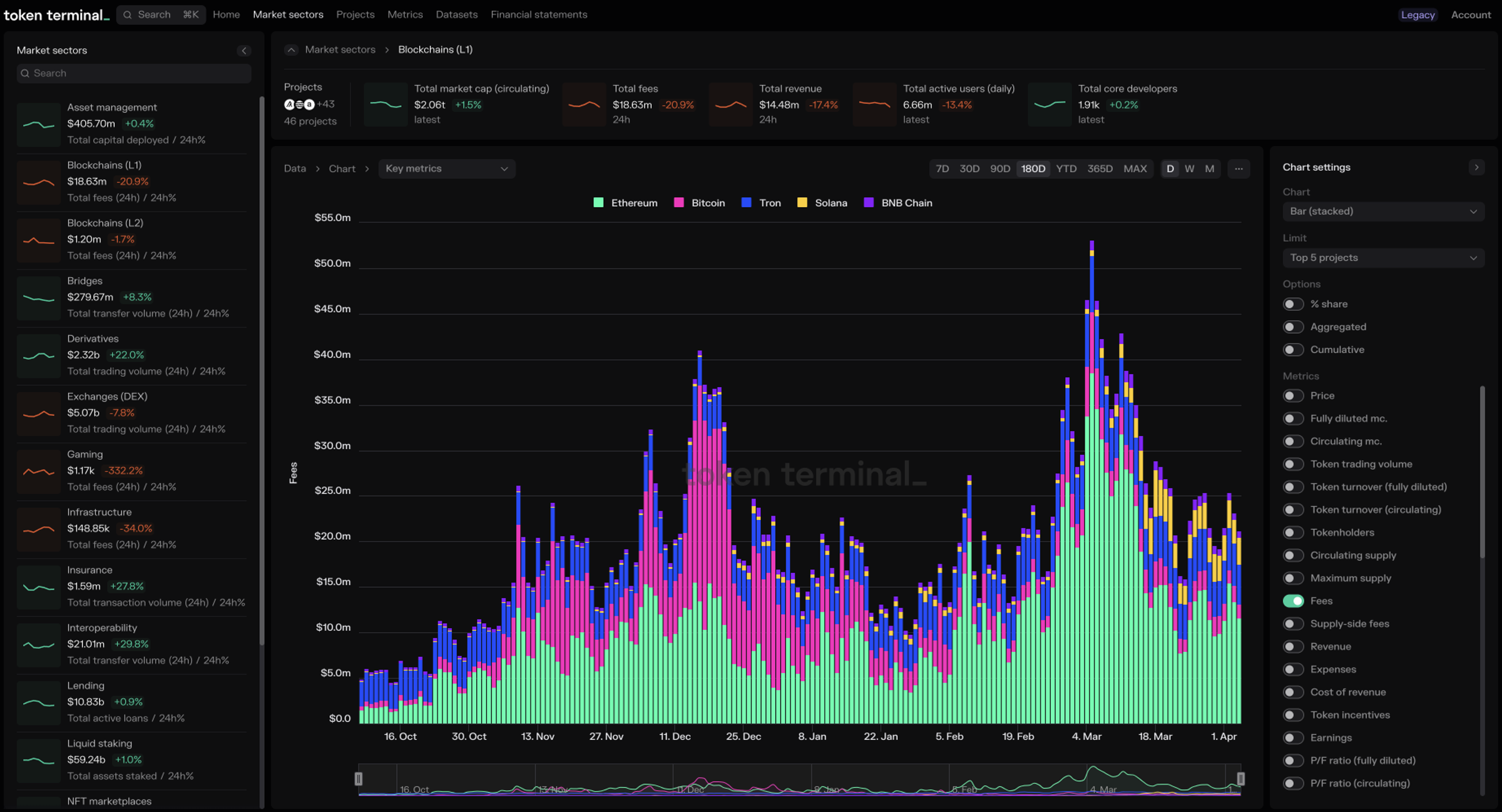

With Base Protocol (BASE) trading at $0.4615 as of September 22,2025, the anticipation around a potential $BASE airdrop is intensifying across the crypto community. If you’re aiming to maximize your Base airdrop allocation, it’s critical to understand that eligibility will likely hinge on both the depth and diversity of your onchain activity. Forget one-off transactions or passive holding, this cycle rewards those who actively shape and support the Base ecosystem.

