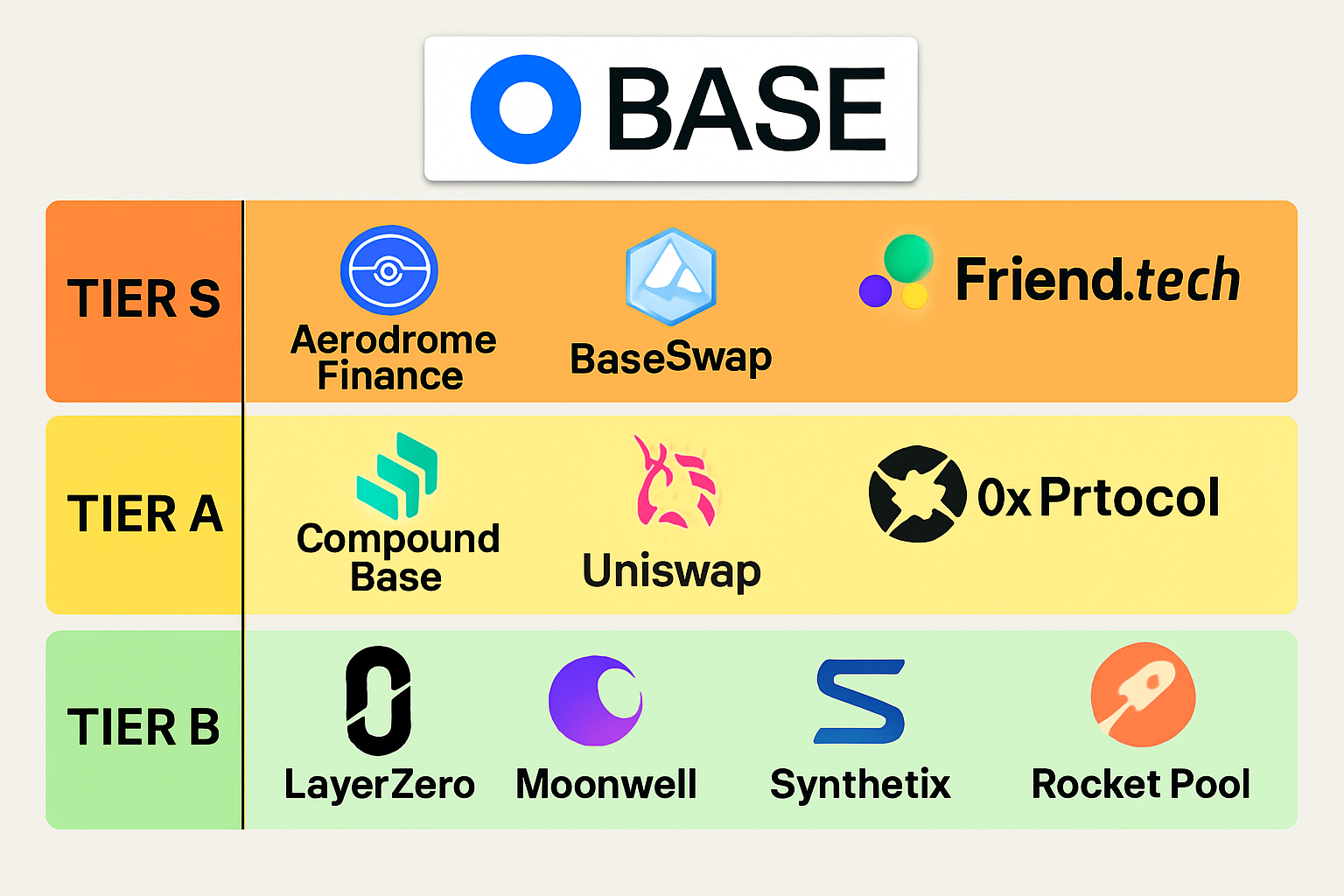

The Base ecosystem is rapidly emerging as a powerhouse within the Layer 2 (L2) landscape, fueled by Coinbase’s backing and an explosion of innovative decentralized applications. For savvy users aiming to maximize potential $BASE token rewards, leveraging the Base Ecosystem Tier List is an essential strategy. This curated list highlights the top protocols and projects most likely to deliver high-value airdrop opportunities, especially for those who engage early and actively.

