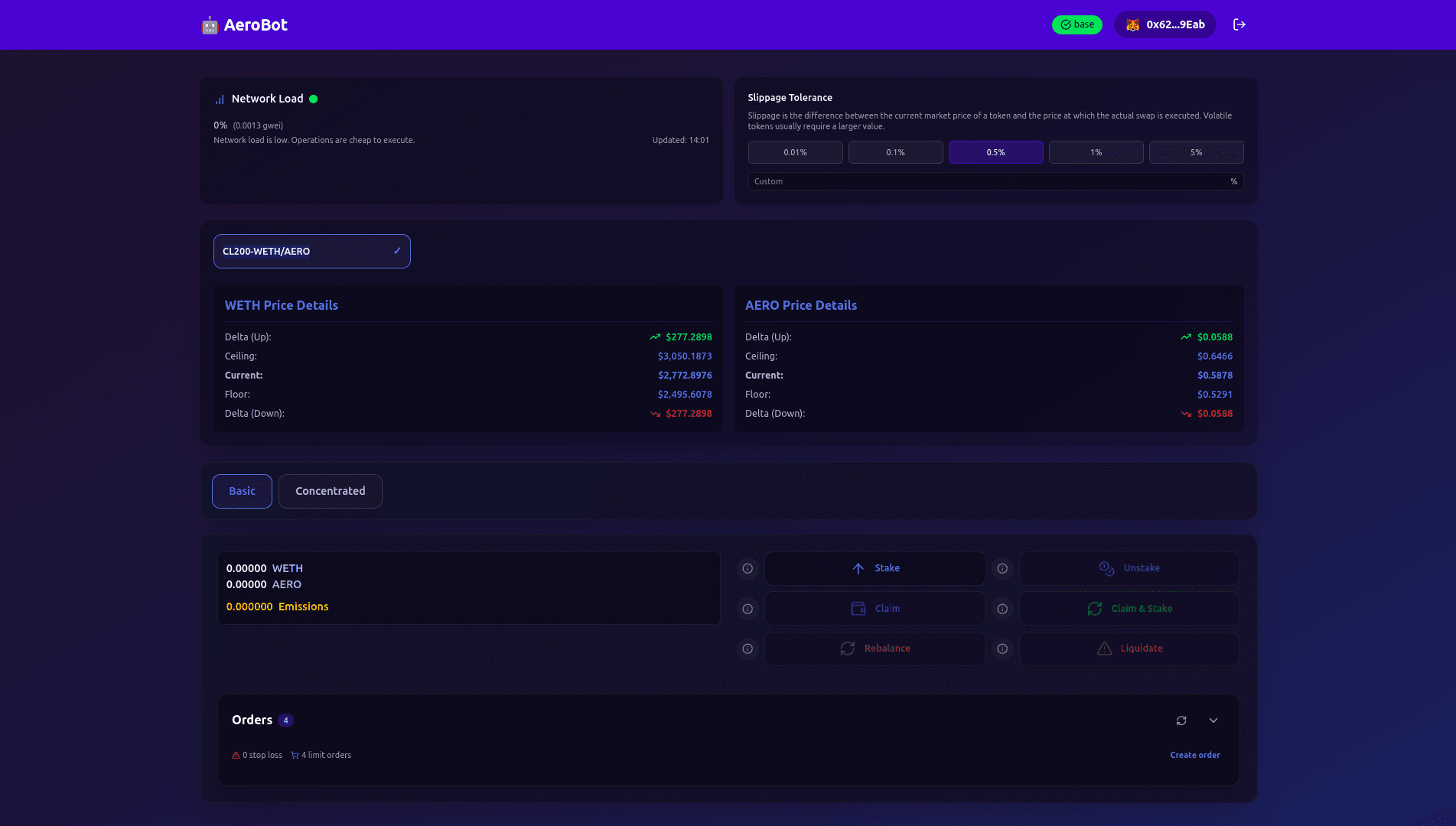

2. Provide Liquidity to Core Base Protocols

Liquidity providers are often prioritized in major airdrops. Supply liquidity to major Base-native DEXs like Aerodrome or Uniswap (on Base), and consider joining yield farming pools where available. Not only does this strategy generate passive yield from trading fees or extra tokens (such as AERO), but it also demonstrates commitment to the ecosystem, something many airdrop teams reward with larger allocations.

