With the Base Protocol ($BASE) trading at $0.30062 as of October 17,2025, and the airdrop anticipation reaching a fever pitch, $BASE token hunters are looking for every edge. The difference between a negligible allocation and a meaningful airdrop reward often comes down to a handful of proven, actionable strategies. If you want to maximize your Base airdrop eligibility and rewards, you need more than just luck, you need a focused, methodical approach tailored to the Base ecosystem’s evolving criteria.

Bridge Assets to Base and Maintain Active On-Chain Usage

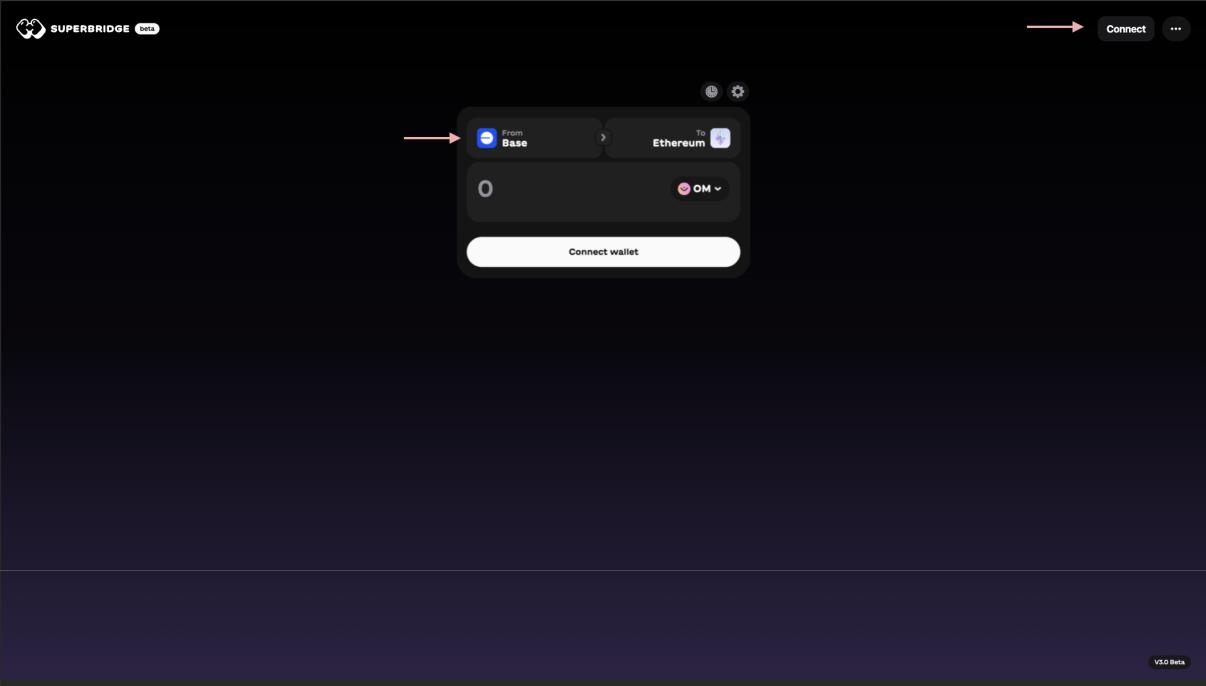

Your journey starts with bridging assets to the Base network. The airdrop’s eligibility algorithms often prioritize wallets that have bridged ETH, USDC, or other tokens from Ethereum mainnet or other chains onto Base. But don’t stop at a one-off transfer, maintain consistent, authentic on-chain activity. This means spreading out your transactions over several weeks or months instead of concentrating all your actions into a single day. Opportunistic spikes can look suspicious and might lower your eligibility score.

Regular interaction with Base-native dApps is key. Swap tokens, provide liquidity, and bridge assets back and forth to build a healthy on-chain footprint. This not only demonstrates genuine usage but also signals long-term interest in the ecosystem, a factor that is increasingly weighted in airdrop calculations. For an in-depth breakdown of on-chain tasks and eligibility signals, see our dedicated guide: Essential Onchain Tasks and Strategies.