1. Increase Onchain Activity and Volume on Base Network

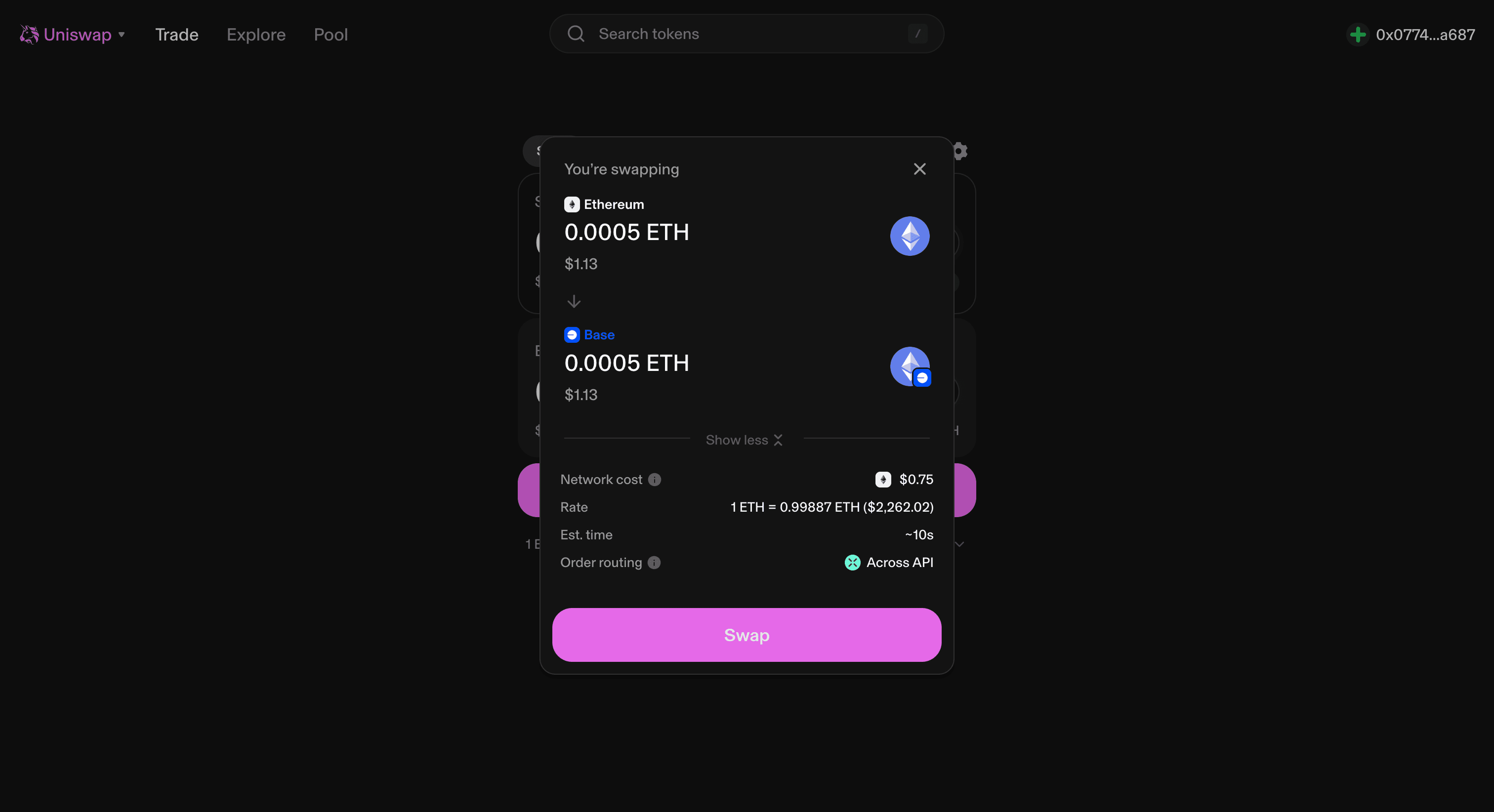

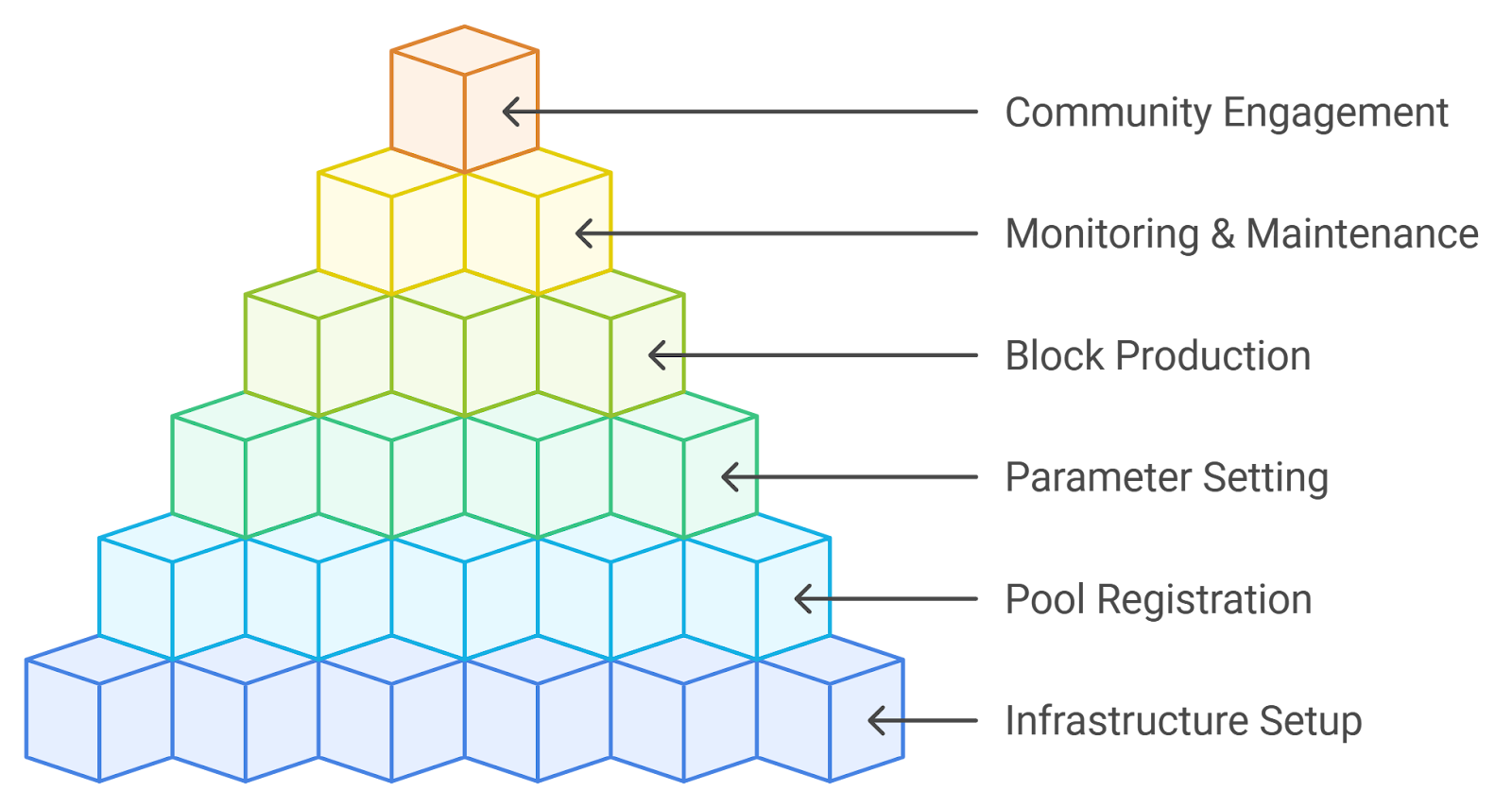

Your onchain score is a direct signal to the Base team that you’re not just present, you’re participating. Routinely swap tokens, provide liquidity, mint NFTs, or stake assets using decentralized applications built on Base. The more diverse and frequent your interactions, the better your perceived value as an ecosystem contributor. Spreading these activities over weeks or months (rather than blasting them all in one day) can help establish a credible history of engagement.