Be systematic: allocate capital across multiple pools (e. g. , ETH/USDC on Aerodrome) and avoid providing liquidity solely for short periods before rumored snapshot dates. Consistency is key; sustained participation reduces your risk of being flagged as an opportunistic farmer.

Top 5 Expert Strategies for Maximizing Your $BASE Airdrop

-

Maximize On-Chain Activity on Base: Consistently interact with leading dApps on the Base network—including Uniswap, Aerodrome, Moonwell, and NFT platforms—to build a robust transaction history. Regular swaps, lending, staking, and NFT mints signal authentic user engagement, a key factor in airdrop eligibility.

-

Provide Liquidity to Core Base Protocols: Supply liquidity to major Base-native DEXs like Aerodrome or Uniswap (Base) and participate in their yield farming pools. Active liquidity providers are often prioritized for larger airdrop allocations, and you can earn protocol rewards (e.g., AERO tokens) in the process.

-

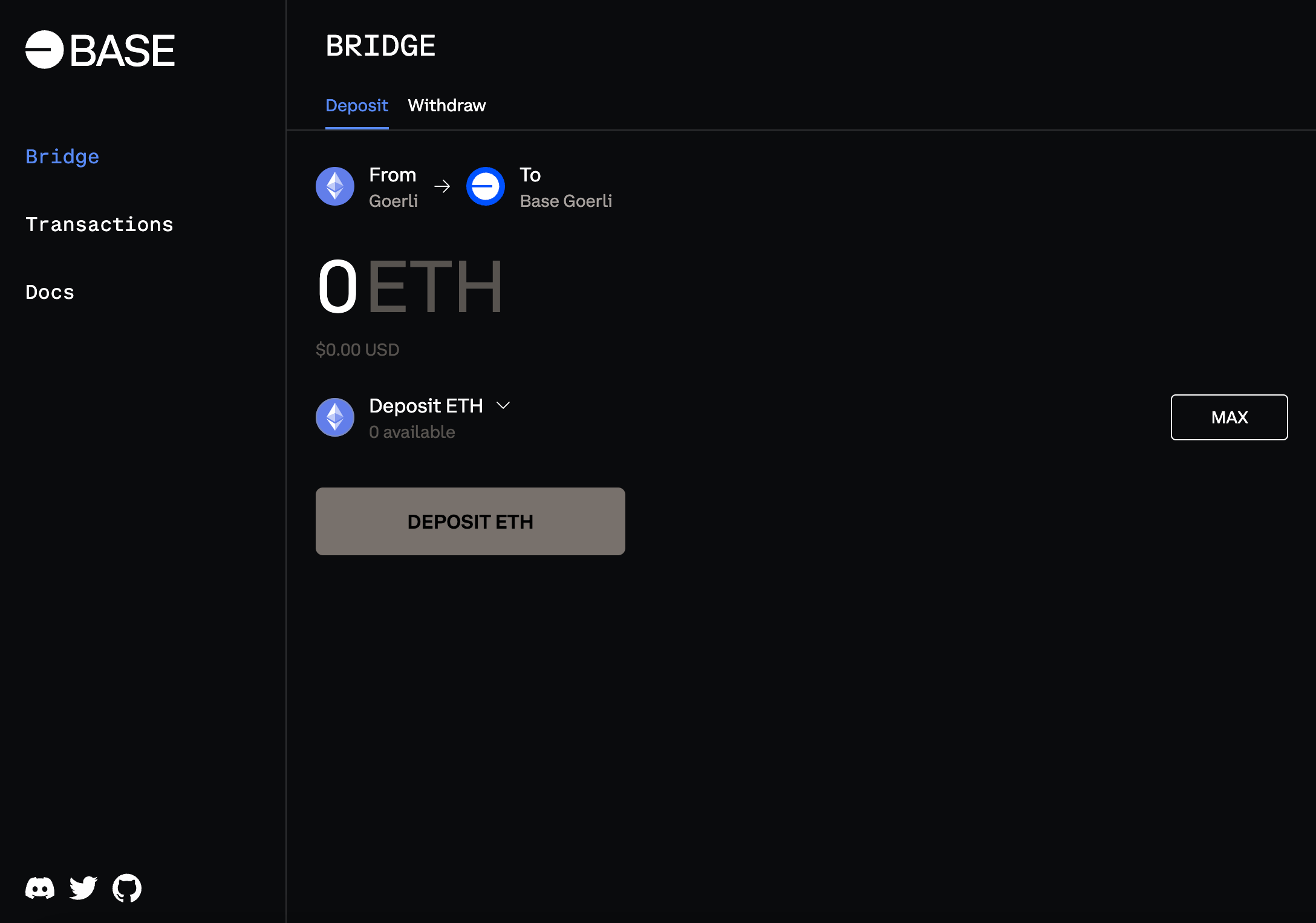

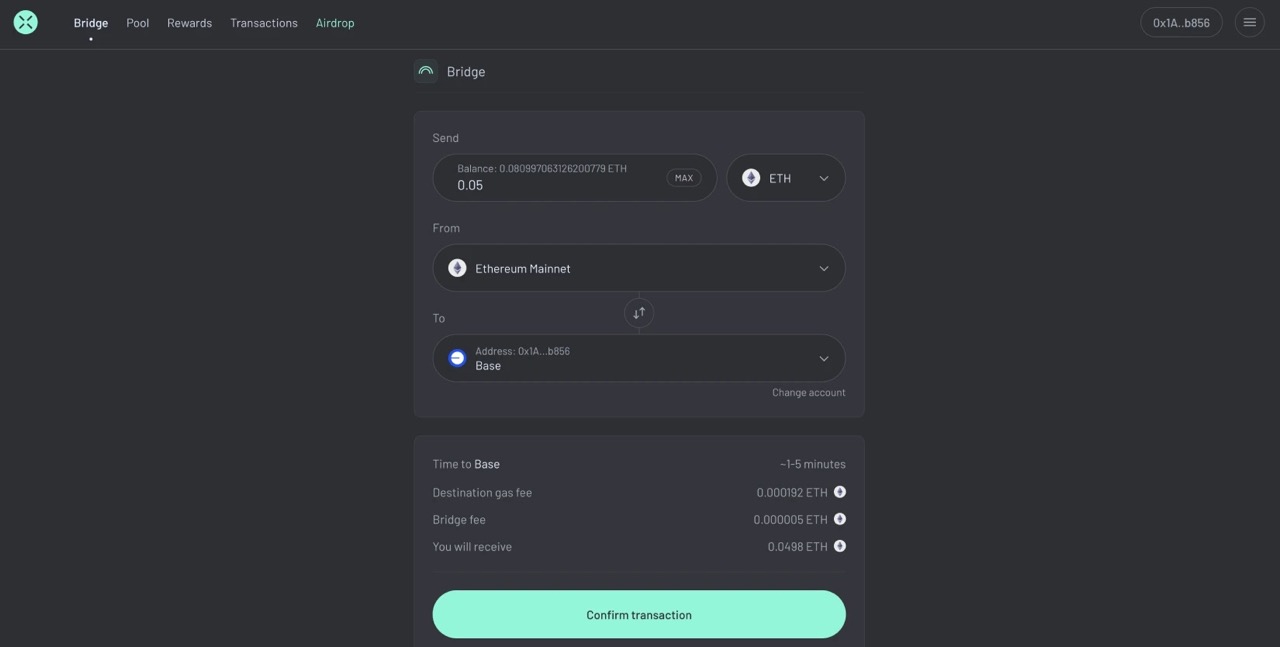

Bridge Assets Frequently and Diversify Transactions: Use official bridges such as brid.gg or superbridge.app/base to transfer assets from Ethereum to Base. Perform a variety of transactions—swaps, mints, staking—to demonstrate diverse usage, which is favored by airdrop criteria.