Engage with Core Base Ecosystem Protocols (DEXs, Lending, NFTs)

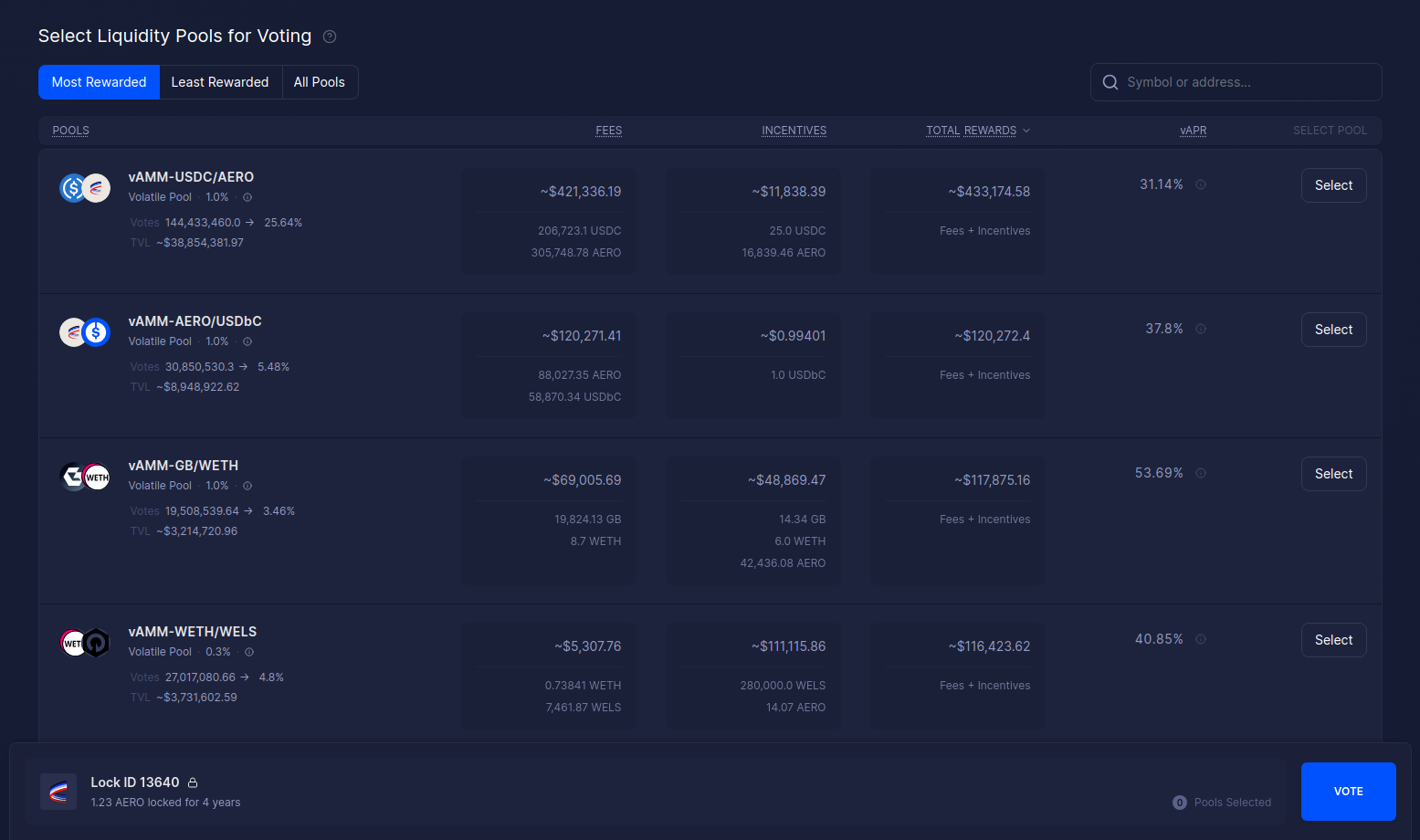

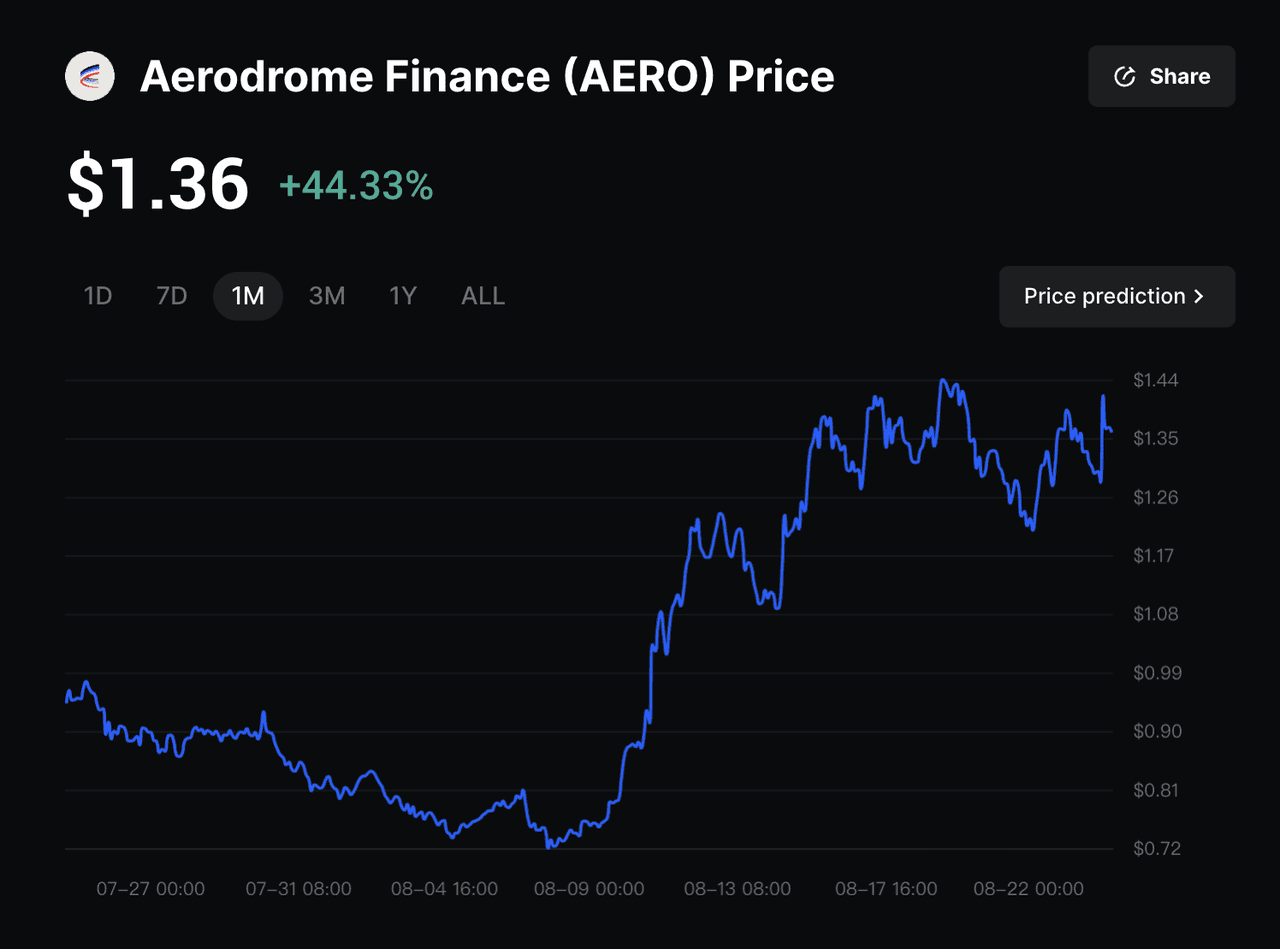

Interacting with major protocols within the Base ecosystem is a non-negotiable step for maximizing your airdrop rewards. Focus on decentralized exchanges (DEXs) like Aerodrome for token swaps, lending platforms such as Seamless Protocol for borrowing and lending, and NFT marketplaces for minting or trading digital assets. The broader your engagement, across DeFi, lending, and NFTs, the more robust your eligibility profile becomes.

Diversification is your friend here. Make sure you interact with multiple tokens and contracts, not just the big names like ETH and USDC. Try trading lesser-known tokens, minting a few NFTs, or providing liquidity in various pools. This broadens your on-chain activity footprint and signals that you’re an active participant rather than a passive speculator.

