In the race for a potential $BASE token airdrop, every move you make on the Base Network could be the difference between a small allocation and a life-changing windfall. With Base Protocol (BASE) currently trading at $0.2993 as of October 10,2025, and the community buzzing about an imminent airdrop, now is the time to get strategic. Whether you’re a DeFi veteran or new to Base, maximizing your airdrop rewards starts with understanding how protocols reward genuine users. Let’s break down five actionable strategies that can put you at the front of the pack.

1. Engage Consistently with Base Network DApps and Protocols

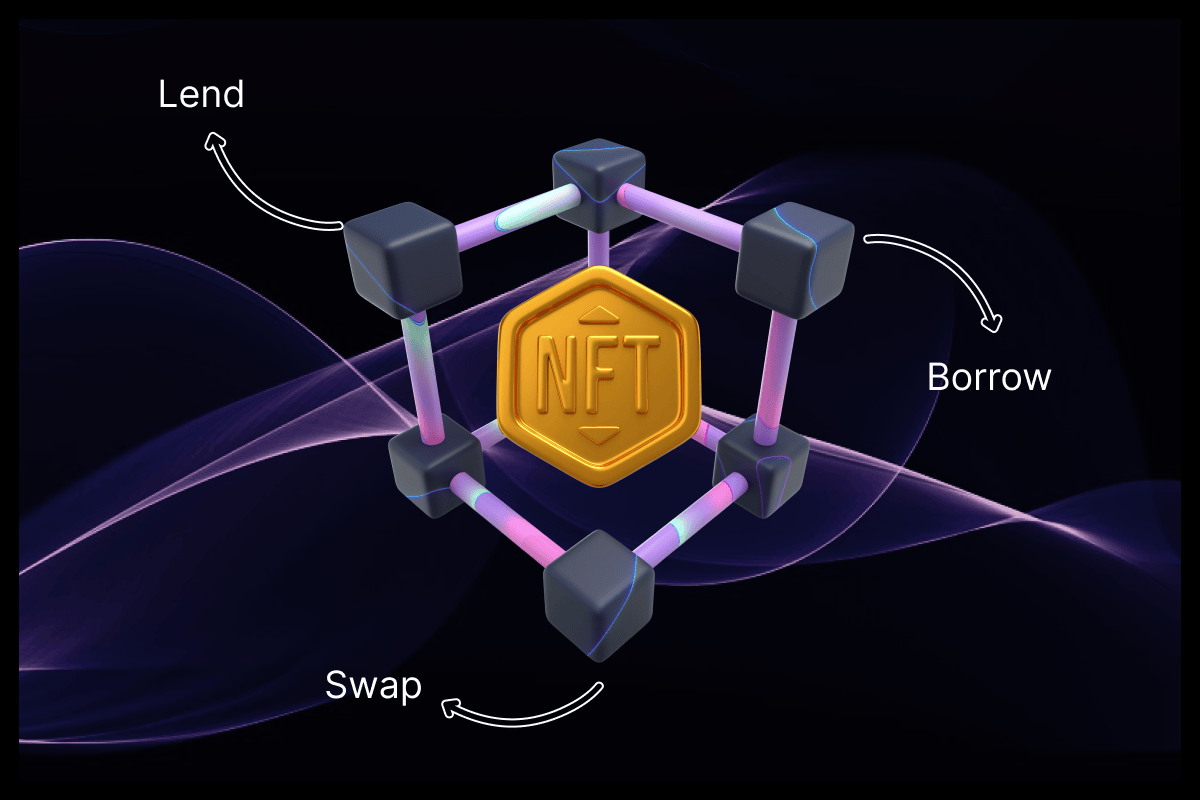

Protocols love active users, and tiered airdrop models often reward those who show up again and again. Don’t just bridge in once and disappear. Instead, make Base your home base. Regularly interact with top decentralized applications (DEXs, lending platforms, NFT marketplaces) built on Base. This means swapping tokens on Uniswap, lending on Aave, or minting NFTs on emerging marketplaces. The key? Consistency. Spread your activity out over weeks or months to prove you’re not just farming for a quick buck but are genuinely invested in the ecosystem.

2. Provide Liquidity to Established Protocols on Base

Liquidity is the lifeblood of any DeFi ecosystem. By depositing assets into battle-tested pools like Uniswap or Aave on Base, you’re not only boosting your transaction volume but also strengthening your on-chain footprint. Many airdrops use volume and liquidity provision as key metrics in their allocation formulas. Don’t spread yourself too thin across dozens of pools; focus on reputable protocols with proven security records. This approach not only increases your eligibility but also minimizes risk.

Top 5 $BASE Airdrop Farming Strategies

-

Diversify Transaction Types and Maintain Realistic Volume: Perform a variety of transactions—swaps, staking, bridging, NFT minting—across the Base ecosystem. Focus on organic, realistic activity to avoid being filtered out by anti-sybil mechanisms targeting repetitive or spammy actions.

-

Participate in Community Governance and Ecosystem Events: Join governance votes, testnets, quests, and engage in official Base community channels. Active participation in governance and events often leads to higher airdrop allocations for dedicated users.

-

Stay Up-to-Date with Official Announcements and Snapshot Dates: Monitor Base’s official channels for news on eligibility snapshots, new protocol launches, or changes in airdrop criteria. Timely action ensures you meet last-minute requirements before snapshots are taken.

