With the anticipated $BASE airdrop on the horizon and Base Protocol (BASE) currently trading at $0.258606 as of November 11,2025, maximizing your eligibility has never been more urgent or rewarding. The Base ecosystem is evolving rapidly, with clear signals that both onchain activity and community engagement through Guild roles will play a pivotal role in determining who receives the most substantial rewards. This guide dissects the five most actionable strategies to ensure you’re not just eligible, but positioned for the largest possible allocation when the $BASE tokens drop.

1. Complete and Maintain Key Guild Roles in Base Ecosystem Communities

The importance of Guild roles has grown exponentially in 2025’s airdrop landscape. For Base, roles like ‘Based’ (for Basename holders), ‘Onchain’ (for active users), and other community-specific distinctions on platforms such as Guild. xyz are widely speculated to be direct eligibility factors. These roles are awarded for completing essential ecosystem tasks, bridging assets, engaging with dApps, or participating in governance, and serve as proof of continuous commitment rather than opportunistic farming.

If you haven’t already, join the official Base Guilds and methodically work through their task lists. Regularly check for new role requirements as criteria often evolve alongside major network upgrades or new dApp launches. For a step-by-step walkthrough on role completion and best practices, see our dedicated guide to Base Guild roles.

2. Conduct Regular Onchain Transactions Using Native Base dApps

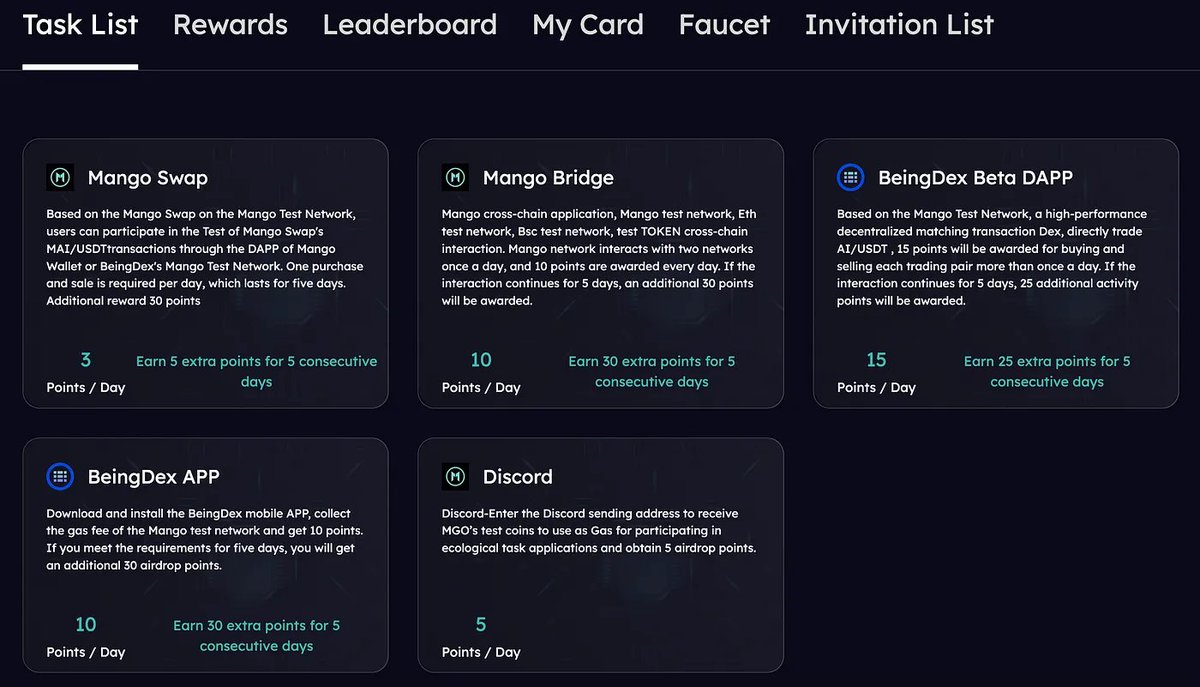

Airdrop algorithms in 2025 are designed to reward sustained activity over time, not just one-off transactions or superficial wallet dusting. To stand out from passive participants, conduct weekly or even daily transactions using native Base dApps. This includes:

- Swapping tokens via decentralized exchanges like Uniswap on Base

- Lending and borrowing assets through DeFi protocols native to Base

- NFT minting and trading on dedicated marketplaces within the network

- Bridging assets in/out of Base, signaling genuine cross-chain utility use

This level of engagement demonstrates authentic participation, an increasingly important metric given how bot-resistant, proof-of-humanity standards are becoming industry norm for high-value drops.

