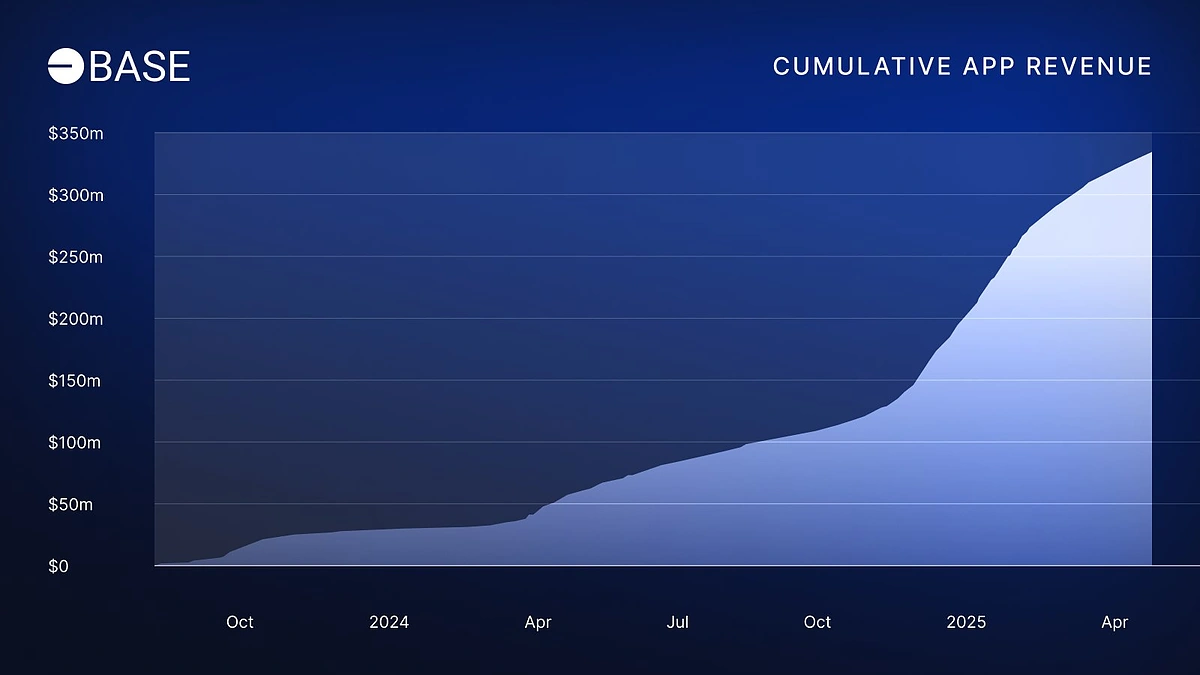

With the $BASE token price currently at $0.4542 and growing speculation around an official Base airdrop, the competition for eligibility is fierce. Early users have already set the playbook: consistent, authentic engagement with Base’s ecosystem is the foundation for maximizing your airdrop potential. If you’re serious about increasing your Base airdrop chances, it’s time to move beyond one-off transactions and adopt a disciplined, multi-faceted strategy.

1. Consistently Use Base-Native DEXes Like Aerodrome for Swapping and Bridging

Your onchain footprint starts with regular activity on Aerodrome, Base’s flagship decentralized exchange (DEX). Early research shows that users who make frequent swaps and bridge assets using native protocols are more likely to be recognized as genuine participants. Don’t just swap once, instead, aim for routine transactions over weeks and months. This approach demonstrates sustained interest rather than opportunistic farming.

For best results:

- Bridge ETH or USDC into Base via official bridges.

- Swap between various tokens (not just ETH/USDC).

- Participate in liquidity pools or yield farms when available.

This pattern of activity is echoed by early users who have seen success with other major L2 airdrops. Consistency is key; avoid clustering all actions in a single day.

2. Provide Liquidity to Base Ecosystem Protocols (DEXes, Lending Platforms)

Liquidity provision is one of the most powerful signals of commitment on any DeFi network, and Base is no exception. By providing liquidity to Aerodrome or other emerging DEXes and lending platforms within the Base ecosystem, you not only earn potential fees but also establish yourself as an integral part of network health.

Focus on:

- Supplying ETH, USDC, or cbAssets to liquidity pools.