If you want to track your progress, some platforms allow you to monitor your Base onchain score. For further reading on optimizing wallet activity for airdrops, check out the guidance from CryptoManiaks.

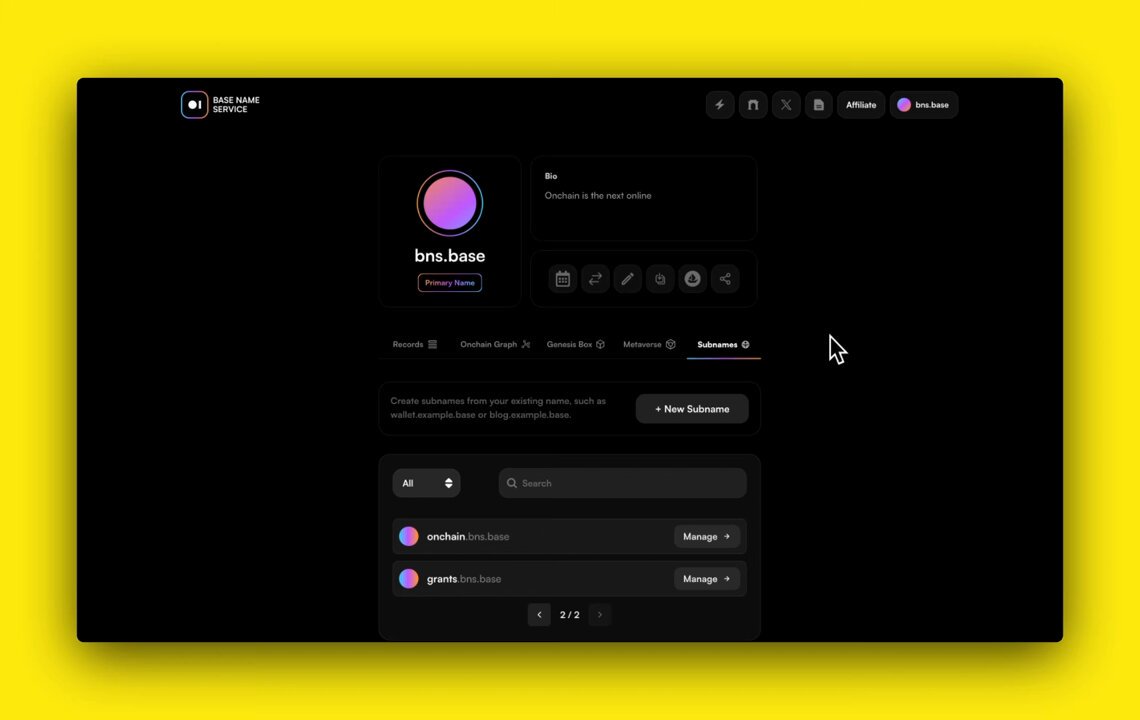

2. Claim and Register a Unique. base Name via Base Name Service

Identity matters in Web3, especially when it comes to airdrop eligibility. By registering a unique. base name (such as yourname. base. eth) through the official Base Name Service, you’re tying all your transactions and protocol usage to a verifiable persona. This isn’t just vanity: it’s proof that you’re invested in the long-term health of the network.

Top 5 Strategies to Maximize Your $BASE Airdrop Allocation

-

Increase Onchain Activity and Volume on Base Network: Consistently perform transactions such as swaps, transfers, and contract interactions on the Base network. Higher and sustained onchain activity signals genuine engagement and may boost your airdrop eligibility.

-

Claim and Register a Unique .base Name via Base Name Service: Secure a personalized identity by registering a .base name (e.g., yourname.base) through the official Base Name Service. This demonstrates active participation and links your onchain actions to a unique profile.