3. Engage in Social and Governance Activities on Web3 Platforms

Your off-chain presence matters nearly as much as your wallet activity. Participating in governance votes (via Snapshot), completing quests on Galxe or Zealy, and being active on web3-native social platforms like Farcaster all contribute to your eligibility profile for the $BASE airdrop.

The rationale is simple: users who help shape the direction of protocols, and amplify their message across web3, are invaluable to ecosystem growth. Many projects now cross-reference social engagement when allocating rewards, so don’t overlook these channels.

- Join governance proposals and vote regularly via Snapshot linked to your wallet address.

- Complete campaigns/quests that issue verifiable badges or NFTs tied to your address.

- Create or share content about your experiences with Base on Farcaster or similar decentralized networks.

If you’re new to these activities or want tactical advice for maximizing impact (and proof), our in-depth guide covers actionable steps across top web3 platforms.

6-Month Price Performance: BASE vs. ETH and Major L2 Tokens

Comparing the 6-month price performance of Base (BASE) against Ethereum and leading Layer-2 tokens as of November 2025.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Base Protocol (BASE) | $0.2584 | $0.2911 | -11.2% |

| Ethereum (ETH) | $3,550.01 | $3,200.00 | +10.9% |

| Optimism (OP) | $0.4258 | $0.4000 | +6.5% |

| Arbitrum (ARB) | $0.2915 | $0.2800 | +4.1% |

| Polygon (MATIC) | $1.20 | $1.10 | +9.1% |

| Bitcoin (BTC) | $104,549.00 | $95,000.00 | +10.1% |

| Immutable X (IMX) | $0.4547 | $0.4200 | +8.3% |

| zkSync (ZK) | $0.0546 | $0.0500 | +9.2% |

Analysis Summary

Over the past six months, most major cryptocurrencies and Layer-2 tokens have experienced moderate growth, with price increases ranging from 4% to 11%. In contrast, Base Protocol (BASE) declined by 11.2%, underperforming both Ethereum and its Layer-2 peers during this period.

Key Insights

- Base Protocol (BASE) was the only asset in this comparison to show a negative 6-month return (-11.2%).

- Ethereum (ETH) and Bitcoin (BTC) led the growth among major assets, with gains of +10.9% and +10.1%, respectively.

- Layer-2 tokens such as Optimism (OP), Polygon (MATIC), Immutable X (IMX), and zkSync (ZK) all posted positive returns between +6.5% and +9.2%.

- Arbitrum (ARB) had the smallest positive gain among L2s at +4.1%.

- The overall market trend for major assets and L2s was upward, with BASE being a notable exception.

This comparison uses real-time and historical price data as of November 11, 2025, sourced directly from CoinGecko. All figures are taken exactly as provided, ensuring an accurate and unbiased performance snapshot over the past six months.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/base-protocol/historical_data

- Ethereum: https://www.coingecko.com/en/coins/ethereum/historical_data

- Optimism: https://www.coingecko.com/en/coins/optimism/historical_data

- Arbitrum: https://www.coingecko.com/en/coins/arbitrum/historical_data

- Polygon: https://www.coingecko.com/en/coins/polygon/historical_data

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin/historical_data

- Immutable X: https://www.coingecko.com/en/coins/immutable-x/historical_data

- zkSync: https://www.coingecko.com/en/coins/zksync/historical_data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

4. Track and Optimize Your Onchain Score with Analytics Tools

The introduction of analytics dashboards such as Dune Analytics and Zerion has made it easier than ever to quantify, and improve, your airdrop readiness. These tools aggregate transaction history, protocol interaction frequency, NFT holdings, liquidity provision stats, and more into an actionable ‘onchain score. ’ Projects like OnChainScore. xyz provide tailored breakdowns specifically for Base users.

The key is not just monitoring these scores but actively optimizing them:

- Diversify your dApp usage: Don’t limit yourself to swaps; explore lending pools, NFT mints, DAOs.

- Avoid inactivity gaps: Spread your transactions out rather than clustering them during campaign periods only.

- Pursue advanced tasks: Try providing liquidity or participating in novel launches that may carry higher weightings.