- Lending or borrowing assets through reputable protocols built on Base.

- Avoiding short-term deposits; maintain positions over multiple weeks if possible.

The logic is simple: projects want to reward those who help bootstrap their ecosystem’s stability. A well-documented history of liquidity provision could be one of the strongest factors in future $BASE token airdrop eligibility.

Base ($BASE) Token Price Prediction 2026-2031

Professional forecast based on 2025 adoption trends, technical analysis, and speculative airdrop scenarios.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.38 | $0.62 | $1.05 | +36% | Potential airdrop volatility; initial DEX listings drive price discovery |

| 2027 | $0.49 | $0.85 | $1.50 | +37% | Increased ecosystem adoption; DeFi and NFT growth on Base |

| 2028 | $0.63 | $1.12 | $2.05 | +32% | Major integrations; L2 scaling competition intensifies |

| 2029 | $0.85 | $1.45 | $2.80 | +29% | Possible bull cycle; Base matures as a top L2; regulatory clarity improves |

| 2030 | $1.10 | $1.75 | $3.40 | +21% | Mainstream DeFi adoption, new use cases, and institutional interest |

| 2031 | $1.25 | $2.05 | $4.10 | +17% | Base establishes itself as leading L2; increased enterprise adoption |

Price Prediction Summary

Base ($BASE) is positioned for significant growth if a native token is launched and the ecosystem continues its current expansion trajectory. The price outlook reflects both bullish scenarios (rapid adoption, airdrop speculation, Layer-2 leadership) and bearish scenarios (regulatory delays, high competition, adoption hurdles). Year-over-year average price estimates show a steady, progressive increase, with volatility expected around major announcements and broader crypto market cycles. Investors should monitor official news closely, as the absence of a token launch or negative regulatory events could materially impact these forecasts.

Key Factors Affecting Base Price

- Timing and structure of official $BASE token launch or airdrop

- Level of user and developer adoption on Base network

- Success of DeFi, NFT, and other dApp ecosystems on Base

- Competition from other Ethereum Layer-2 solutions (e.g., Arbitrum, Optimism, zkSync)

- Overall crypto market cycles (bull/bear trends)

- Regulatory clarity for Layer-2 and airdrop tokens

- Coinbase’s ongoing support and integration of Base

- Security, scalability, and technological advancements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

3. Interact with a Wide Range of Tokens and Contracts (10-15 and Unique Assets)

Diversification matters, not just in your portfolio but in your onchain activity as well. According to recent guidance from early recipients and research aggregators, interacting with at least 10-15 distinct tokens across different contracts significantly boosts your visibility in the network snapshot process that often precedes an airdrop event.

Top 5 Proven Strategies to Maximize $BASE Airdrop Eligibility

-

Consistently Use Base-Native DEXes Like Aerodrome for Swapping and BridgingEarly users regularly interact with Aerodrome, Base’s leading decentralized exchange, to swap tokens and bridge assets. This ongoing usage builds a robust onchain history and signals genuine participation.

-

Provide Liquidity to Base Ecosystem Protocols (DEXes, Lending Platforms)Supplying assets like ETH or USDC to Base-native protocols (e.g., Aerodrome, Seamless Protocol) demonstrates deeper ecosystem involvement and may weigh heavily in airdrop eligibility.

-

Interact with a Wide Range of Tokens and Contracts (10-15+ Unique Assets)Regularly swap or hold at least 10-15 different tokens (such as cbETH, USDbC, wstETH, DAI) and interact with various smart contracts to diversify your activity footprint.

-

Participate in Base Community Initiatives and Guild RolesEarn roles in the Base Guild (like Based, Onchain, USDC Saver) and join campaigns such as Onchain Summer to showcase active community engagement.

-

Maintain Regular Onchain Activity and Optimize Your Onchain ScoreSpread your transactions over time, complete Base Learn modules, and keep your wallet active to build a consistent, high-quality onchain profile that stands out for future airdrop snapshots.

This means going beyond basic swaps:

- Trade lesser-known tokens alongside majors like ETH or USDC.

- Migrate assets between protocols (e. g. , from DEXes to NFT platforms).

- Mint NFTs or participate in protocol launches for extra contract diversity.