Participate in Governance and Community Initiatives

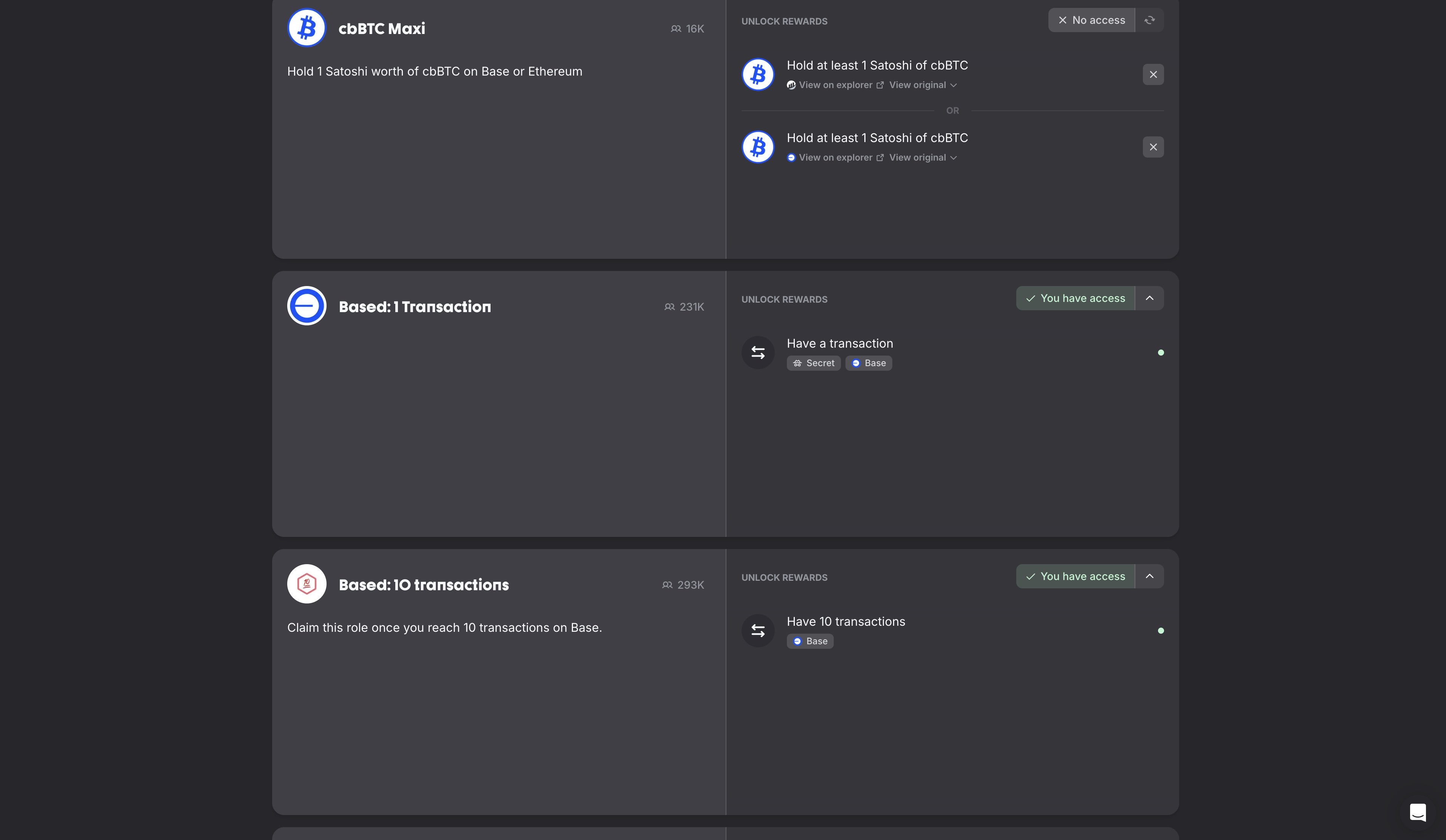

The Base ecosystem isn’t just about transactions, it’s about community. Participating in governance and community initiatives can give you an edge over passive users. Join the Base Guild, complete quests to earn roles like ‘Based’ or ‘Onchain, ‘ and get involved in campaigns such as Onchain Summer or Galxe quests. These activities often come with digital badges or pins that serve as on-chain proof of engagement.

If governance proposals are available, vote or delegate your votes using your wallet. Even simply reading proposals and signing messages can leave a valuable trace that may be picked up by airdrop eligibility algorithms. For a step-by-step guide on maximizing your community and governance participation, check out this resource.