Base (BASE) Price Prediction 2026-2031

Professional Analyst Forecasts Post-Airdrop, Based on 2025 Market Data and Ecosystem Growth

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.19 | $0.32 | $0.55 | +24% | Airdrop distribution and initial sell pressure could cause early volatility, but increased ecosystem usage may support recovery and growth. |

| 2027 | $0.25 | $0.48 | $0.95 | +50% | Growing adoption of Base L2, more dApps, and broader DeFi/NFT activity could drive demand. Regulatory clarity may add stability. |

| 2028 | $0.36 | $0.67 | $1.40 | +40% | Potential for a broader crypto bull market. If Base secures major partnerships or integrations, prices could trend higher. |

| 2029 | $0.45 | $0.85 | $1.90 | +27% | Sustained network activity and mainstream adoption of Ethereum L2s could push BASE toward new highs, but competition from other L2s may cap gains. |

| 2030 | $0.60 | $1.10 | $2.50 | +29% | Mature DeFi/NFT ecosystem and possible inclusion in major CEX listings. Regulatory headwinds or new tech could impact volatility. |

| 2031 | $0.80 | $1.55 | $3.40 | +41% | If Base achieves significant user growth and developer traction, price could outperform, but risk of market saturation remains. |

Price Prediction Summary

Base (BASE) is expected to experience significant volatility following the airdrop, with initial price pressure likely from token unlocks and distribution. However, as the Base ecosystem matures, adoption increases, and more use cases are developed, BASE could see steady price appreciation over the next six years. Both bullish and bearish scenarios are considered, with the average price trending upward in line with broader Layer 2 adoption and Ethereum scaling.

Key Factors Affecting Base Price

- Airdrop distribution effects and initial sell pressure

- Growth in Base network adoption and onchain activity

- Expansion of DeFi, NFT, and Guild-based utilities on Base

- Regulatory developments affecting Layer 2s and airdrop tokens

- Competition from other Ethereum Layer 2 solutions

- Partnerships, integrations, and major exchange listings

- Overall crypto market cycles and investor sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This data-driven approach enables you to pivot quickly if certain actions start carrying more weight, or if new protocols become key eligibility touchpoints within the evolving Base ecosystem.

5. Participate Early and Continuously in New Base Ecosystem Launches and Testnets

One of the most overlooked yet highly effective strategies for maximizing $BASE airdrop eligibility is to become an early adopter in new Base ecosystem launches and testnets. Historically, projects reward users who not only show up first but remain active through various development phases. This means joining public testnets, providing actionable feedback, and interacting with emerging protocols before they hit mainnet.

- Subscribe to official Base ecosystem updates to be alerted about upcoming launches or experimental dApps.

- Engage with new protocols on day one, whether it’s minting testnet NFTs, bridging assets, or stress-testing DeFi primitives.

- Document your participation: screenshots, transaction hashes, or social posts can serve as proof if retroactive rewards are distributed.

- Stay engaged post-launch; many projects reward sustained involvement rather than just initial hype cycles.

This proactive approach not only increases your chances of making the eligibility list but also often leads to surprise retroactive rewards from both core Base and third-party teams building atop the protocol. For a stepwise breakdown of how to identify and capitalize on these opportunities, refer to our step-by-step guide for early adopters.

Your Action Checklist for $BASE Airdrop Success

The synergy between these five strategies, completing key Guild roles, maintaining regular onchain transactions via native dApps, actively engaging in web3 social governance, optimizing your onchain score with analytics tools, and consistently participating in new launches, forms a holistic approach that aligns perfectly with how most major airdrops now allocate rewards. The days of simply holding tokens or sporadically using a single dApp are over; what matters is visible, multi-faceted commitment across the entire Base ecosystem.

If you’re serious about securing your share of $BASE tokens as the protocol trades at $0.258606, now is the time to act methodically. Don’t wait for official snapshots or announcements, most eligibility windows are based on months of prior activity. By leveraging these tactics today, you’ll be well ahead of opportunistic participants when distribution details drop.

Final Thoughts: Stay Adaptive and Informed

The landscape for Base airdrop 2025 is dynamic by design. Eligibility criteria can shift suddenly as new governance proposals pass or innovative dApps launch within the network. The best way to maximize your allocation is to remain adaptive, track your progress regularly using analytics dashboards and stay plugged into official communication channels for instant updates on new tasks or role requirements.

For more granular playbooks tailored to each strategy above, including walkthroughs for optimizing your Base onchain score, completing Guild tasks efficiently, and identifying high-value testnet opportunities, explore our comprehensive resources:

- How to Complete Base Guild Roles: Step-by-Step Guide

- Essential Onchain Tasks and Strategies for Maximum Allocation

- Complete Step-by-Step Guide: Maximizing Your BASE Token Airdrop Eligibility

The window of opportunity is open now, and those who act with consistency and intention will be best positioned when $BASE tokens are finally distributed across the community.