The Base ecosystem continues to attract considerable attention from DeFi enthusiasts and onchain explorers, especially with the anticipated $BASE token airdrop looming large in 2024. With Base Protocol (BASE) currently trading at $0.3967 as of September 30,2025, and the community abuzz over eligibility criteria, maximizing your chances for a significant airdrop allocation has never been more important. But what are the most effective actions you can take right now to position yourself at the top of the eligibility ladder? Let’s break down the essential strategies and walk through each step in detail.

Strategic Steps to Boost Your Base Airdrop Eligibility

Based on analysis of current trends, official announcements, and onchain data, here are the prioritized strategies every serious participant should execute:

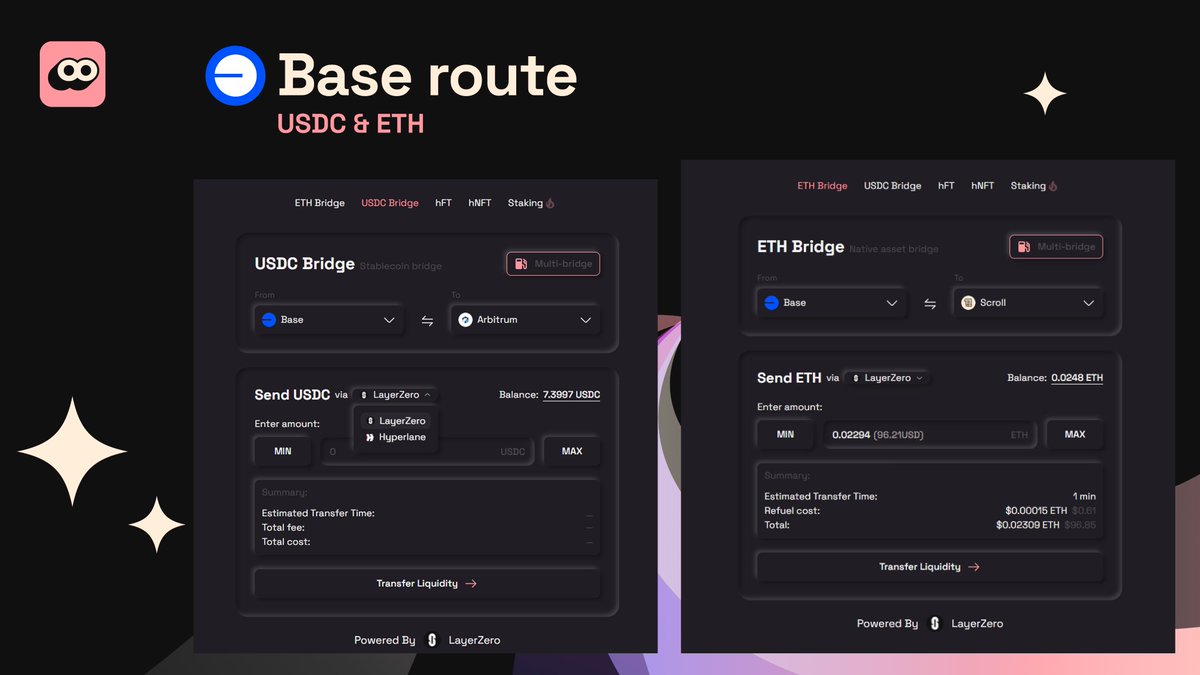

1. Bridge Assets to Base Network Using Official Bridges

Your journey begins by moving assets onto the Base network itself. The simplest way is to use trusted bridges like Base Bridge or Coinbase Wallet. Bridging ETH or stablecoins from Ethereum mainnet not only demonstrates early adoption but also forms the foundation for all other onchain activities. This is often one of the first criteria checked during major protocol airdrops.

- Why it matters: Onchain metrics frequently reward users who have bridged funds early and in significant amounts.

- Tip: Consider making several transactions over time rather than just one large transfer.

2. Interact Regularly with Top Base dApps

Airdrop eligibility is rarely about one-off interactions; protocols want to see genuine usage across their ecosystem. Engage deeply with leading decentralized applications (dApps) such as swapping tokens on Aerodrome, providing liquidity via Uniswap Base, or minting NFTs through platforms like Zora. The more diverse your activity, the stronger your profile will appear to potential snapshot tools scanning for active addresses.

- Diversify your actions: Swap tokens, provide liquidity, stake assets if available, and participate in NFT mints.

- Avoid sybil behavior: Use your wallet naturally over weeks or months rather than executing all actions in a single day.

3. Claim and Register a Base ENS Domain to Establish Onchain Identity

The rise of onchain identity means that claiming a unique. base ENS domain can be much more than vanity, it signals commitment to the ecosystem. Registering an ENS domain through services like Base Name Service (BNS) ties all your activity to a recognizable identity and may even unlock exclusive roles within community guilds or future governance rights.

