With the Base Token Airdrop now on every DeFi enthusiast’s radar, maximizing your Onchain Score has become a strategic priority. As of September 21,2025, Base Protocol (BASE) is priced at $0.4940 with a modest 24-hour gain of and $0.0121 ( and 0.0251%). The introduction of a network token and the growing emphasis on user activity means your eligibility for the $BASE airdrop will likely hinge on more than just holding assets – it will depend on how actively and diversely you engage within the Base ecosystem.

Why Your Onchain Score Matters for the Base Token Airdrop

The Onchain Score is an evolving metric that evaluates your real usage and contribution to the Base network. According to recent updates from Coinbase leadership and community sources, this score tracks not only transaction volume but also diversity of activities, consistency over time, and community participation. In short: the more you do, and the more varied your actions, the higher your score. This guide details exactly how to prioritize your efforts to maximize eligibility for potential $BASE token rewards.

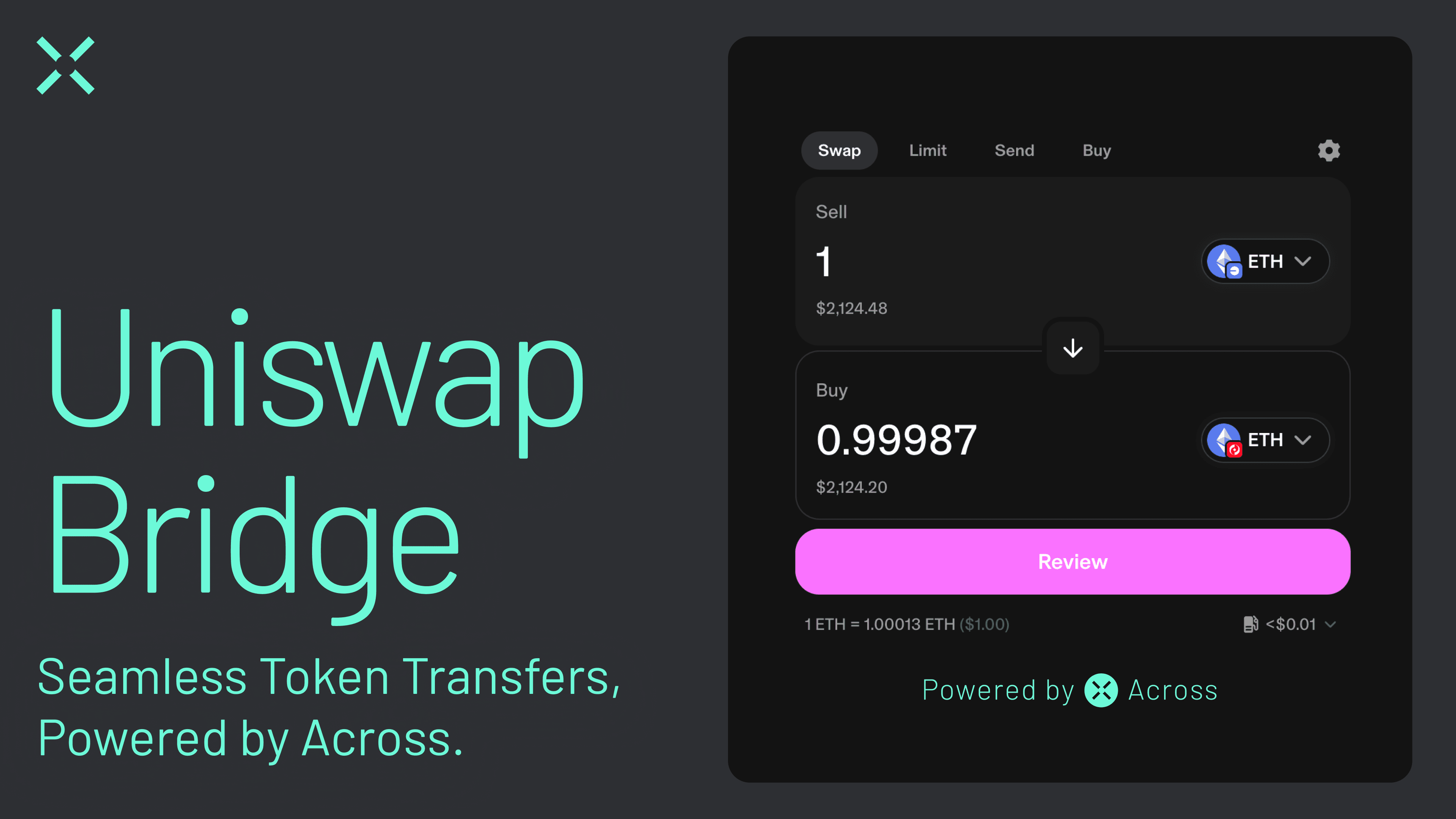

1. Consistently Bridge Assets to Base and Use Native DApps

Your journey starts with bridging assets from Ethereum or other supported chains into Base using the official bridge. Regularly moving assets – not just as a one-off action – signals ongoing engagement. Once bridged, put those assets to work in native decentralized applications (DApps) such as swapping tokens or interacting with NFT platforms built directly on Base.

- Tip: Spread out your bridging transactions over days or weeks instead of doing everything at once. This approach demonstrates consistent activity rather than opportunistic behavior.