Why Use a Base Ecosystem Tier List?

With dozens of projects launching on Base, not all offer equal potential for airdrop eligibility or future value. A well-researched tier list, such as those maintained by Boxmining and AirdropBee, categorizes projects by reward probability, required effort, and risk profile. This approach helps users prioritize their time and capital on protocols with strong fundamentals and active communities.

For example, Boxmining’s Airdrop Tierlist sorts opportunities from S-Tier (exceptional) down to C-Tier (speculative). Projects ranked higher typically exhibit robust user engagement, ongoing development, and clear signals of upcoming token launches or reward campaigns.

Top 10 Trending Protocols for Potential $BASE Airdrops

Top 10 Base Ecosystem Projects for Airdrop Eligibility

-

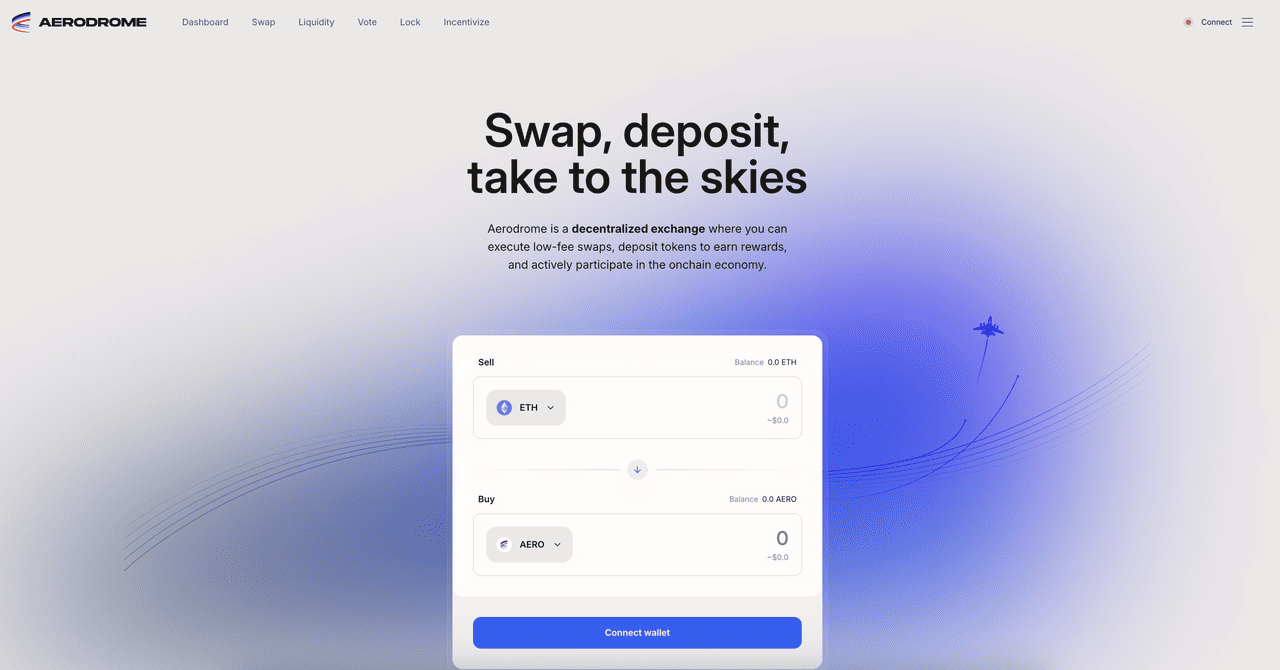

Aerodrome Finance: The leading decentralized exchange (DEX) on Base, Aerodrome offers high liquidity and yield farming opportunities. Active participation may position users for potential future airdrops.

-

BaseSwap: A popular DEX native to the Base network, BaseSwap enables seamless token swaps and liquidity provision, both of which are often considered for airdrop eligibility.

-

Friend.tech: A social DeFi platform built on Base, Friend.tech lets users tokenize social interactions. Its rapid user growth and innovative model make it a top candidate for potential airdrops.