-

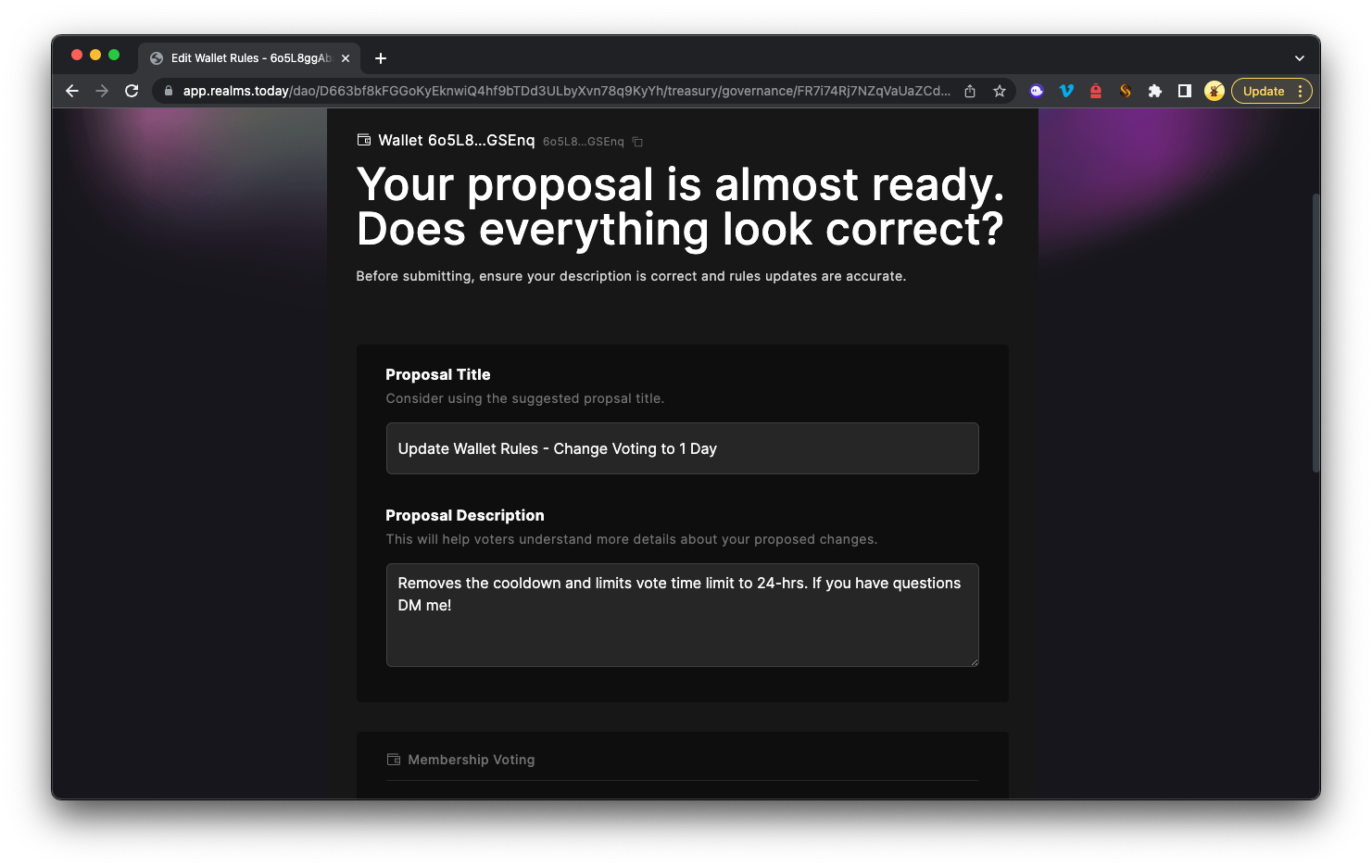

Engage in Social and Governance Activities: Participate in Base ecosystem governance (e.g., voting on proposals), complete social tasks on platforms like Galxe, and join official Discord or Twitter campaigns. Community involvement is increasingly factored into airdrop calculations.

-

Utilize Multiple Wallets Ethically: Set up several unique wallets (avoiding Sybil activity) and interact independently with the Base ecosystem. This increases your overall exposure while respecting fair participation guidelines enforced by airdrop teams.