- Learn more about bridging strategies here

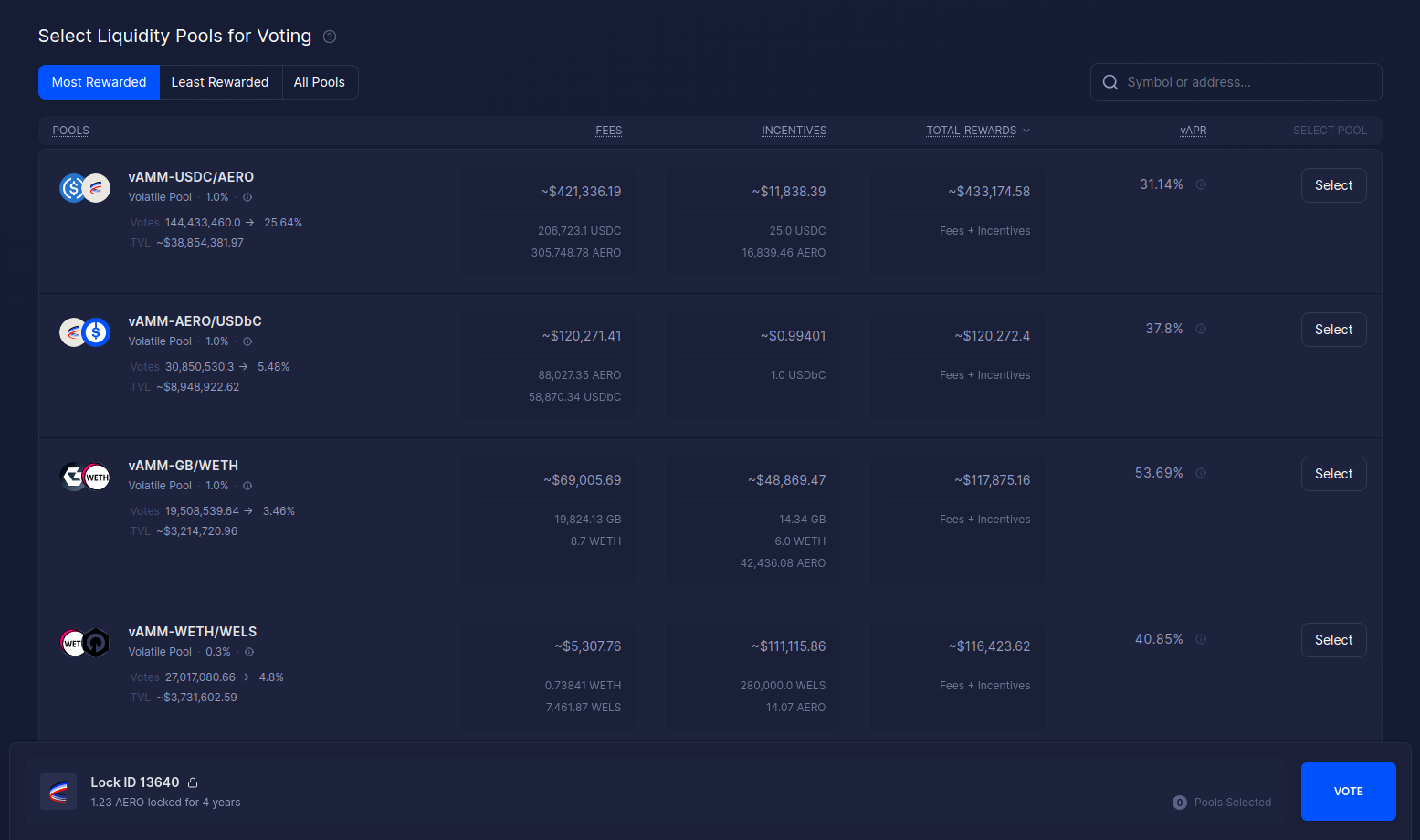

2. Provide Liquidity and Trade on Base-native DEXes

Liquidity provision is a key signal of commitment in any DeFi ecosystem, and Base is no exception. By supplying ETH, USDC, or other assets to liquidity pools on DEXes like Uniswap (Base), Aerodrome, or similar platforms native to Base, you not only earn potential yield but also bolster your Onchain Score.

- Diversify: Engage with multiple pools across different protocols rather than concentrating all liquidity in one place.

- Explore additional DeFi strategies for Base here

Trading activity matters too: regular swaps between tokens show active participation in the network’s financial layer. Avoid wash trading; organic volume spread over time is favored by most scoring algorithms.

Base (BASE) Token Price Prediction (2026–2031)

Price projections based on current fundamentals, market trends, and Base ecosystem developments. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.45 | $0.65 | $1.10 | +31% | Initial post-airdrop volatility; increased adoption from new use cases, but possible sell pressure from airdrop recipients. |

| 2027 | $0.60 | $0.90 | $1.50 | +38% | Base establishes itself as a leading L2; increased onchain activity, but competition from other L2s remains strong. |

| 2028 | $0.80 | $1.20 | $2.10 | +33% | Wider ecosystem growth, more integrations, and improved scalability; regulatory clarity boosts institutional adoption. |

| 2029 | $1.00 | $1.55 | $2.80 | +29% | Base benefits from broader crypto bull cycle; potential for new DeFi primitives and NFT growth on Base. |

| 2030 | $1.20 | $1.90 | $3.60 | +23% | Matured network with robust developer and user base; Base token utility expands (governance, gas, staking). |

| 2031 | $1.10 | $1.75 | $3.20 | -8% | Possible market correction after extended growth; consolidation phase, but Base remains a top L2 player. |

Price Prediction Summary