The goal here isn’t volume, it’s breadth. Each unique interaction builds your case as an engaged community member rather than a passive speculator chasing quick gains.

The Role of Community Initiatives and Onchain Reputation

Beyond transactional activity, your involvement in Base’s community and reputation systems can be a decisive factor for $BASE token airdrop eligibility. Early user data suggests that protocols are increasingly weighing qualitative engagement when evaluating airdrop recipients. This is where Base Guild roles, event participation, and educational achievements come into play.

4. Participate in Base Community Initiatives and Guild Roles

Being active in the Base community isn’t just about social presence, it’s about verifiable onchain actions. Joining the official Base Guild unlocks roles such as “Based, ” “Onchain, ” or “USDC Saver, ” each tied to specific behaviors like holding a Basename, making recent transactions, or maintaining USDC balances on Base. These roles are more than badges: they’re cryptographically linked to your wallet and can serve as proof of ongoing commitment.

- Claim your Basename (similar to ENS) for unique network identity.

- Join campaigns like Onchain Summer or Galxe quests for additional role-based rewards.

- Attend verified Base events, digital and physical, to collect exclusive digital credentials.

This multi-layered participation signals that you’re invested in the network’s long-term success, not just hunting for quick rewards. For more granular strategies on maximizing these initiatives, see our detailed guide at How to Maximize Your Base Airdrop Allocation: Essential Onchain Tasks and Strategies.

5. Maintain Regular Onchain Activity and Optimize Your Onchain Score

Your onchain score is an evolving metric reflecting both the frequency and diversity of your activity on the Base network. Protocols may use proprietary algorithms to evaluate wallets based on transaction regularity, contract interactions, liquidity provision duration, and even social credentials from guilds or quests.

- Pace your activity: Spread out swaps, liquidity moves, and contract interactions over several weeks or months.

- Avoid inactivity gaps: Even small weekly actions can keep your address active in snapshot windows.

- Document everything: Save transaction hashes, proof of guild roles, badge links, these may help with appeals if criteria are ever disputed post-airdrop.

This systematic approach helps you stand out from one-time actors or bots that often get filtered out during eligibility reviews. Remember: real contributors leave consistent footprints across multiple areas of the ecosystem.

Top 5 Strategies to Maximize $BASE Airdrop Eligibility

-

Consistently Use Base-Native DEXes Like Aerodrome for Swapping and Bridging: Regularly interact with Aerodrome, Base’s leading decentralized exchange, by swapping tokens and bridging assets. This demonstrates active and ongoing participation in the Base ecosystem.

-

Provide Liquidity to Base Ecosystem Protocols (DEXes, Lending Platforms): Supply assets such as ETH or USDC to Base-native protocols like Aerodrome or lending platforms. Providing liquidity is a strong signal of ecosystem support and may boost airdrop eligibility.

-

Interact with a Wide Range of Tokens and Contracts (10-15+ Unique Assets): Swap and hold at least 10-15 different tokens on Base. Engaging with a diverse set of assets and smart contracts creates a robust on-chain footprint.

-

Participate in Base Community Initiatives and Guild Roles: Join official Base Guilds, claim roles (like Based or Onchain), and take part in campaigns such as Onchain Summer. These actions highlight your commitment and involvement in the Base community.

-

Maintain Regular Onchain Activity and Optimize Your Onchain Score: Spread your transactions and interactions over time to build a consistent activity history. Regular engagement is often favored in airdrop criteria and helps optimize your onchain reputation.

Final Thoughts: Discipline Over Hype

The current $BASE token price of $0.4542, with a 24-hour change of and $0.0352 ( and 0.0841%), reflects growing demand but also underscores the uncertainty around official distribution plans as of September 27,2025. While no guarantees exist until an announcement is made by Base or Coinbase channels, history shows that disciplined engagement across DEXes like Aerodrome, liquidity pools, diverse contracts, community guilds, and regular onchain activity offers the highest probability for future rewards.

If you’re ready to move from speculation to systematic action, start implementing these five strategies today, and remember to verify all opportunities through official sources only. For deeper insights into optimizing your onchain footprint ahead of a potential snapshot event, review our comprehensive resource at How to Maximize Your Base Airdrop Allocation: Essential Onchain Tasks and Strategies.