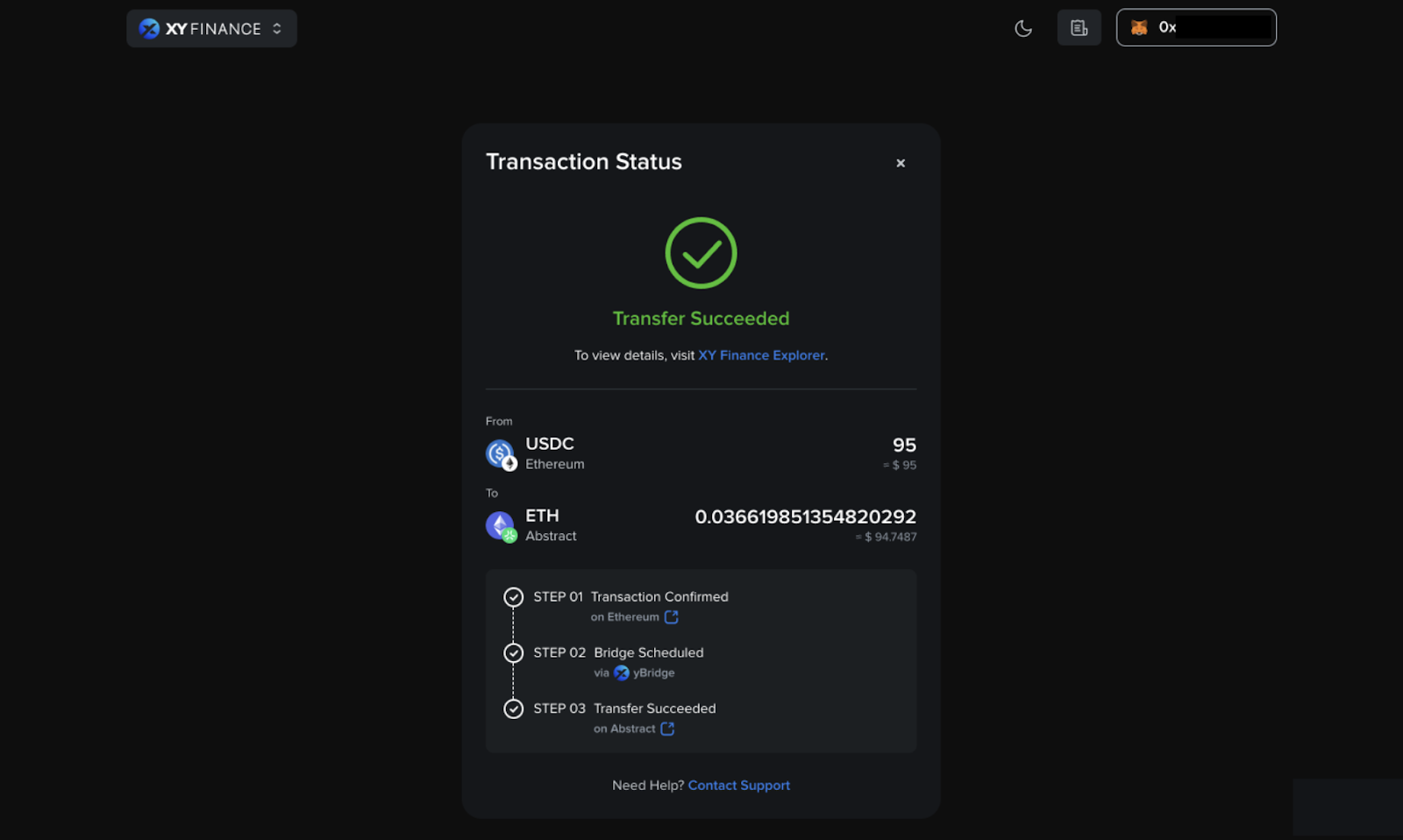

3. Bridge Assets Frequently and Diversify Transactions

Diversification matters. Use official bridges like brid.gg or superbridge.app/base to move assets from Ethereum or other chains onto Base multiple times per month. This signals active participation across chains, a metric favored by many airdrop criteria.

Diversify your transaction types: perform swaps between different pairs, mint NFTs on various platforms, stake tokens in DeFi protocols, and experiment with new dApps as they launch within the ecosystem. Avoid repetitive patterns that could be interpreted as bot-like behavior; instead, showcase organic usage through varied activities.