The Base (BASE) token is projected to experience steady growth from 2026 through 2031, with increasing average price each year driven by network adoption, expanded use cases, and broader Layer 2 (L2) trends. While short-term volatility is expected post-airdrop, the long-term outlook is positive, especially if Base can maintain technological leadership and ecosystem growth. However, competition, regulatory shifts, and broader market cycles may introduce significant fluctuations, as reflected in the wide minimum-maximum price ranges.

Key Factors Affecting Base Price

- Adoption and utility of the Base network (transaction volume, active users, developer activity).

- Success and scale of Base-native DeFi, NFT, and application ecosystems.

- Airdrop dynamics and initial token distribution effects.

- Regulatory developments for L2 solutions and overall crypto markets.

- Competition from other L2s (Arbitrum, Optimism, zkSync, etc.).

- Technological improvements (scalability, interoperability, security enhancements).

- Broader market cycles (bull and bear market phases).

- Potential for new use cases (e.g., Base token as gas, governance, staking).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

3. Engage in Lending, Borrowing, and Staking Protocols on Base

Lending protocols are foundational pillars of any L2 ecosystem’s DeFi stack. By lending out stablecoins or borrowing against collateral on protocols supported by Base (such as Compound v3 or emerging local options), you demonstrate trust in – and reliance upon – the network’s infrastructure.

- Lend and Borrow: Try both sides of these markets; lending alone isn’t enough if you want maximum score impact.

- Staking: Participate in staking programs offered by new projects launching natively on Base; early adoption here can yield outsized rewards both in terms of yield and scoring metrics.

This level of engagement signals that you are not just passing through but are an active participant helping build liquidity depth and protocol resilience within the ecosystem.

Top Steps to Maximize Your Onchain Score for the BASE Airdrop

-

Consistently Bridge Assets to Base and Use Native DApps: Regularly transfer assets (like ETH or USDC) from Ethereum to Base using the official Base Bridge. Engage with Base-native decentralized applications such as Uniswap, Aerodrome, and Friend.tech to demonstrate ongoing activity and boost your Onchain Score.