-

Participate in Base Guilds and Complete Community Quests for Role Badges: Join the official Base Guild and complete quests or tasks to earn role badges. Active community participation is often rewarded and can enhance your eligibility profile.

-

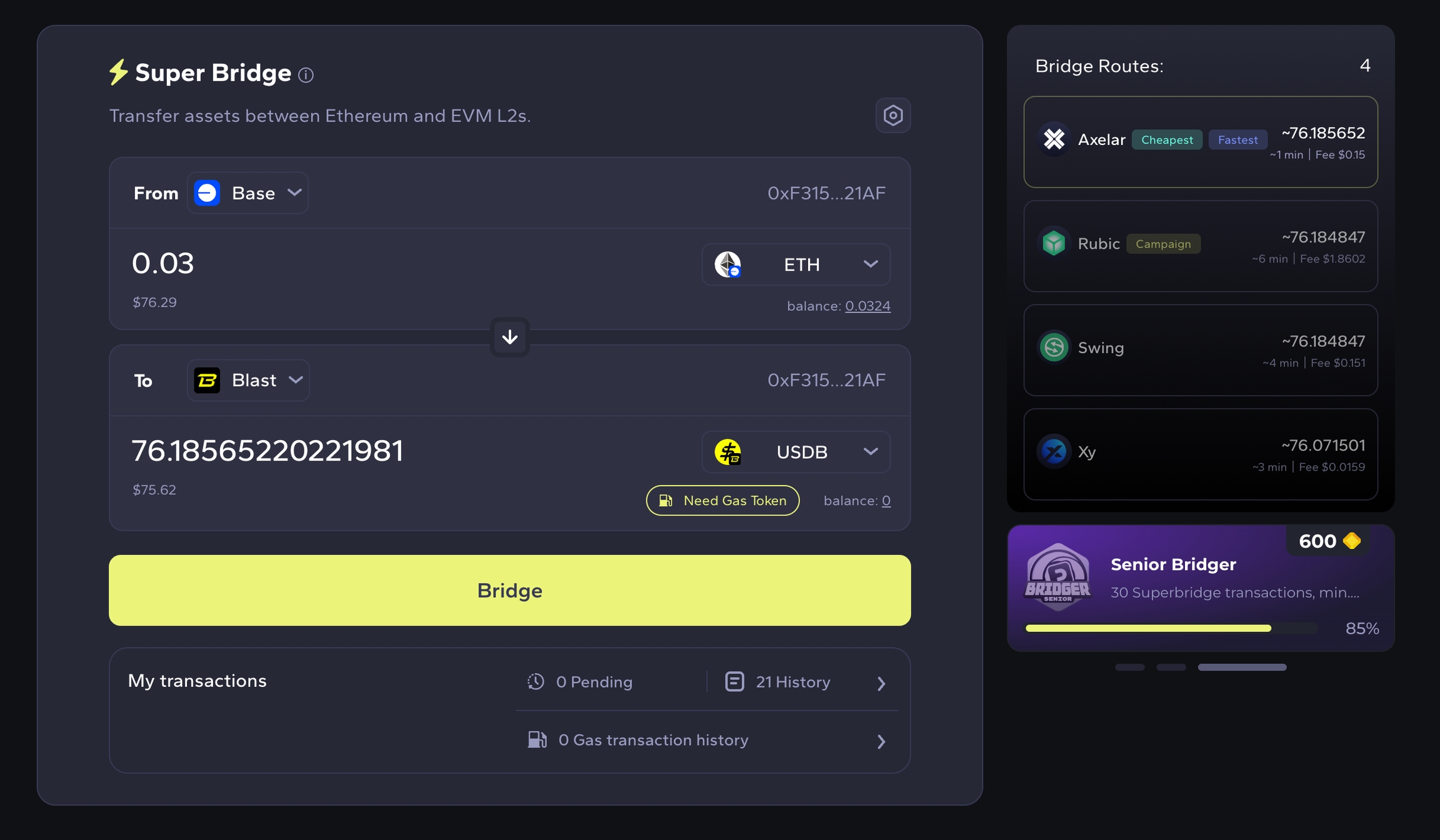

Bridge Assets to Base from Other Networks Using Official or Popular Bridges: Move assets to Base via trusted bridges like Base Bridge or Orbiter Finance. Cross-chain bridging demonstrates commitment to the Base ecosystem and increases your onchain activity.