$BASE Price Update: Why Timing Your Activity Matters at $0.451173

The current BASE price sits at $0.451173, reflecting recent market consolidation after minor volatility (24h range: $0.4452–$0.4573). This price zone is crucial for liquidity providers and active users alike, your transaction volumes are measured in real terms against this benchmark when protocols assess distribution fairness.

If you’re planning large transactions or liquidity provision moves, monitor the price closely; strategic timing can optimize both your yield farming returns and visibility during potential snapshot windows.

Beyond timing, your approach must remain pragmatic. Don’t chase short-term pumps or attempt to game the system with last-minute surges in activity. Most airdrop teams now scrutinize wallet behaviors for patterns that suggest opportunistic farming. Instead, maintain a steady cadence of engagement, spread your swaps, bridges, and liquidity events over several weeks to appear as an authentic participant rather than a speculator.

4. Engage in Social and Governance Activities

Base ecosystem projects increasingly reward community involvement. Participating in governance votes, proposing improvements, and joining social campaigns (such as Discord discussions or Twitter quests) can all boost your airdrop eligibility. Many protocols track wallet addresses linked to governance proposals or active Discord members and allocate larger shares accordingly.

To maximize this strategy:

- Vote on Base protocol governance proposals when available.

- Complete social tasks on platforms like Galxe, which often include following official Base accounts or sharing project updates.

- Join community calls and AMAs, your wallet may be whitelisted for future rewards simply by showing up and participating.

Stay engaged but authentic; avoid spamming or low-effort participation as these are easily flagged by moderators and snapshot algorithms alike.