- Create your brand: Choose a memorable. base name linked directly to your main wallet address.

- Add credibility: Domains are increasingly used as proof-of-participation in snapshot-based distributions.

Base (BASE) Price Prediction 2026-2031

Comprehensive price outlook for BASE following the anticipated airdrop, considering adoption, market cycles, and ecosystem growth.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.30 | $0.52 | $0.78 | +31% | Post-airdrop volatility likely; price discovery phase with active trading and ecosystem expansion |

| 2027 | $0.38 | $0.68 | $1.10 | +31% | Greater dApp adoption and possible L2 ecosystem growth; regulatory clarity boosts confidence |

| 2028 | $0.45 | $0.83 | $1.45 | +22% | Sustained adoption; BASE becomes a key L2, but faces competition from other scaling solutions |

| 2029 | $0.51 | $0.96 | $1.85 | +16% | Network effects kick in, but market faces cyclical corrections; BASE remains relevant |

| 2030 | $0.60 | $1.12 | $2.25 | +17% | Technology improvements (e.g., zk-rollups) enhance value; broader crypto bull cycle possible |

| 2031 | $0.72 | $1.38 | $2.80 | +23% | Mainstream adoption of L2s; BASE potentially positioned as a leading scaling solution |

Price Prediction Summary

The BASE token is expected to experience significant volatility post-airdrop in late 2025 and early 2026, with prices stabilizing as adoption increases. Over the next six years, BASE’s price trajectory is likely to reflect broader crypto market cycles, Layer-2 competition, and the success of its ecosystem. Minimum prices reflect bearish scenarios (market corrections, regulatory hurdles), while maximum prices consider high adoption and bullish market conditions. The average price prediction suggests steady growth, assuming ongoing utility and ecosystem development.

Key Factors Affecting Base Price

- Post-airdrop market volatility and speculative trading

- Adoption of the Base network by users and developers

- Competition from other Layer-2 solutions (e.g., Arbitrum, Optimism, zkSync)

- Regulatory developments affecting Ethereum Layer-2s and airdrop tokens

- Technological improvements (rollups, interoperability, scalability)

- Overall crypto market cycles (bull/bear markets)

- Partnerships, integrations, and real-world use cases for BASE

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

6-Month Cryptocurrency Price Comparison: BASE vs Major Assets

Performance of BASE, ETH, OP, and other major cryptocurrencies from April 2025 to September 2025

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Base Protocol (BASE) | $0.3967 | $1.31 | -69.7% |

| Ethereum (ETH) | $4,139.07 | $3,500.00 | +18.3% |

| Optimism (OP) | $0.6599 | $0.7500 | -12.0% |

| Arbitrum (ARB) | $0.4074 | $0.5000 | -18.5% |

| Bitcoin (BTC) | $112,736.00 | $60,000.00 | +87.9% |

| Solana (SOL) | $205.76 | $150.00 | +37.2% |

| Polygon (MATIC) | $0.2232 | $0.3000 | -25.6% |

| Avalanche (AVAX) | $29.34 | $25.00 | +17.4% |

Analysis Summary

Over the past six months, Base Protocol (BASE) has experienced a significant decline of -69.7%, sharply underperforming compared to major cryptocurrencies like Bitcoin (+87.9%), Solana (+37.2%), and Ethereum (+18.3%). Other Layer 2 and scaling solutions such as Optimism (OP), Arbitrum (ARB), and Polygon (MATIC) have also seen declines, but less severe than BASE.

Key Insights

- BASE has been the worst performer among the compared assets, with a 69.7% decline over six months.

- Bitcoin and Solana led the market with strong gains of +87.9% and +37.2%, respectively.

- Ethereum posted a moderate gain of +18.3%, outperforming most Layer 2 tokens.

- Optimism, Arbitrum, and Polygon all saw declines, but none as steep as BASE.

- Avalanche (AVAX) also posted a solid gain of +17.4%.

All prices and percentage changes are sourced directly from the provided real-time market data as of September 30, 2025, ensuring accuracy and consistency in the comparison.

Data Sources:

- Main Asset: https://www.bitgetapp.com/price/base-protocol/historical-data

- Ethereum: https://www.coingecko.com/en/coins/ethereum/historical_data

- Optimism: https://www.coingecko.com/en/coins/optimism/historical_data

- Arbitrum: https://www.coingecko.com/en/coins/arbitrum/historical_data

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin/historical_data

- Solana: https://www.coingecko.com/en/coins/solana/historical_data

- Polygon: https://www.coingecko.com/en/coins/polygon/historical_data

- Avalanche: https://www.coingecko.com/en/coins/avalanche/historical_data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

The Importance of Onchain Activity Consistency

If there’s one recurring theme across all major airdrops, including Optimism and Arbitrum, it’s that consistent engagement trumps sporadic activity. Building up an impressive “Base Onchain Score” means maintaining regular transactions across multiple protocols over time rather than spiking activity right before an announcement is expected.