-

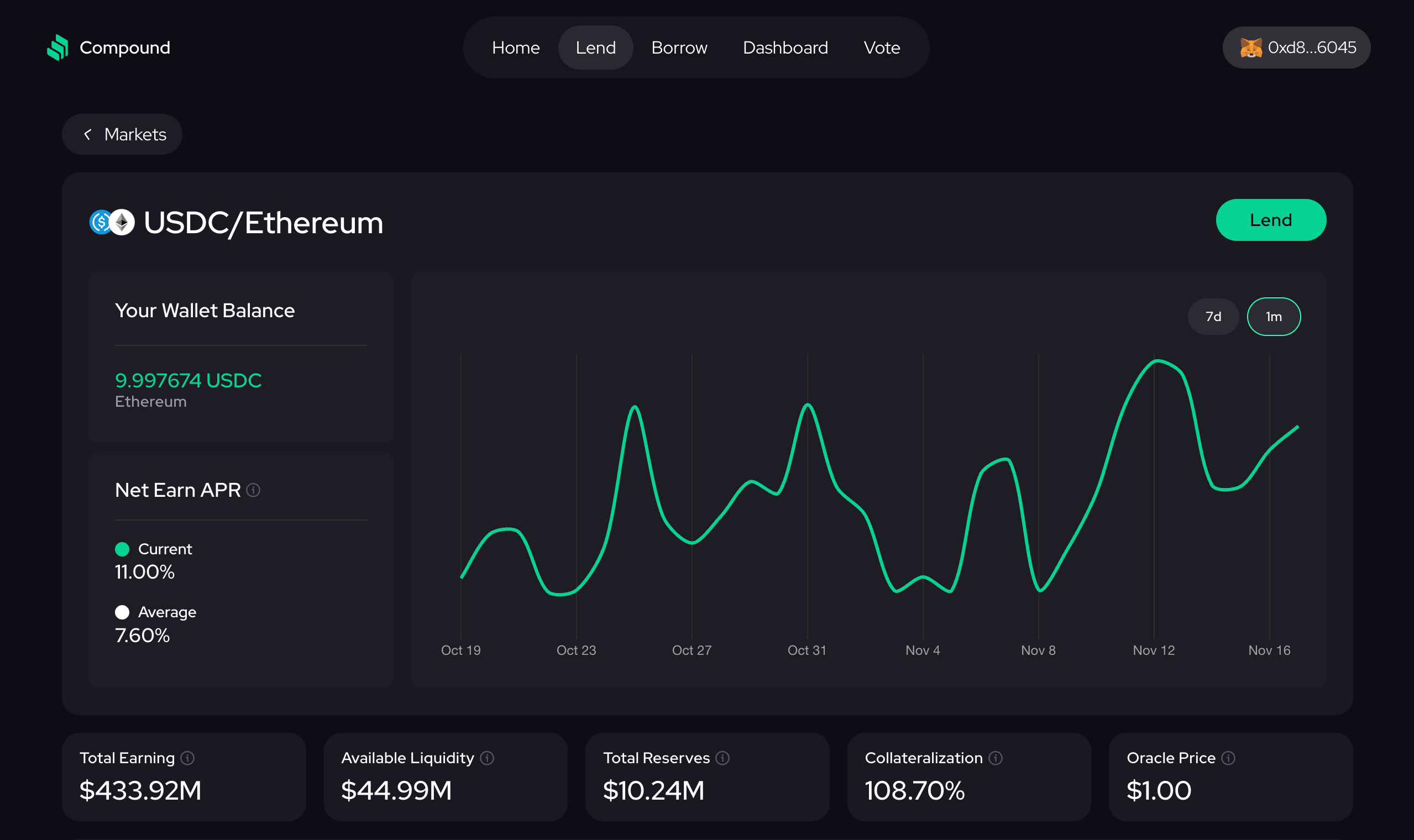

Compound Base: The Compound protocol’s deployment on Base brings decentralized lending and borrowing to the network, with user activity potentially qualifying for future rewards.

-

Uniswap (on Base): As the world’s largest DEX, Uniswap’s Base deployment allows users to trade and provide liquidity, both of which are commonly rewarded in airdrop campaigns.