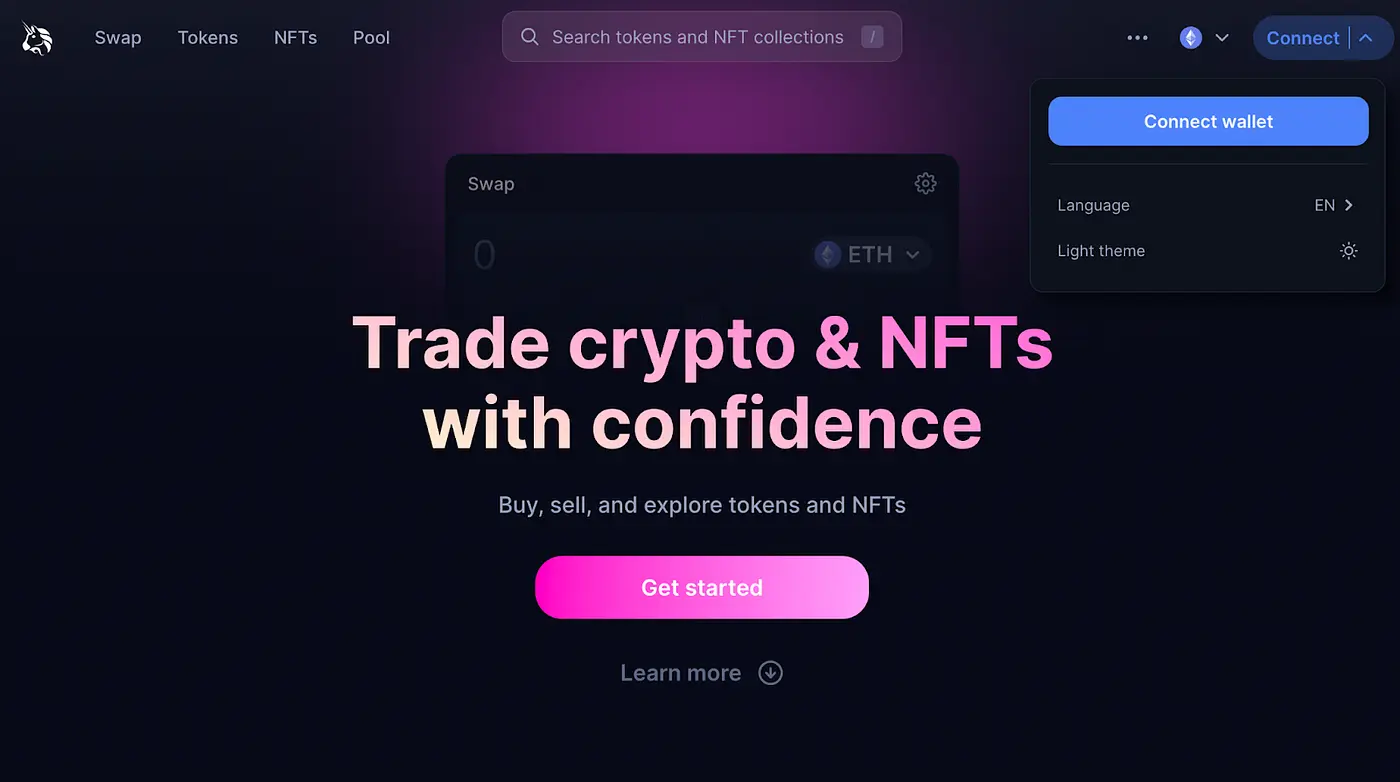

3. Interact with Leading dApps and DeFi Protocols on Base

The next step is deepening your protocol footprint. Engage with flagship DeFi protocols, swap tokens using decentralized exchanges, lend or borrow assets, provide liquidity in pools, or participate in governance votes if available. These actions leave permanent traces in your wallet history that are easily auditable by any future snapshot tool used for $BASE distribution.