-

Provide Liquidity and Trade on Base-native DEXes: Supply liquidity or actively trade on Base-native decentralized exchanges like Aerodrome, Uniswap, and Velodrome. These actions increase your transaction volume and show deeper ecosystem participation.

-

Engage in Lending, Borrowing, and Staking Protocols on Base: Use established DeFi protocols such as Aave (on Base), Compound, or Seamless Protocol to lend, borrow, or stake assets. This diversified DeFi activity can significantly enhance your eligibility score.

-

Maintain High Onchain Activity and Diverse Interactions: Perform a variety of onchain actions—such as swaps, NFT mints, contract deployments, and regular transactions—across different Base-native applications. Consistent, diverse usage signals genuine engagement to the network.

-

Participate in Social and Community Engagement (Discord, Guilds, Quests): Join the Base Discord, complete quests on platforms like Guild.xyz, and earn roles or badges. Active involvement in community events and campaigns (e.g., Onchain Summer) further strengthens your Onchain Score.

The Importance of High Activity and Diverse Interactions

A high Onchain Score isn’t about spamming transactions – it’s about authentic engagement across multiple facets of the network over time. In upcoming sections we’ll cover how maintaining diverse interactions and participating in social/community initiatives can further boost your eligibility odds for the coveted $BASE airdrop.