3. Diversify Transaction Types and Maintain Realistic Volume

Gone are the days when mindlessly spamming swaps or bridges would guarantee an airdrop. Modern anti-sybil mechanisms are designed to filter out inorganic behavior. To stand out, perform a variety of transactions: swap tokens, stake assets, bridge funds, mint NFTs, and interact with different contract types. Keep your activity organic and avoid sudden, massive spikes in volume. Remember, the goal is to mimic real user behavior. If your on-chain footprint looks too robotic, you risk being excluded from major reward tiers.

For a deeper dive into maximizing your allocation through on-chain tasks, check out our comprehensive guide at /how-to-maximize-your-base-airdrop-allocation-essential-onchain-tasks-and-strategies.

4. Participate in Community Governance and Ecosystem Events

The Base ecosystem isn’t just about transactions – it’s about community. Projects frequently prioritize active governance participants and event attendees when distributing airdrops. Join governance votes, participate in testnets or quests, and show up for official Base community calls or channels. These actions not only boost your eligibility score but also plug you into alpha leaks on upcoming snapshot dates and protocol launches.

Base (BASE) Token Price Prediction 2026-2031

Professional forecast based on current market data, anticipated airdrop effects, and ecosystem development.

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.22 | $0.34 | $0.55 | +13% | Initial volatility post-airdrop; strong adoption could push prices up, but profit-taking and token unlocks may cause dips. |

| 2027 | $0.28 | $0.42 | $0.68 | +24% | Ecosystem growth and new dApp launches drive demand; possible regulatory headwinds limit upside. |

| 2028 | $0.36 | $0.51 | $0.85 | +21% | Base benefits from broader Layer-2 adoption; increased DeFi/NFT activity boosts use cases. |

| 2029 | $0.45 | $0.62 | $1.08 | +22% | Market cycle peaks, with bullish sentiment and new partnerships; competition from other L2s intensifies. |

| 2030 | $0.38 | $0.56 | $1.25 | -10% | Potential market correction after bull run; Base remains a top L2 but faces maturing ecosystem challenges. |

| 2031 | $0.44 | $0.67 | $1.48 | +20% | Renewed growth as blockchain usability and mainstream adoption increase; sustained developer activity. |

Price Prediction Summary

The BASE token is expected to experience significant volatility following its anticipated airdrop, with prices influenced by ecosystem adoption, user activity, and broader crypto market cycles. After an initial period of volatility in 2026, average prices are projected to rise steadily as the Base network matures and gains traction as a leading Layer-2 solution. However, competition, regulatory uncertainty, and market corrections could create periods of downward pressure. Long-term prospects remain positive, especially if Base achieves mainstream adoption and sustained ecosystem growth.

Key Factors Affecting Base Price

- Timing and structure of the BASE token airdrop, including vesting and unlock schedules.

- Adoption of the Base network by developers and users, especially for DeFi, NFTs, and SocialFi.

- Market sentiment and broader crypto market cycles (bull/bear trends).

- Regulatory developments affecting token distributions, airdrops, and Layer-2 networks.

- Competition from other Layer-2 solutions and scalability technologies.

- Partnerships with major platforms (e.g., Coinbase) and integration with popular wallets.

- Technological improvements, network upgrades, and security enhancements.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Staying involved with governance isn’t just a checkbox for airdrop eligibility, it’s a direct line to the heart of the Base Network. Developers and protocol teams often reward users who help shape the future of their ecosystem. Whether it’s voting on proposals, providing feedback in Discord, or completing quests during testnet phases, your voice and your wallet both matter. These community actions signal to airdrop allocators that you’re more than a passive speculator, you’re an active participant helping grow the protocol from the inside out.

5. Stay Up-to-Date with Official Announcements and Snapshot Dates

Missing a key snapshot date can cost you dearly. The best airdrop farmers are always plugged in, monitoring Base’s official channels, following protocol announcements, and setting alerts for new governance proposals or eligibility changes. Snapshot dates are when projects record user activity to determine who qualifies for rewards, so acting promptly is critical. Don’t get caught off guard by last-minute requirements or surprise launches. Bookmark official Base news sources, follow their social feeds, and join community forums to ensure you never miss a beat.

Best Practices for Maximizing Your $BASE Airdrop Rewards

- Consistency Wins: Spread your interactions over time for a more natural on-chain footprint.

- Security First: Always use official bridges, wallets, and protocols to avoid scams.

- Document Everything: Keep records of your transactions and community participation in case you need to verify eligibility later.

- Don’t Over-Optimize: Focus on genuine engagement, protocols are getting smarter at detecting sybil behavior.

With the Base Protocol (BASE) price currently at $0.2993, every move you make could be magnified if the airdrop allocation formula favors sustained, organic activity. The strategies above aren’t just theory, they’re proven tactics drawn from the most successful airdrop hunters across the crypto space.

If you want to go even deeper and explore advanced on-chain strategies, don’t miss our step-by-step guide at /how-to-maximize-your-base-airdrop-allocation-essential-onchain-tasks-and-strategies.

The window of opportunity is open but won’t last forever. Start building your presence on Base, diversify your activity, and stay alert for the next big announcement. In this game, fortune favors the bold, and the well-prepared.