If you want more $BASE tokens in any future drop, think like an active builder, not just an opportunist.

4. Participate in Base Guilds and Complete Community Quests for Role Badges

Airdrops aren’t just about raw transaction volume anymore, they increasingly reward social trust signals and reputation-building within project communities. Join official Base Guilds, earn role badges (like ‘Based’ or ‘Onchain’), complete quests, attend events, and collect digital credentials tied to your wallet address. This multi-layered engagement can be decisive if allocation formulas factor in social proof alongside technical activity.

The takeaway? If you want to increase $BASE airdrop eligibility odds, and maximize potential rewards, focus on authentic participation across identity registration, protocol usage, community roles, and sustained cross-network activity.

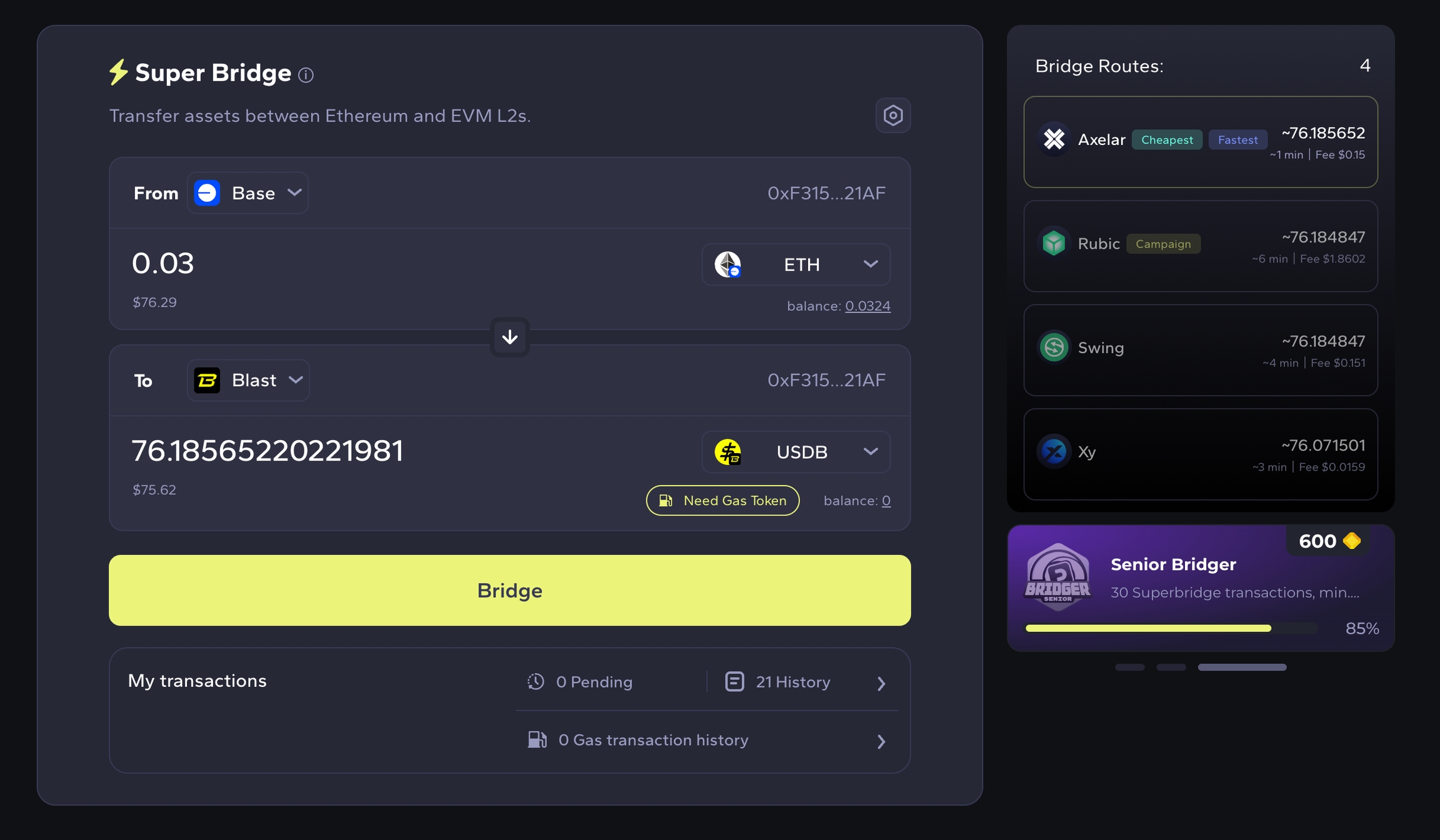

5. Bridge Assets to Base from Other Networks Using Official or Popular Bridges

One of the most overlooked yet powerful strategies is bridging assets from other blockchains onto Base. This action demonstrates your willingness to commit capital and signals cross-chain conviction, two factors that often weigh heavily in airdrop distribution models. Use official or widely-recognized bridges to transfer ETH, stablecoins, or other supported tokens onto the Base network. Not only does this diversify your onchain footprint, but it also shows you’re invested enough to pay gas and take risks outside of your comfort zone.

Remember: bridging isn’t just a one-time event. Periodically moving assets onto Base, especially during ecosystem campaigns or liquidity mining events, can leave a strong trail of activity for snapshot tools to pick up on when eligibility is assessed.

Optimize Your $BASE Airdrop Allocation With These Key Moves

Top 5 Strategies to Maximize Your $BASE Airdrop Allocation

-

Increase Onchain Activity and Volume on Base Network: Consistently perform transactions such as swaps, transfers, and liquidity provision on the Base network. Higher and regular onchain activity signals genuine usage, which is often rewarded in airdrop allocations.

-

Claim and Register a Unique .base Name via Base Name Service: Secure your identity by registering a .base name through the Base Name Service. This not only personalizes your wallet but also demonstrates active participation in the Base ecosystem.

-