Base (BASE) Token Price Prediction 2026-2031

Projected minimum, average, and maximum prices for $BASE based on current market data, adoption trends, and industry analysis.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.22 | $0.38 | $0.62 | +26% | Volatility expected post-airdrop; price may dip as early recipients sell, but increased ecosystem adoption could drive recovery. |

| 2027 | $0.28 | $0.45 | $0.80 | +18% | Gradual growth as DeFi on Base matures; broader Layer 2 adoption and new use cases support price appreciation. |

| 2028 | $0.34 | $0.54 | $1.05 | +20% | Possible bull market phase; regulatory clarity and Coinbase integrations could attract institutional interest. |

| 2029 | $0.41 | $0.65 | $1.32 | +20% | Sustained ecosystem expansion and improved scalability; competition from other L2s may limit upside. |

| 2030 | $0.49 | $0.76 | $1.60 | +17% | Market matures; BASE becomes a core DeFi protocol on Ethereum L2, with steady user growth and mainstream interest. |

| 2031 | $0.55 | $0.89 | $1.95 | +17% | If network continues to grow and avoids major regulatory setbacks, BASE could approach $2 in a bullish scenario. |

Price Prediction Summary

The BASE token’s price outlook from 2026 to 2031 is moderately bullish, with average prices projected to rise steadily as the Base ecosystem expands. Initial post-airdrop volatility may pressure prices in early 2026, but long-term adoption, integration with Coinbase, and the growth of DeFi on Layer 2 networks are likely to support a progressive increase in value. Both minimum and maximum price ranges reflect the volatility typical of emerging tokens, but BASE’s strong backing and utility suggest potential for sustained growth.

Key Factors Affecting Base Price

- Airdrop dynamics and initial token distribution: Early sell-offs may cause short-term price dips.

- Adoption rates of Base-native DeFi protocols and DApps.

- Integration with Coinbase products and services, driving user onboarding.

- Overall Layer 2 (L2) Ethereum adoption and competition (e.g., Optimism, Arbitrum, zkSync).

- Regulatory developments impacting token utility and exchange listings.

- Technological advancements in scalability, security, and user experience.

- General crypto market cycles, including potential bull and bear markets.

- Community engagement, governance participation, and ecosystem incentives.

- Risk of dilution from future token unlocks or additional airdrops.

- Broader macroeconomic factors and investor sentiment toward digital assets.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Optimize Wallet Diversity and Consistent Transaction Patterns

One of the most overlooked aspects of airdrop eligibility is wallet diversity and transaction consistency. Using a single wallet for all your activities is fine, but some users choose to diversify across multiple wallets (while avoiding Sybil patterns) to increase their chances. Regardless of your approach, ensure your transaction history looks organic: spread out your activity, avoid sudden volume spikes, and keep your interactions steady over time.

Top 5 Strategies to Maximize Your Base Airdrop Eligibility

-

Bridge Assets to Base and Maintain Active On-Chain UsageUse official bridges such as Base Bridge to transfer assets like ETH or USDC from Ethereum or other networks onto Base. Regularly transact, swap, and interact with Base-native contracts to build a robust on-chain history. This sustained activity signals genuine participation and can boost your eligibility for the airdrop.

-

Engage with Core Base Ecosystem Protocols (DEXs, Lending, NFTs)Actively use major Base-native DeFi protocols such as Aerodrome (DEX), Seamless Protocol (lending), and NFT platforms like Mint.fun. Swap tokens, provide liquidity, borrow/lend assets, and mint or trade NFTs to demonstrate deep ecosystem involvement.

-

Participate in Governance and Community InitiativesJoin the Base Guild to earn roles, take part in campaigns like Onchain Summer, and vote or delegate in governance if available. These actions provide on-chain proof of engagement and may be considered in airdrop allocations.

-

Optimize Wallet Diversity and Consistent Transaction PatternsSpread your activities across different tokens and contracts, and maintain a steady transaction history over weeks or months. Avoid sudden spikes in volume or one-off actions, as genuine, consistent activity is often favored in airdrop criteria.

In the next section, we’ll dive deeper into completing official social and promotional tasks, and reveal advanced tips for $BASE token hunters looking for every possible advantage.