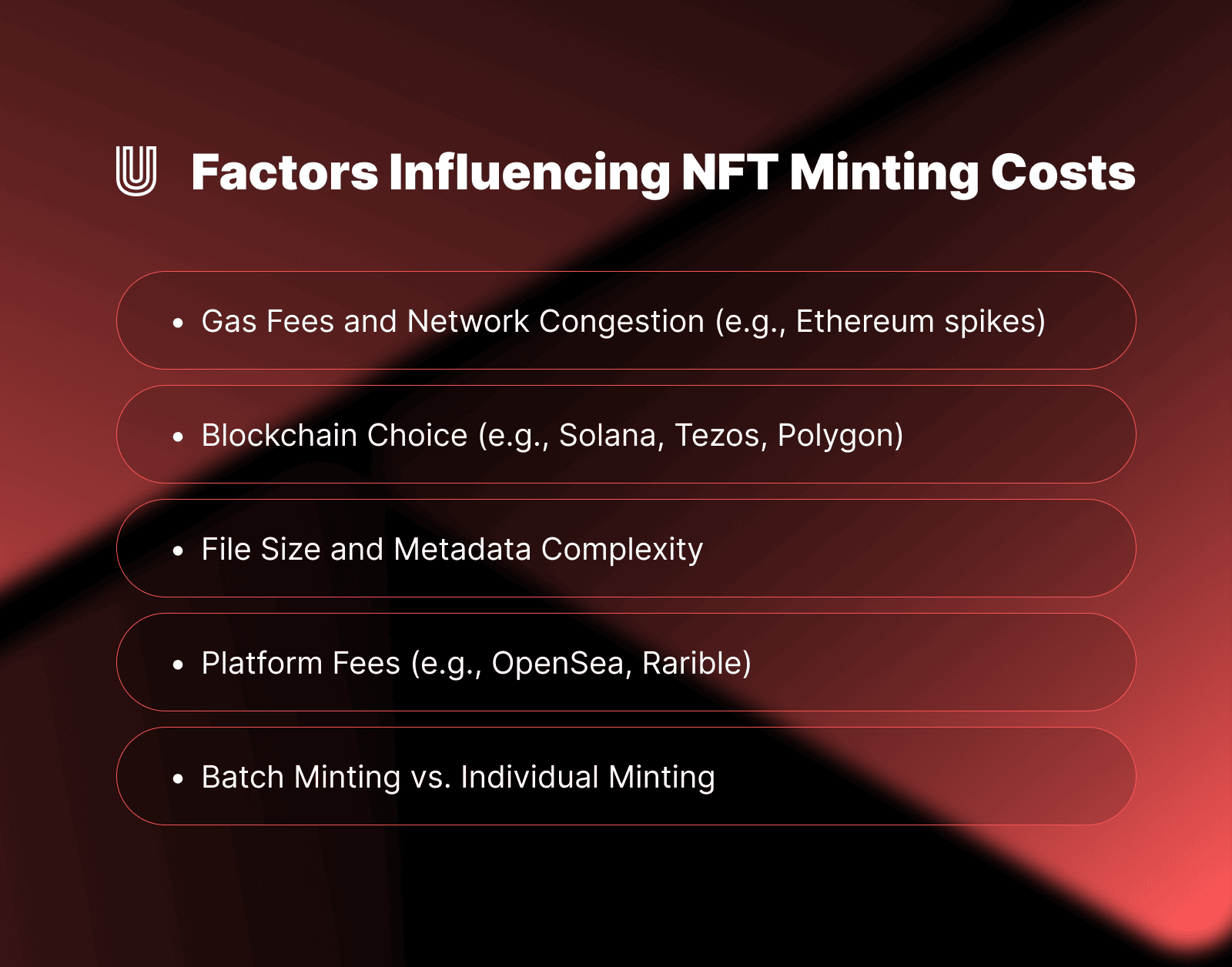

4. Maintain High Onchain Activity and Diverse Interactions

To truly stand out for the Base Token Airdrop, maintaining consistent, high-frequency activity is critical. The Onchain Score algorithm rewards users who interact with a broad range of protocols and features on the Base network. This means you should regularly:

- Swap tokens on various DEXes (don’t limit yourself to just one platform).

- Mint or trade NFTs using Base-native marketplaces.

- Interact with different types of smart contracts, such as participating in yield farms or testing new dApps as they launch.

Diversity matters as much as volume. For example, if you consistently use only one protocol, your score may plateau versus those who demonstrate a willingness to explore and contribute across the ecosystem. Schedule weekly or bi-weekly interactions instead of clustering all your activity into a single session; this approach mimics organic user behavior and is favored by most eligibility algorithms.

5. Participate in Social and Community Engagement (Discord, Guilds, Quests)

The Base ecosystem isn’t just about transactions, it’s about community. Active participation in social channels such as Discord servers, official Guilds, and on-chain quests can provide a meaningful boost to your Onchain Score. Here’s how to maximize this dimension:

- Base Discord Engagement: Join the official Base Discord and participate in discussions or help answer newcomers’ questions. Many projects reward active members with roles that are tracked on-chain.

- Base Guild Roles: Seek out roles like ‘Based’ or ‘Onchain’ within the Base Guild by completing specific tasks or quests, these are often directly referenced in scoring models for airdrop eligibility.

- Onchain Quests and Campaigns: Complete learning modules, daily mints during events like Onchain Summer, or other interactive campaigns hosted by the Base team.

This layer of engagement not only demonstrates your commitment but also helps you stay informed about upcoming opportunities that might further increase your score. For more detail on how these activities influence eligibility, you can refer to resources such as this guide on community tasks for Base.

Track Your Progress: Monitoring Your Onchain Score

With so many moving parts contributing to your Onchain Score for the $BASE airdrop, it’s essential to monitor your progress regularly. Platforms like onchainscore. xyz allow you to input your wallet address and receive real-time feedback on where you stand, helping you identify gaps or areas where further engagement is needed.

The most successful airdrop hunters treat their wallet like an evolving portfolio, balancing DeFi activity with steady social participation over time.

Current Market Context: BASE Price Remains Stable at $0.4940

The value proposition for maximizing your Onchain Score becomes even more compelling given current market conditions. As of September 21,2025, BASE Protocol (BASE) is trading at $0.4940, with a modest 24-hour gain of $0.0121 ( and 0.0251%). This stability suggests continued interest and confidence in the network ahead of its anticipated token distribution event.

Final Checklist: Actionable Steps for Maximizing Your Base Airdrop Eligibility

If you’re serious about positioning yourself for maximum rewards from the upcoming Base Token Airdrop:

- Bridge assets consistently, not just once.

- Diversify liquidity provision, trading across multiple DEXes native to Base.

- Lend and borrow actively, including staking when possible.

- Sustain regular DeFi interactions, exploring new protocols as they launch.

- Engage deeply with community channels, earning roles and badges that reflect genuine involvement.

The combination of these strategies will not only improve your Onchain Score but also make you an integral part of the growing Base ecosystem, a win-win whether or not an airdrop materializes exactly as anticipated.