-

0x Protocol (on Base): 0x Protocol facilitates decentralized exchange infrastructure on Base, supporting a range of DeFi applications and potential airdrop opportunities for active users.

-

LayerZero (Base integration): LayerZero’s cross-chain messaging protocol now integrates with Base, enabling interoperability and positioning active participants for possible airdrop rewards.

-

Moonwell (on Base): A leading lending and borrowing protocol, Moonwell’s Base deployment encourages user engagement through DeFi activities that are often considered for airdrops.

-

Synthetix (Base deployment): Synthetix brings synthetic asset trading to Base, and users interacting with its platform may be eligible for future airdrop allocations.

-

Rocket Pool (Base staking): Rocket Pool offers decentralized ETH staking on Base, with early adopters and stakers frequently targeted for airdrop distributions.

The following protocols are currently considered the most promising within the Base ecosystem for potential $BASE token rewards:

- Aerodrome Finance: As one of Base’s leading decentralized exchanges (DEXs), Aerodrome is central to liquidity provision. Activity here may be tracked for retroactive rewards.

- BaseSwap: Another major DEX on Base, BaseSwap has rapidly gained traction among DeFi users seeking efficient swaps and yield farming opportunities.

- Friend. tech: This social trading app leverages tokenized social profiles, offering unique engagement mechanics that could be rewarded in future airdrops.

- Compound Base: Compound’s deployment on Base brings trusted lending markets to the network, early borrowers or suppliers might be eligible for protocol incentives.

- Uniswap (on Base): The world’s largest DEX now supports the Base network. Interacting with Uniswap pools on Base is a key qualifying activity for many airdrop hunters.

- 0x Protocol (on Base): Known for its API-driven trading infrastructure, 0x’s integration with Base offers seamless swaps, and possibly future governance rewards.

- LayerZero (Base integration): As an interoperability protocol connecting multiple chains, LayerZero’s recent integration with Base could open doors to cross-chain incentive programs.

- Moonwell (on Base): Moonwell provides lending/borrowing services tailored to the Base network; active participation here may be tracked by snapshot tools ahead of any distribution events.

- Synthetix (Base deployment): Synthetix brings synthetic asset trading to new L2s like Base, users who mint or trade synths early are often first in line when reward schemes launch.

- Rocket Pool (Base staking): Decentralized ETH staking via Rocket Pool now includes support for the Base chain. Early stakers can frequently benefit from both protocol-level and partner project airdrops.

Tactics: How to Maximize Your Eligibility Using the Tier List

Navigating the tier list isn’t just about picking names, it requires strategic engagement. Here are actionable steps you should take:

- Dive Deep into High-Tier Projects: Focus first on S-Tier and A-Tier protocols like Aerodrome Finance and Uniswap on Base. These have demonstrated real traction and are flagged by analysts as having imminent reward potential (source).

- Lend or Provide Liquidity: Protocols such as Compound Base, Moonwell, and Rocket Pool often reward users who supply assets or stake ETH early in their lifecycle. Track your activity via project dashboards or portfolio trackers.

- Diversify Across Categories: Don’t limit yourself to DEXs alone, engage with lending markets (Moonwell), synthetic asset platforms (Synthetix), social dApps (Friend. tech), and cross-chain solutions (LayerZero). This broadens your exposure across multiple upcoming distributions.

The Importance of Community Engagement and Staying Updated

A recurring theme among successful airdrop farmers is active participation in project communities. Joining Discord servers or Telegram groups for these ten protocols keeps you informed about testnet launches, snapshot dates, or exclusive campaign announcements. Additionally, monitoring aggregator sites like Collective Shift, which track evolving eligibility criteria across L2 networks including Base, can help you spot new opportunities before they trend widely.

Beyond simple interaction, the quality and consistency of your activity can be a differentiator. For example, protocols like Uniswap (on Base) and Aerodrome Finance may reward users who provide deep liquidity or participate in governance. Meanwhile, LayerZero’s Base integration often incentivizes those who bridge assets or test cross-chain features. The more you immerse yourself in each project’s ecosystem, whether by trading, staking, lending, or contributing to community discussions, the greater your odds of being included in future airdrop snapshots.