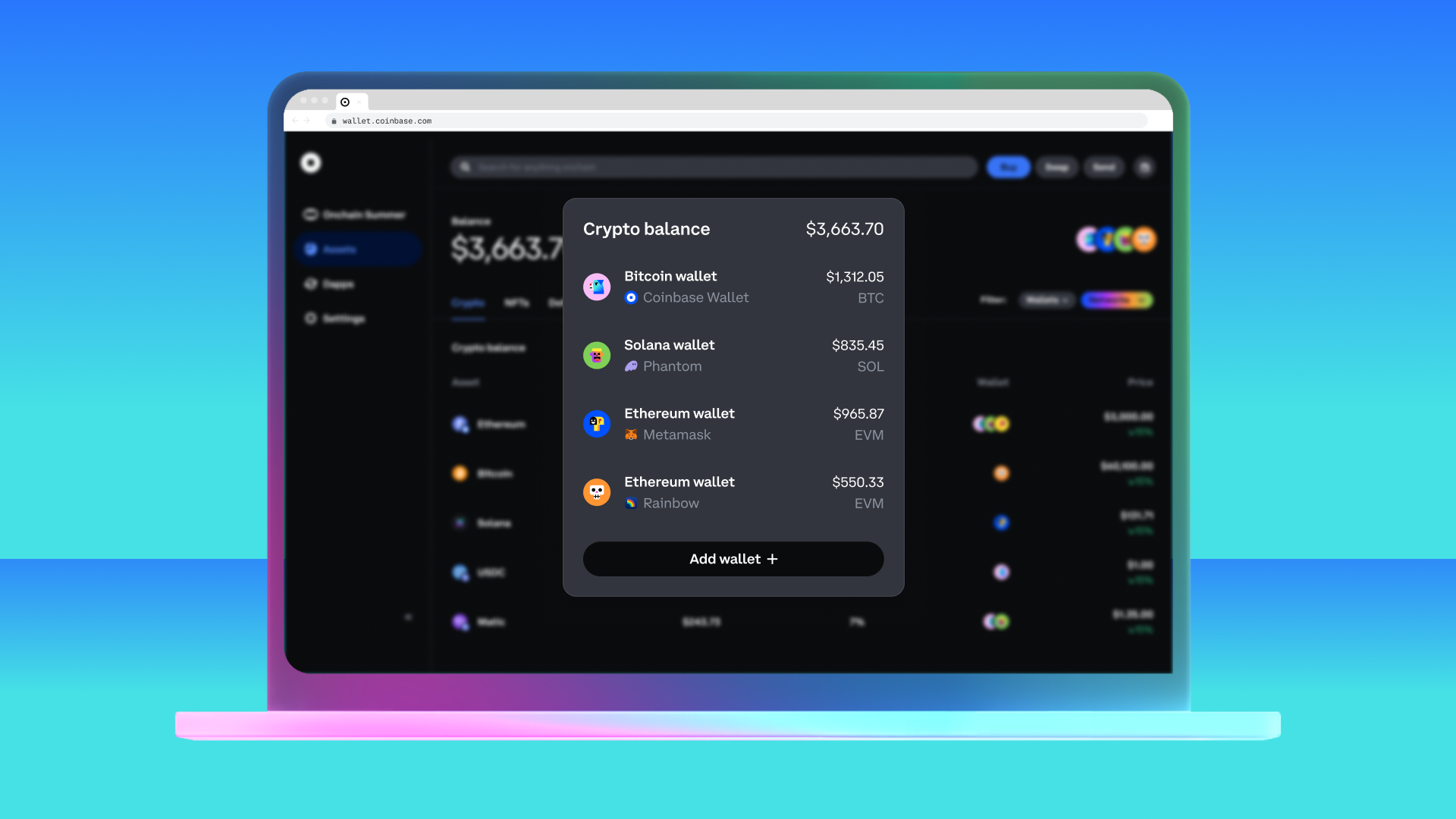

5. Utilize Multiple Wallets Ethically

Diversifying your exposure across several wallets is a time-tested approach, but it must be done ethically. Setting up multiple unique wallets allows you to independently interact with the Base ecosystem from different angles: one for DEX trading, another for liquidity provision, a third for NFT minting, etc. This increases your overall footprint without crossing into Sybil territory (where one user unfairly claims multiple allocations).

Best practices:

- Never automate interactions across wallets, manual participation is key.

- Avoid reusing IP addresses or device fingerprints when setting up new wallets.

- Keep transaction histories distinct; don’t copy-paste the same actions between accounts.

Airdrop teams are getting smarter about detecting Sybil behavior. If you’re caught gaming the system with identical wallets and mirrored activity, you risk disqualification from all allocations, not just one.

Final Steps: Consistency Wins Over Hype

The landscape of Base airdrop farming strategies is evolving rapidly as protocols refine their distribution models. To secure the biggest $BASE token allocation possible at today’s price of $0.451173, focus on authentic engagement across these five pillars:

Top 5 Expert Strategies for Maximizing Your $BASE Airdrop

-

Maximize On-Chain Activity on Base: Regularly interact with key dApps on the Base network—including DEXs like Uniswap (Base), NFT platforms, bridges, and lending protocols. Consistent, genuine activity such as swaps, lending, staking, and NFT mints demonstrates real user engagement and increases your eligibility for a larger airdrop allocation.

-

Provide Liquidity to Core Base Protocols: Supply liquidity to major Base-native DEXs, such as Aerodrome or Uniswap on Base. Participating in yield farming pools and providing liquidity not only earns you rewards but also signals commitment to the ecosystem—an important factor for airdrop eligibility.

-

Bridge Assets Frequently and Diversify Transactions: Use official, reputable bridges like brid.gg or superbridge.app/base to move assets from Ethereum or other chains onto Base. Perform a variety of transactions—swaps, mints, staking—to showcase diverse and authentic usage patterns that are favored by airdrop criteria.

-

Engage in Social and Governance Activities: Participate in community governance proposals and complete social media tasks, such as following official Base accounts or joining Discord and Twitter campaigns. Contributing to the Base ecosystem’s growth and visibility can earn you additional points in airdrop calculations, as many projects reward active community involvement.

-

Utilize Multiple Wallets Ethically: Set up several unique wallets—ensuring each interacts independently with the Base ecosystem. Avoid Sybil behavior by maintaining genuine, fair participation. This disciplined approach increases your overall exposure while aligning with the fair participation guidelines enforced by most airdrop teams.

Your goal should be to build a credible on-chain identity that reflects real usage, not just box-ticking exercises for snapshots. Remember: sustained effort outperforms last-minute sprints every time in this game.

If you’re serious about learning how to farm Base airdrop opportunities effectively, systematic participation is non-negotiable. Plan your trade, trade your plan, and let your transaction history speak for itself when snapshot day arrives.