- This approach reduces suspicion of sybil farming (where users create many wallets just for rewards).

- You’ll be better positioned if future snapshots weigh long-term participation more heavily than last-minute surges.

If you’re looking for an even deeper dive into advanced strategies, like deploying smart contracts or earning unique guild badges, be sure to check out our comprehensive guide at How to Maximize Your $BASE Airdrop Eligibility: Complete Criteria and Step-by-Step Guide (2024).

4. Deploy and Interact with Smart Contracts on Base

Going beyond basic dApp usage, deploying your own smart contracts or interacting with contract-based protocols is a powerful way to set yourself apart. Even launching a simple contract, such as an ERC-20 token or NFT collection, demonstrates technical engagement and deeper commitment to the Base ecosystem. Many airdrop algorithms reward users who go the extra mile, especially if they interact with innovative or emerging protocols on Base.

- Experiment and learn: Use verified tools like Remix or third-party platforms to deploy contracts safely on Base.

- Participate in protocol launches: Engage with new DeFi projects that require direct contract interaction for staking, governance, or liquidity mining.

5. Participate in Base Guilds and Complete Quests to Earn Roles and Badges

The social layer of the Base ecosystem is rapidly evolving, with guilds offering structured ways for users to prove their ongoing involvement. Join official Base Guild communities, complete quests, and earn roles such as ‘Based’ (for Basename holders) or ‘Onchain’ (for recent active users). These badges are visible signals of your dedication, and are increasingly referenced in snapshot criteria for major airdrops.

- Track your progress: Many guilds have dashboards showing which roles you’ve earned and what quests remain.

- Stay active: New quests are added regularly; completing them over time shows genuine engagement rather than opportunistic activity.

Essential Actions to Maximize Your $BASE Airdrop Eligibility

-

Bridge Assets to Base Network Using Official BridgesTransfer your Ethereum or supported assets to the Base network using trusted bridges like the Base Bridge or Coinbase Wallet. This is the foundational step to begin onchain activity within the Base ecosystem.

-

Interact Regularly with Top Base dAppsEngage with leading decentralized applications on Base, such as swapping tokens on Aerodrome, providing liquidity on Uniswap Base, or minting NFTs via Zora. Regular, varied usage demonstrates active participation.

-

Claim and Register a Base ENS Domain to Establish Onchain IdentitySecure a unique identity by registering a .base domain through the Base Name Service (BNS). This links your wallet to a recognizable name and may enhance eligibility.

-

Deploy and Interact with Smart Contracts on BaseShow advanced engagement by deploying your own smart contract or interacting with contract-based protocols on Base. Even simple contract deployments can signal technical involvement.

-

Participate in Base Guilds and Complete Quests to Earn Roles and BadgesJoin official Base Guilds and take part in quests or activities to earn roles like ‘Based’ or ‘Onchain’, and collect badges. These achievements showcase your commitment to the Base community.

-

Maintain Consistent Onchain Activity Over Time to Build a Strong Base Onchain ScoreEngage in regular transactions and activities on the Base network. Consistency over time can help build a robust onchain score, which is often a key factor in airdrop eligibility.

6. Maintain Consistent Onchain Activity Over Time

This step cannot be overstated: sustained activity is king. Consistency across weeks or months, rather than bursts of last-minute transactions, signals authentic participation. Protocols may calculate a “Base Onchain Score” that weights frequency, diversity, and longevity of your interactions across all major touchpoints: bridging, dApps, ENS domains, smart contracts, and guild roles.

- Avoid short-term spikes: Random surges in activity close to rumored snapshot dates can actually hurt your profile.

- Diversify over time: Spread out your actions so you’re not just active in one protocol or category.

Final Thoughts: Position Yourself for Maximum $BASE Rewards

The competitive landscape for the $BASE token airdrop is intensifying as more participants recognize the value of strategic onchain behavior. By bridging assets using official tools, engaging deeply with top dApps like Aerodrome and Uniswap Base, claiming a. base ENS domain for identity, deploying or interacting with smart contracts directly on Base, participating in guilds to earn roles and badges, and maintaining consistent activity over time, you’ll stand out from the crowd when eligibility snapshots are taken.

Remember: while no single action guarantees an allocation, following these prioritized strategies will maximize your chances based on current trends and community insights. For more advanced tactics, including tips on optimizing gas fees and monitoring snapshot rumors, explore our detailed breakdown at How to Maximize Your BASE Airdrop Allocation: Essential Onchain Tasks and Strategies.