Interact with Leading dApps and DeFi Protocols on Base (e.g., swapping, lending, providing liquidity): Use top decentralized applications like Uniswap or Aave on Base for activities such as token swaps, lending, and liquidity provision. Engaging with these protocols boosts your onchain footprint and eligibility.

-

Participate in Base Guilds and Complete Community Quests for Role Badges: Join the Base Guild and complete quests to earn badges and roles (like ‘Based’ or ‘Onchain’). These verifiable achievements highlight your ongoing community engagement.

-

Bridge Assets to Base from Other Networks Using Official or Popular Bridges: Transfer assets from Ethereum or other chains to Base using trusted bridges such as Base Bridge or Orbiter Finance. Bridging activity is a key eligibility metric for many airdrops.

Every move you make on Base should be intentional and verifiable. Here’s where many miss out: they focus solely on transaction count, ignoring the importance of identity (via . base name registration), protocol diversity, and visible community participation. Don’t just farm volume, build a rich digital persona that Base can’t ignore when it comes time to reward its most valuable users.

For those who want to push even further, consider documenting your journey across social channels or participating in public quests that issue onchain credentials. This not only boosts your visibility but also creates extra layers of proof should any disputes arise over eligibility.

Stay Agile as Airdrop Criteria Evolve

The criteria for Base airdrop eligibility are fluid and could change at any time as the team refines their approach. Staying agile means regularly checking official announcements and adapting your strategy as new tasks or campaigns are announced. For up-to-date guides and eligibility breakdowns, visit CryptoManiaks’ Base Token Airdrop Guide.

$BASE Price Snapshot: Real-Time Context Matters

As of September 22,2025, Base Protocol (BASE) is trading at $0.4615. This price point not only reflects current market sentiment but also underscores why maximizing your allocation now could yield significant upside if demand surges post-airdrop.

The window for optimizing your Base airdrop allocation won’t stay open forever. By focusing on these five actionable strategies, increasing onchain activity, registering a unique. base name, engaging leading dApps, participating in community guilds, and bridging assets, you’re positioning yourself at the front of the line for any future $BASE token distribution.