Complete Official Social and Promotional Tasks (e. g. , Quests, Zealy, Galxe)

For Base airdrop hunters, it’s not enough to just be active on-chain; you also need to show up socially. The Base team and its partners frequently roll out official campaigns on platforms like Zealy and Galxe, offering quests, campaigns, and promotional tasks. Completing these isn’t just about earning digital badges or NFTs, it’s about building a public, provable track record of engagement that can be verified by airdrop algorithms.

Examples of these tasks include joining Discord servers, following official Twitter accounts, participating in AMAs, or completing educational modules. While some may seem simple, they all add up to a holistic profile that demonstrates your commitment to the Base ecosystem. When you earn campaign-specific NFTs or pins, those assets live on-chain and can be used as eligibility signals for $BASE token distribution. Don’t underestimate the power of these social proofs: they’re increasingly being used to separate real users from opportunists and bots.

Advanced Tips for $BASE Token Hunters

Once you’ve covered the fundamentals, it’s time to refine your approach. Here are some advanced tips for those determined to maximize their Base airdrop rewards:

- Track Campaigns and Deadlines: Stay on top of new Base ecosystem campaigns by subscribing to official channels and following reputable airdrop calendars. Missing a task window could mean missing out on eligibility points.

- Document Everything: Keep a detailed log of your on-chain activity, wallet addresses, completed quests, and earned badges. Screenshots and transaction hashes are your friends if you ever need to prove your participation.

- Stay Secure: Only connect your wallet to official campaign sites. Scams and phishing attempts are on the rise during major airdrop events, protect your assets and your eligibility.

- Monitor $BASE Price Movements: With $BASE trading at $0.30062 as of October 17,2025, knowing the current price can help you decide when to interact with DeFi protocols or provide liquidity, especially if you’re looking to maximize rewards without overexposing yourself to volatility.

For a full breakdown of eligibility factors and step-by-step on-chain activity guides, visit our comprehensive resource: Base Airdrop Eligibility Step-by-Step Guide.

Top 5 Strategies to Maximize Your Base Airdrop Eligibility

-

Bridge Assets to Base and Maintain Active On-Chain Usage: Regularly bridge assets such as ETH or USDC from Ethereum mainnet or other chains to Base using official bridges like Base Bridge. Consistent on-chain activity, including swaps and transfers, helps build a robust participation history, which is often rewarded in airdrops.

-

Engage with Core Base Ecosystem Protocols (DEXs, Lending, NFTs): Actively interact with established Base-native protocols such as Aerodrome (DEX), Seamless Protocol (lending), and NFT platforms like Mint.fun on Base. Providing liquidity, trading, lending, and minting NFTs demonstrates deep engagement within the ecosystem.

-

Participate in Governance and Community Initiatives: Join the Base Guild to earn roles (e.g., ‘Based’, ‘Onchain’), and engage in events like Onchain Summer or Galxe quests. Voting on proposals or completing community challenges provides on-chain proof of your involvement, which can boost eligibility.

-

Optimize Wallet Diversity and Consistent Transaction Patterns: Use multiple wallets for different activities, but maintain authentic, non-sybil behavior. Spread your transactions over time and interact with a variety of tokens and contracts to create a natural on-chain footprint. Avoid sudden spikes in volume, as steady activity is favored for eligibility.

-

Complete Official Social and Promotional Tasks (e.g., Quests, Zealy, Galxe): Participate in verified campaigns on platforms like Galxe and Zealy. Completing quests, social tasks, and earning digital badges or pins not only showcases your engagement but may be tracked as eligibility criteria for the airdrop.

Why Consistency and Authenticity Matter

The most successful $BASE token hunters are those who approach the airdrop with patience, consistency, and genuine curiosity. The Base team is actively working to reward real users, people who have contributed value to the ecosystem over time, not just opportunists looking for a quick win. By bridging assets, engaging with core protocols, participating in governance and social campaigns, optimizing wallet usage, and documenting your journey, you’re stacking the odds in your favor.

Remember: every on-chain action is a data point. Spread your activities naturally over time. Avoid copy-paste patterns across multiple wallets. Focus on building a rich user profile that reflects authentic engagement with the Base network. If you stay proactive and informed, you’ll be well-positioned to maximize your share of the next $BASE token distribution.